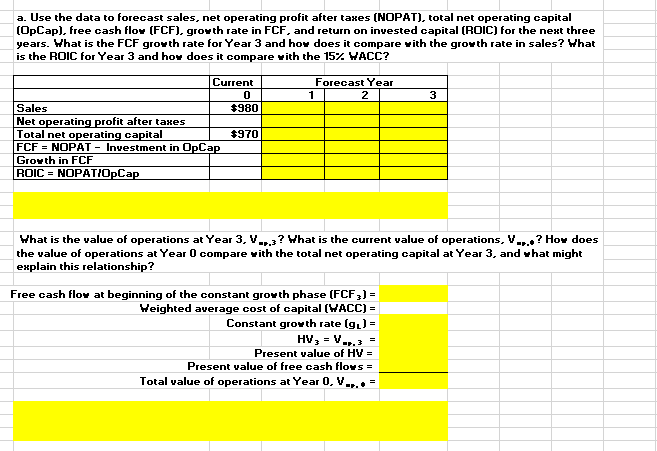

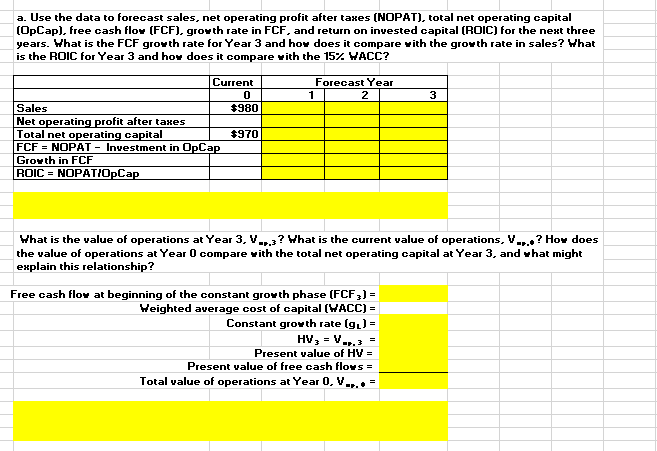

a. Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), growth rate in FCF, and return on invested capital (ROIC) for the next three years. What is the FCF growth rate for Year 3 and how does it compare with the growth rate in sales? What is the ROIC for Year 3 and how does it compare with the 15%. WACC? Forecast Year 1 2 3 Current 0 Sales $980 Net operating profit after taxes Total net operating capital $970 FCF = NOPAT - Investment in OpCap Growth in FCF ROIC - NOPAT/OpCap What is the value of operations at Year 3, V...? What is the current value of operations, V....? How does the value of operations at Year 0 compare with the total net operating capital at Year 3, and what might explain this relationship? Free cash flow at beginning of the constant growth phase (FCF3) = Weighted average cost of capital (WACC) = Constant growth rate (g) = HV, -V...3 = Present value of HV = Present value of free cash flows = Total value of operations at Year 0. V.... a. Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), growth rate in FCF, and return on invested capital (ROIC) for the next three years. What is the FCF growth rate for Year 3 and how does it compare with the growth rate in sales? What is the ROIC for Year 3 and how does it compare with the 15%. WACC? Forecast Year 1 2 3 Current 0 Sales $980 Net operating profit after taxes Total net operating capital $970 FCF = NOPAT - Investment in OpCap Growth in FCF ROIC - NOPAT/OpCap What is the value of operations at Year 3, V...? What is the current value of operations, V....? How does the value of operations at Year 0 compare with the total net operating capital at Year 3, and what might explain this relationship? Free cash flow at beginning of the constant growth phase (FCF3) = Weighted average cost of capital (WACC) = Constant growth rate (g) = HV, -V...3 = Present value of HV = Present value of free cash flows = Total value of operations at Year 0. V