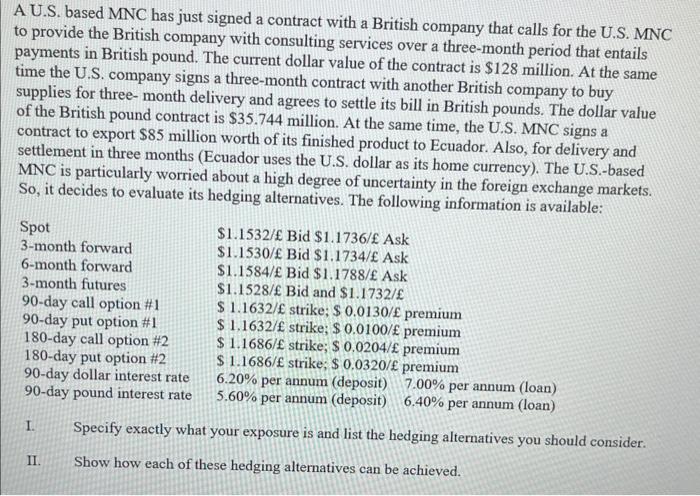

A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the British company with consulting services over a three-month period that entails payments in British pound. The current dollar value of the contract is $128 million. At the same time the U.S. company signs a three-month contract with another British company to buy supplies for three- month delivery and agrees to settle its bill in British pounds. The dollar value of the British pound contract is $35.744 million. At the same time, the U.S. MNC signs a contract to export $85 million worth of its finished product to Ecuador. Also, for delivery and settlement in three months (Ecuador uses the U.S. dollar as its home currency). The U.S.-based MNC is particularly worried about a high degree of uncertainty in the foreign exchange markets. So, it decides to evaluate its hedging alternatives. The following information is available: m(loan) m (loan) I. Specify exactly what your exposure is and list the hedging alternatives you should consider. II. Show how each of these hedging alternatives can be achieved. A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the British company with consulting services over a three-month period that entails payments in British pound. The current dollar value of the contract is $128 million. At the same time the U.S. company signs a three-month contract with another British company to buy supplies for three- month delivery and agrees to settle its bill in British pounds. The dollar value of the British pound contract is $35.744 million. At the same time, the U.S. MNC signs a contract to export $85 million worth of its finished product to Ecuador. Also, for delivery and settlement in three months (Ecuador uses the U.S. dollar as its home currency). The U.S.-based MNC is particularly worried about a high degree of uncertainty in the foreign exchange markets. So, it decides to evaluate its hedging alternatives. The following information is available: m(loan) m (loan) I. Specify exactly what your exposure is and list the hedging alternatives you should consider. II. Show how each of these hedging alternatives can be achieved