Question

A U.S.-based company contemplates a capital investment project in Mexico. The company would invest MXN 312 million on the project and then recoup after-tax cash

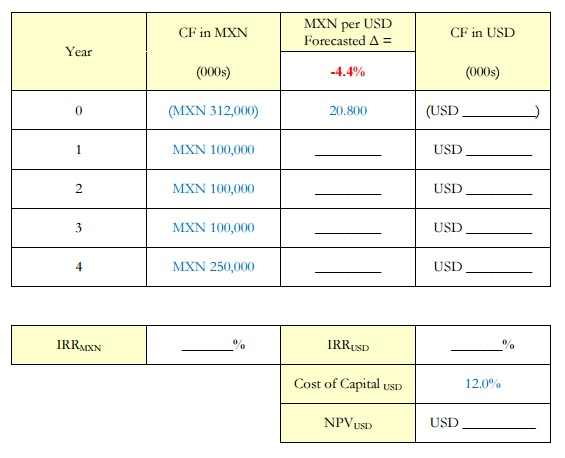

A U.S.-based company contemplates a capital investment project in Mexico. The company would invest MXN 312 million on the project and then recoup after-tax cash flows over four years as shown in the exhibit below. The current exchange rate is USD/MXN 20.8. The company forecasts that the Mexican peso is expected to depreciate by 4.4% per year over the next four years. For discounting US dollarequivalent cash flows associated with projects of this nature, the firm estimates its risk-adjusted cost of capital to be 12.0%.

Complete the table below to identify the internal rate of return (IRR) of this project in MXN terms, the forecasted MXN per USD exchange rate over the next five years, the expected dollar-equivalent cash flows, and the dollar-equivalent internal rate of return, and the net present value (NPVUSD) at the dollar cost of capital of 12.0% for this investment project. The specific steps are as follows: a. Forecast future spot rates b. Convert MXN cash flows to USD-equivalent cash flows c. Conduct DCF analysis on USD-equivalent cash flows

Please show formulas to display work done by hand, excel is not an option, thanks

Year IRRADKN CF in MXN (000s) MXN 312,000 MXN 100,000 MXN 100,000 MXN 100,000 MXN 250,000 MXN per USD -4.4% 20.800 IRRUSD Cost of Capital usD NPVUSID CF in USD 000s (USD USD USD USD USD 12.00% USDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started