Question

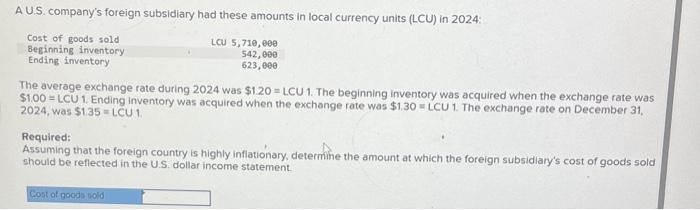

A U.S. company's foreign subsidiary had these amounts in local currency units (LCU) in 2024: Cost of goods sold Beginning inventory Ending inventory LCU

A U.S. company's foreign subsidiary had these amounts in local currency units (LCU) in 2024: Cost of goods sold Beginning inventory Ending inventory LCU 5,710,000 542,000 623,000 The average exchange rate during 2024 was $1.20 LCU 1. The beginning inventory was acquired when the exchange rate was $1.00 LCU 1. Ending inventory was acquired when the exchange rate was $1.30=LCU 1. The exchange rate on December 31, 2024, was $1.35 LCU 1 Required: Assuming that the foreign country is highly inflationary, determine the amount at which the foreign subsidiary's cost of goods sold should be reflected in the U.S. dollar income statement Cost of goods sold

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine the amount at which the foreign subsidiarys cost of goo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

7th edition

1259722635, 978-1259722639

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App