Answered step by step

Verified Expert Solution

Question

1 Approved Answer

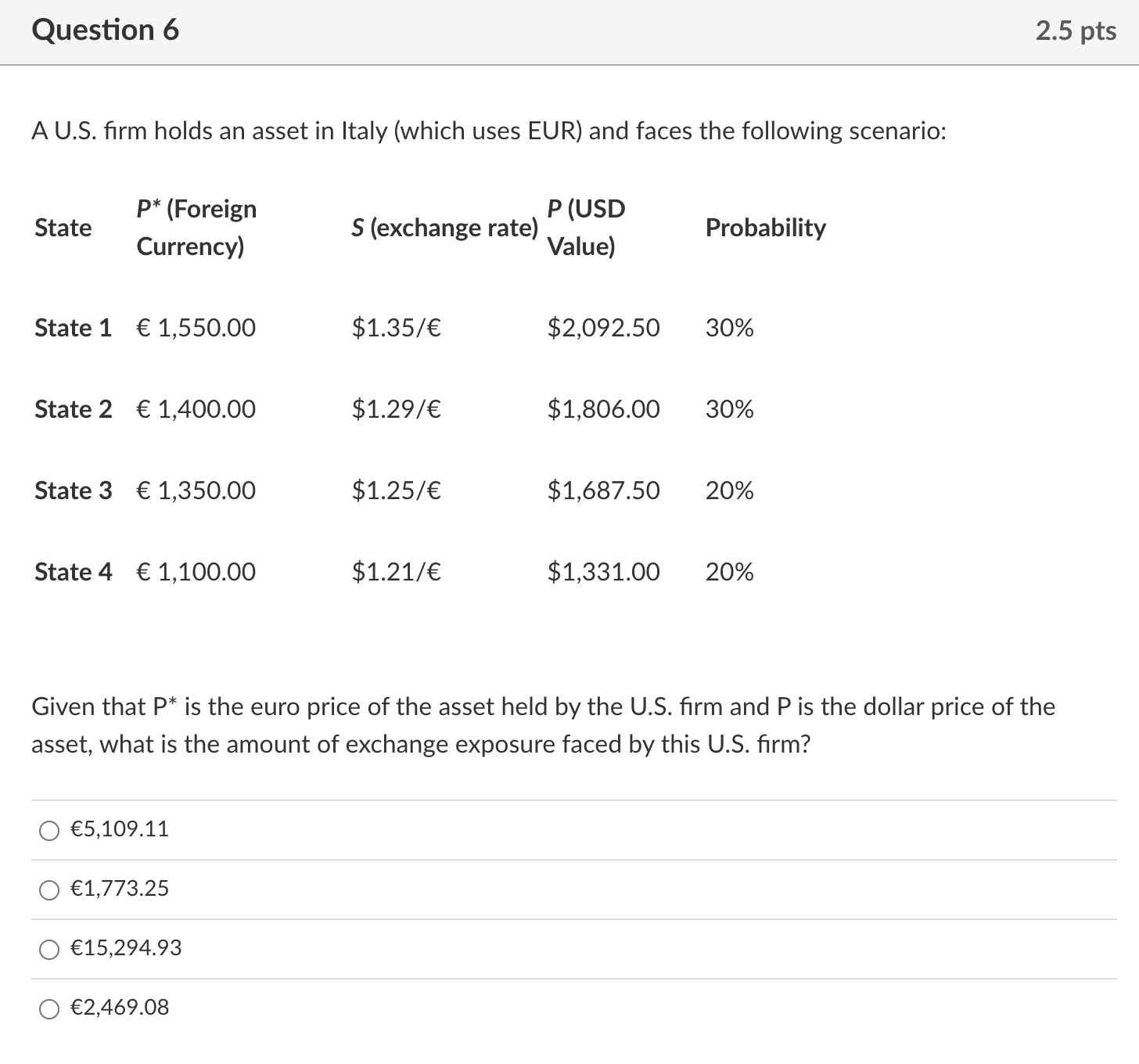

A U.S. firm holds an asset in Italy (which uses EUR) and faces the following scenario: y Given that P is the euro price of

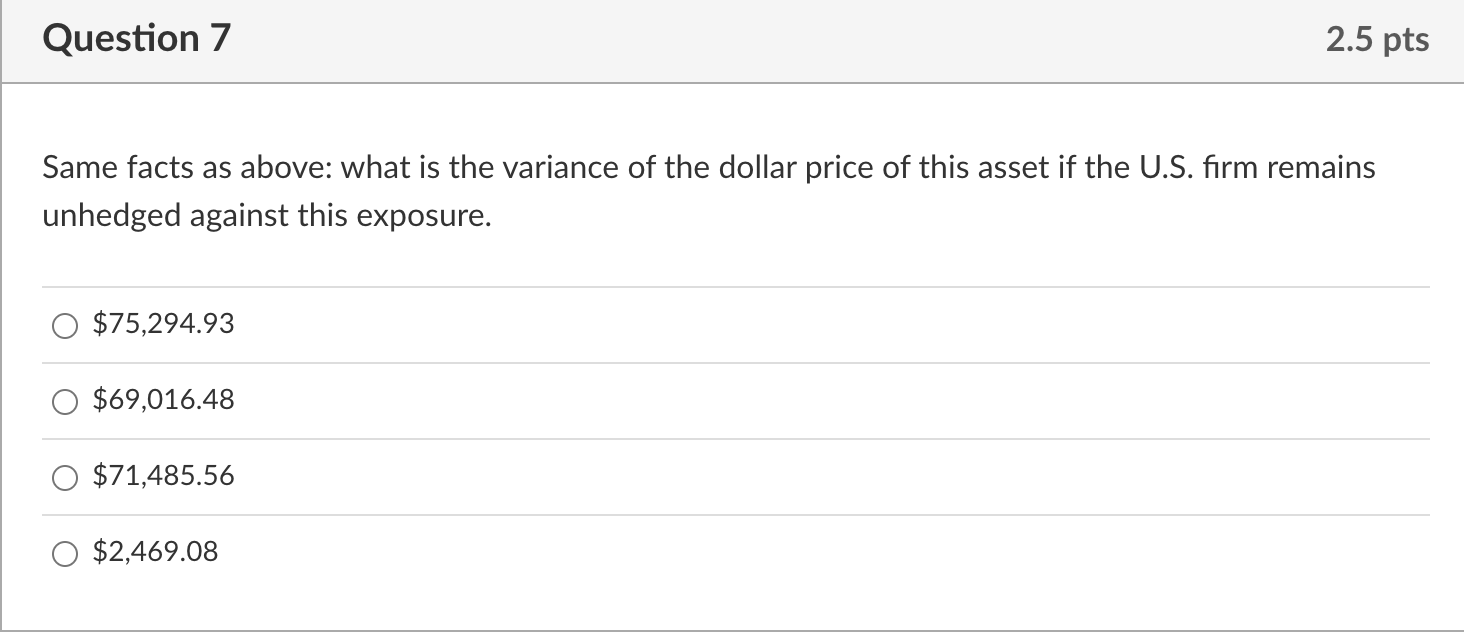

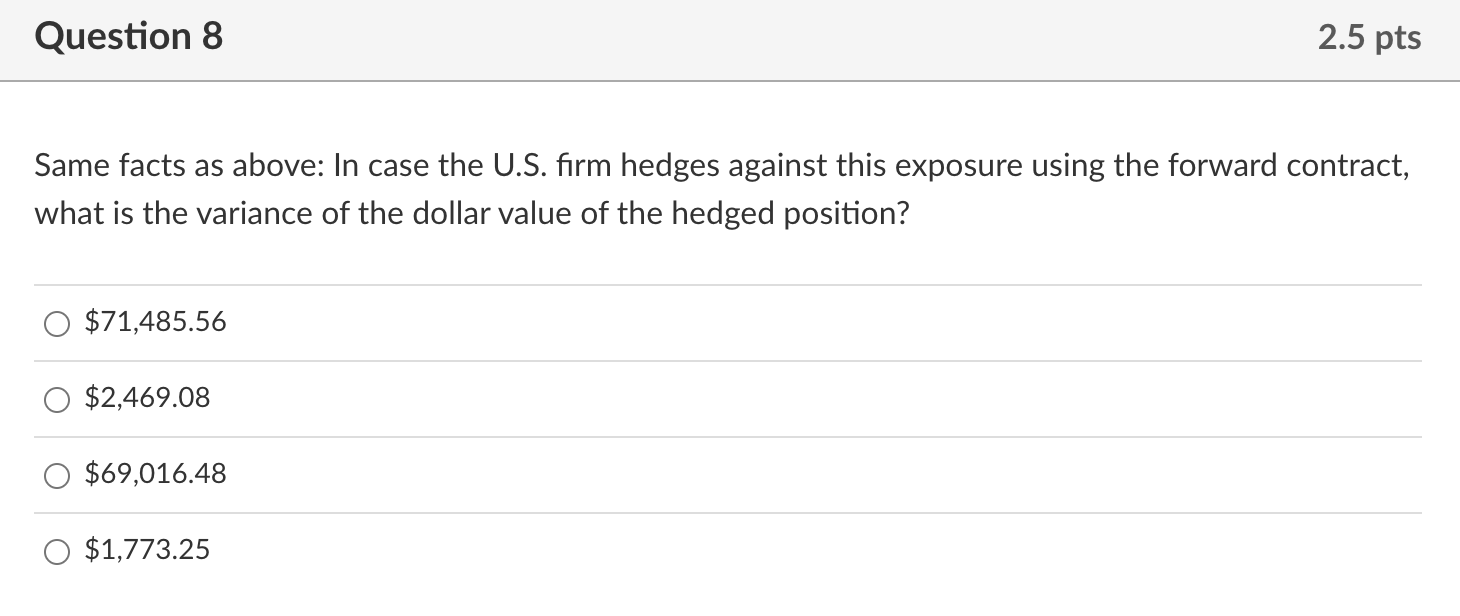

A U.S. firm holds an asset in Italy (which uses EUR) and faces the following scenario: y Given that P is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset, what is the amount of exchange exposure faced by this U.S. firm? 5,109.11 1,773.25 15,294.93 2,469.08 Same facts as above: what is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure. $75,294.93 $69,016.48 $71,485.56 $2,469.08 Same facts as above: In case the U.S. firm hedges against this exposure using the forward contract, what is the variance of the dollar value of the hedged position? $71,485.56 $2,469.08 $69,016.48 $1,773.25

A U.S. firm holds an asset in Italy (which uses EUR) and faces the following scenario: y Given that P is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset, what is the amount of exchange exposure faced by this U.S. firm? 5,109.11 1,773.25 15,294.93 2,469.08 Same facts as above: what is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure. $75,294.93 $69,016.48 $71,485.56 $2,469.08 Same facts as above: In case the U.S. firm hedges against this exposure using the forward contract, what is the variance of the dollar value of the hedged position? $71,485.56 $2,469.08 $69,016.48 $1,773.25 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started