Answered step by step

Verified Expert Solution

Question

1 Approved Answer

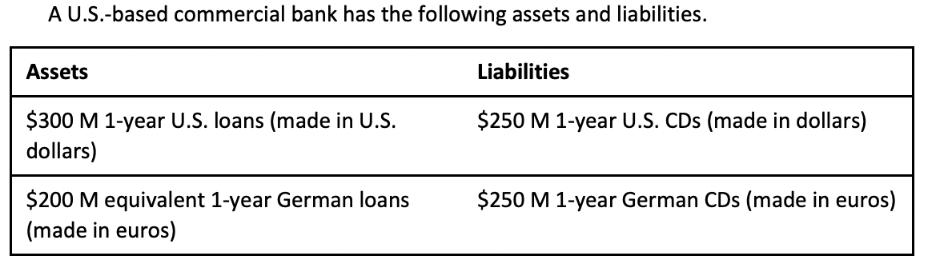

A U.S.-based commercial bank has the following assets and liabilities. Assets $300 M 1-year U.S. loans (made in U.S. dollars) $200 M equivalent 1-year

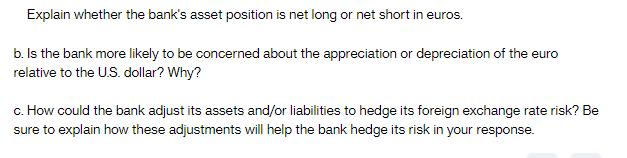

A U.S.-based commercial bank has the following assets and liabilities. Assets $300 M 1-year U.S. loans (made in U.S. dollars) $200 M equivalent 1-year German loans (made in euros) Liabilities $250 M 1-year U.S. CDs (made in dollars) $250 M 1-year German CDs (made in euros) Explain whether the bank's asset position is net long or net short in euros. b. Is the bank more likely to be concerned about the appreciation or depreciation of the euro relative to the U.S. dollar? Why? c. How could the bank adjust its assets and/or liabilities to hedge its foreign exchange rate risk? Be sure to explain how these adjustments will help the bank hedge its risk in your response.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The banks asset position is net long in euros The bank has 200 million in eurodenominated assets and 250 million in eurodenominated liabilities This ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started