Question

(A) Using the Dividend Discount Model Step 1: Find the discount rate: Following industry practice when apply the CAPM model; we will use Treasury

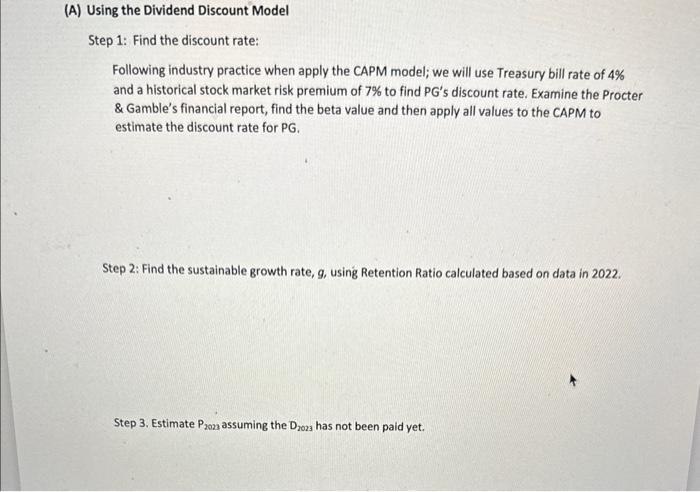

(A) Using the Dividend Discount Model Step 1: Find the discount rate: Following industry practice when apply the CAPM model; we will use Treasury bill rate of 4% and a historical stock market risk premium of 7% to find PG's discount rate. Examine the Procter & Gamble's financial report, find the beta value and then apply all values to the CAPM to estimate the discount rate for PG. Step 2: Find the sustainable growth rate, g, using Retention Ratio calculated based on data in 2022. Step 3. Estimate P2023 assuming the D2023 has not been paid yet.

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Find the discount rate using the Capital Asset Pricing Model CAPM The CAPM formula is Expected Return RiskFree Rate Beta Market Risk Premium As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Equity Analysis and Portfolio Management Tools to Analyze and Manage Your Stock Portfolio

Authors: Robert A.Weigand

1st edition

978-111863091, 1118630912, 978-1118630914

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App