Question

A U.S. investment bank has an existing commitment to buy 10 million Swedish Krona on the spot market one month from today. If the U.S.

A U.S. investment bank has an existing commitment to buy 10 million Swedish Krona on the spot market one month from today. If the U.S. dollar price of the Swedish currency increases between now and the end of 1 month, the bank will face a higher dollar outflow. Thus, the bank wants to hedge its risk. Youve been asked to recommend a cross-hedge using futures contracts. You have access to two futures contracts, a Euro futures contract and a Swiss franc futures contract. The size of the Euro contract is 125,000 Euros and the size of the Swiss franc contract is 125,000 francs. Both contracts are priced in U.S. dollars and are exchange traded.

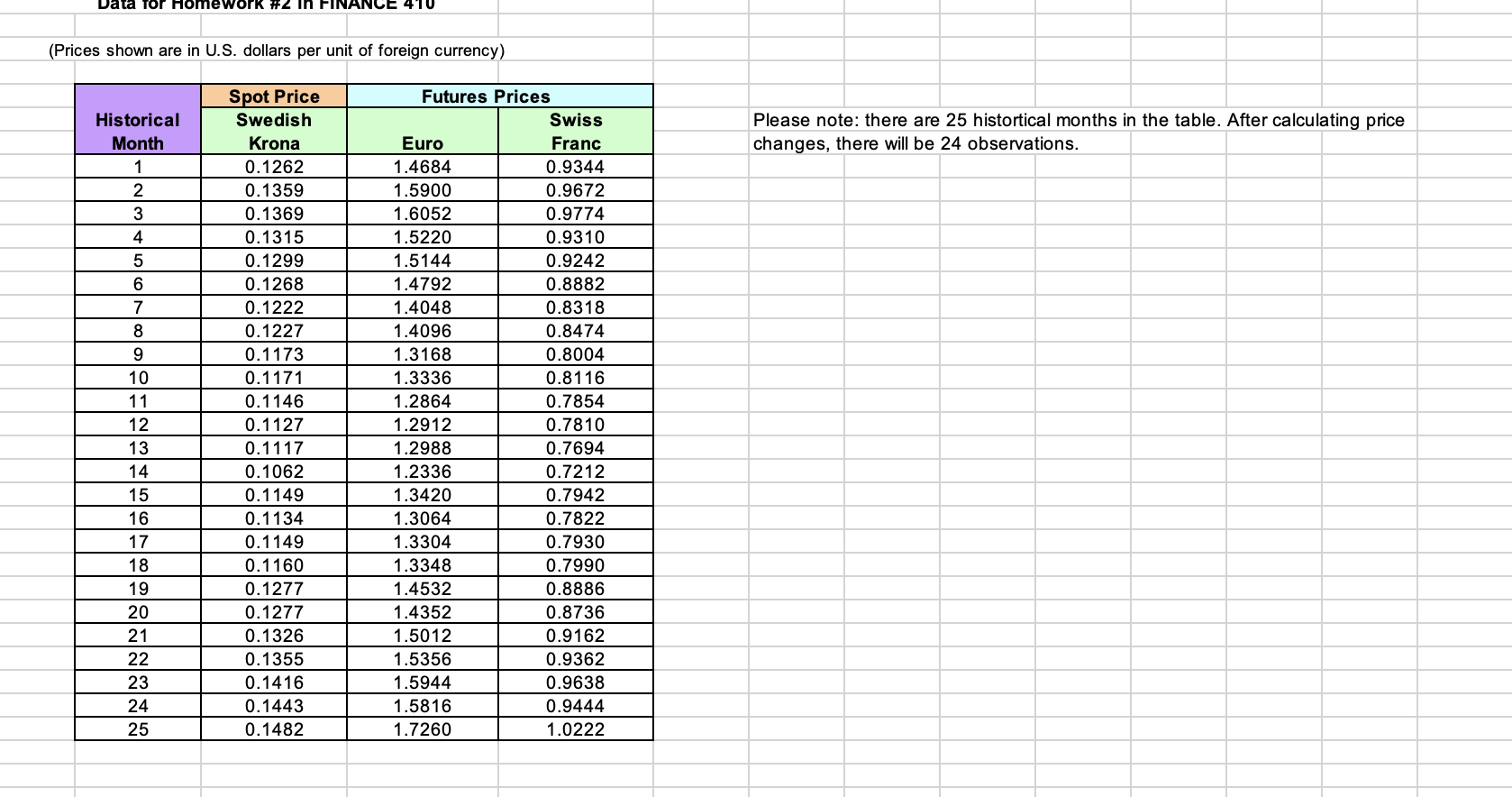

The data to be used for this question are in a spreadsheet on Canvas in the homework folder.

Which futures contract is better for hedging, the Euro contract or the Swiss franc contract? Using the better contract, how many contracts should be traded? Should you go long or short?

Can the hedge be improved by using both futures contracts? If so, recommend a new hedge using both contracts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started