Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Using the data in the table below and calculate the following performance measures. i. Sharpe ratio ii. Treynor measure iii. Jensen's alpha iv.

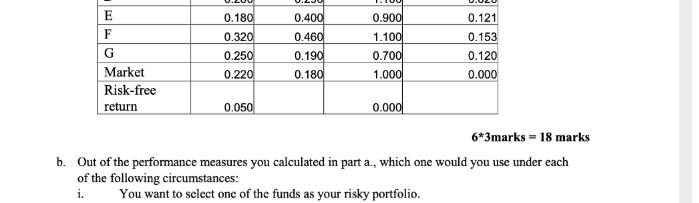

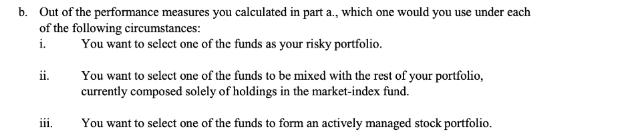

a. Using the data in the table below and calculate the following performance measures. i. Sharpe ratio ii. Treynor measure iii. Jensen's alpha iv. M-squared measure v. T-squared measure, and vi. Appraisal ratio (information ratio) Fund A B C D E Average Standard Beta Return Deviation Coefficient 0.240 0.200 0.290 0.260 0 180 0.220 0.170 0.380 0.290 0.400 0.800 0.900 1.200 1.100 0 900l Unsystematic Risk 0.017 0.450 0.074 0.026 0121 E F G Market Risk-free return 0.180 0.320 0.250 0.220 0.050 0.400 0.460 0.190 0.180 0.900 1.100 0.700 1.000 0.000 0.121 0.153 0.120 0.000 6*3marks = 18 marks b. Out of the performance measures you calculated in part a., which one would you use under each of the following circumstances: i. You want to select one of the funds as your risky portfolio. b. Out of the performance measures you calculated in part a., which one would you use under each of the following circumstances: i. ii. # You want to select one of the funds as your risky portfolio. You want to select one of the funds to be mixed with the rest of your portfolio, currently composed solely of holdings in the market-index fund. You want to select one of the funds to form an actively managed stock portfolio.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Given Avg Return Std deviation Beta Coeff Unsys Risk A 024 022 08 0017 B 02 017 09 045 C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started