Answered step by step

Verified Expert Solution

Question

1 Approved Answer

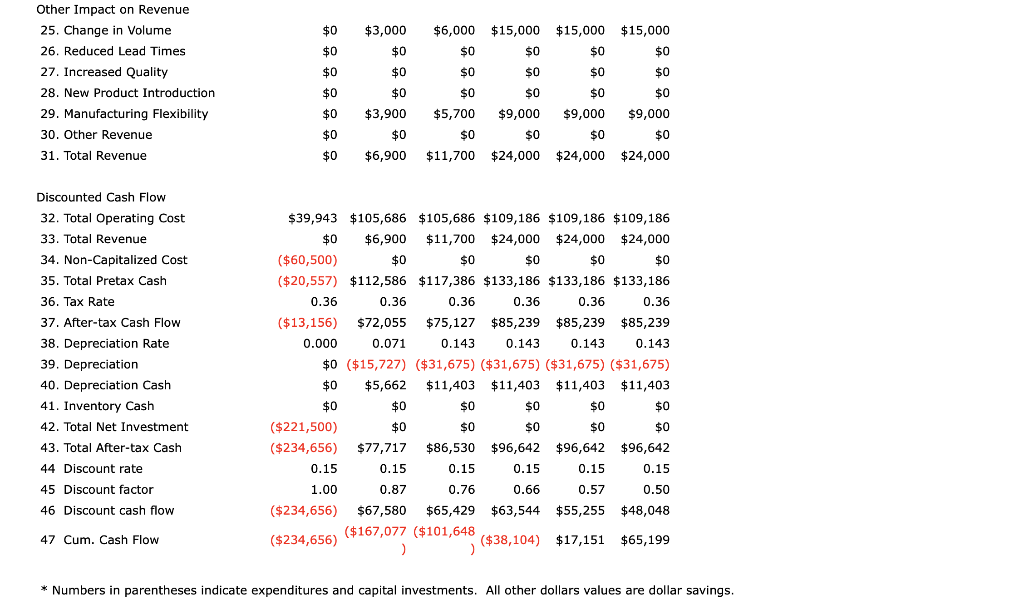

(a) Using Cumulative Cash Flow data (Line 47), determine the discounted payback period . (b) Determine the discounted return on investment, ROI. (c) Using Discount

(a) Using Cumulative Cash Flow data (Line 47), determine the discounted payback period.

(b) Determine the discounted return on investment, ROI.

(c) Using Discount Cash Flow data (Line 46), draw the cash flow diagram for this application.

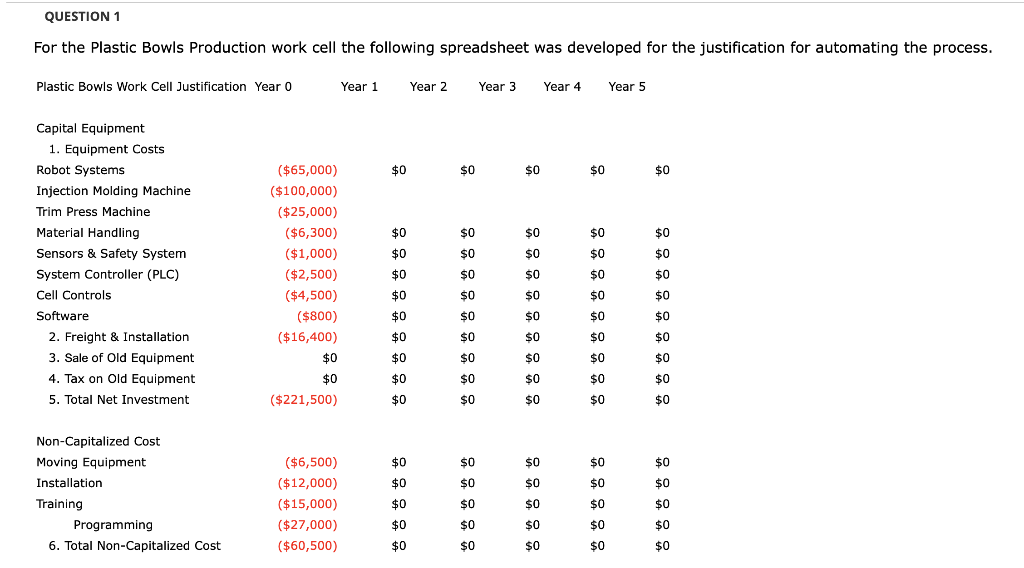

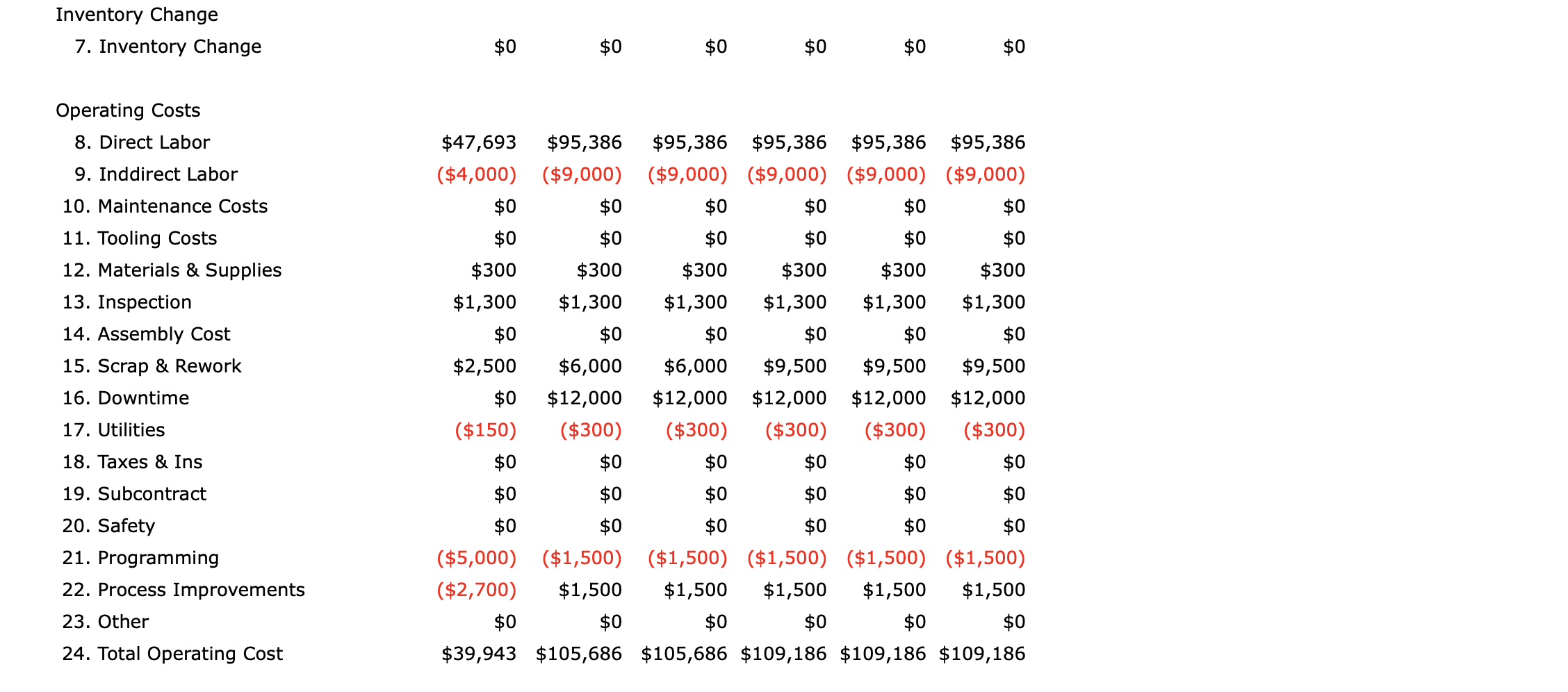

For the Plastic Bowls Production work cell the following spreadsheet was developed for the justification for automating the process. Inventory Change 7. Inventory Change $0$0$0$0$0$0 Operating Costs 8.DirectLabor9.InddirectLabor10.MaintenanceCosts11.ToolingCosts12.Materials&Supplies13.Inspection14.AssemblyCost15.Scrap&Rework16.Downtime17.Utilities18.Taxes&Ins19.Subcontract20.Safety21.Programming22.ProcessImprovements23.Other24.TotalOperatingCost$47,693($4,000)$0$0$300$1,300$0$2,500$0($150)$0$0$0($5,000)($2,700)$0$39,943$95,386($9,000)$0$0$300$1,300$0$6,000$12,000($300)$0$0$0($1,500)$1,500$0$105,686$95,386($9,000)$0$0$300$1,300$0$6,000$12,000($300)$0$0$0($1,500)$1,500$0$105,686$95,386($9,000)$0$0$300$1,300$0$9,500$12,000($300)$0$0$0($1,500)$1,500$0$109,186$95,386($9,000)$0$0$300$1,300$0$9,500$12,000($300)$0$0$0($1,500)$1,500$0$109,186$95,386($9,000)$0$0$300$1,300$0$9,500$12,000($300)$0$0$0($1,500)$1,500$0$109,186 * Numbers in parentheses indicate expenditures and capital investments. All other dollars values are dollar savings. For the Plastic Bowls Production work cell the following spreadsheet was developed for the justification for automating the process. Inventory Change 7. Inventory Change $0$0$0$0$0$0 Operating Costs 8.DirectLabor9.InddirectLabor10.MaintenanceCosts11.ToolingCosts12.Materials&Supplies13.Inspection14.AssemblyCost15.Scrap&Rework16.Downtime17.Utilities18.Taxes&Ins19.Subcontract20.Safety21.Programming22.ProcessImprovements23.Other24.TotalOperatingCost$47,693($4,000)$0$0$300$1,300$0$2,500$0($150)$0$0$0($5,000)($2,700)$0$39,943$95,386($9,000)$0$0$300$1,300$0$6,000$12,000($300)$0$0$0($1,500)$1,500$0$105,686$95,386($9,000)$0$0$300$1,300$0$6,000$12,000($300)$0$0$0($1,500)$1,500$0$105,686$95,386($9,000)$0$0$300$1,300$0$9,500$12,000($300)$0$0$0($1,500)$1,500$0$109,186$95,386($9,000)$0$0$300$1,300$0$9,500$12,000($300)$0$0$0($1,500)$1,500$0$109,186$95,386($9,000)$0$0$300$1,300$0$9,500$12,000($300)$0$0$0($1,500)$1,500$0$109,186 * Numbers in parentheses indicate expenditures and capital investments. All other dollars values are dollar savingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started