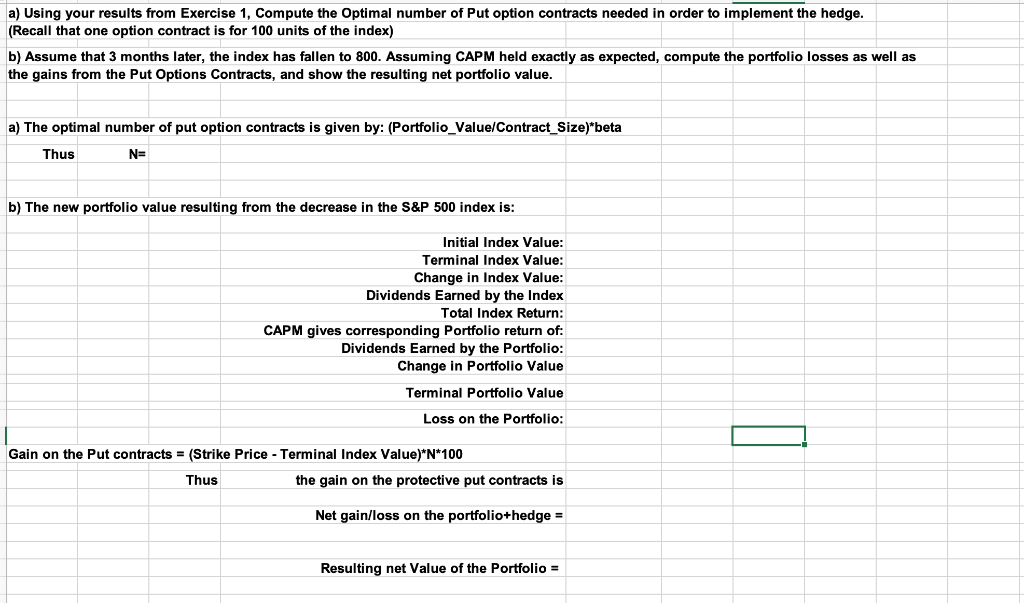

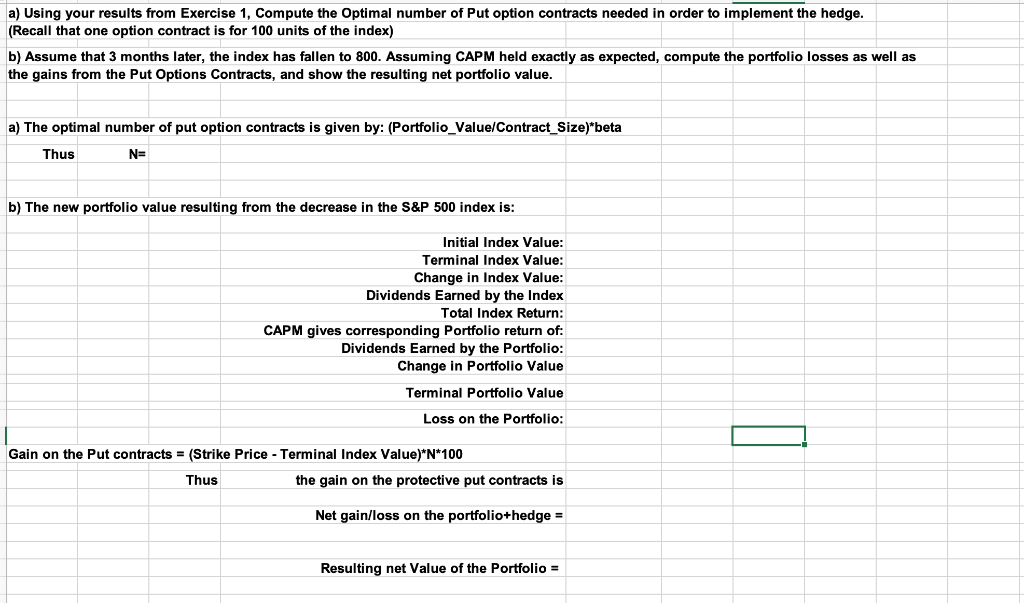

a) Using your results from Exercise 1, Compute the optimal number of Put option contracts needed in order to implement the hedge. (Recall that one option contract is for 100 units of the index) b) Assume that 3 months later, the index has fallen to 800. Assuming CAPM held exactly as expected, compute the portfolio losses as well as the gains from the Put Options Contracts, and show the resulting net portfolio value. a) The optimal number of put option contracts is given by: (Portfolio_Value/Contract_Size)*beta Thus N= b) The new portfolio value resulting from the decrease in the S&P 500 index is: Initial Index Value: Terminal Index Value: Change in Index Value: Dividends Earned by the Index Total Index Return: CAPM gives corresponding Portfolio return of: Dividends Earned by the Portfolio: Change in Portfolio Value Terminal Portfolio Value Loss on the Portfolio: Gain on the Put contracts = (Strike Price - Terminal Index Value)*N*100 Thus the gain on the protective put contracts is Net gain/loss on the portfolio+hedge = Resulting net Value of the Portfolio = a) Using your results from Exercise 1, Compute the optimal number of Put option contracts needed in order to implement the hedge. (Recall that one option contract is for 100 units of the index) b) Assume that 3 months later, the index has fallen to 800. Assuming CAPM held exactly as expected, compute the portfolio losses as well as the gains from the Put Options Contracts, and show the resulting net portfolio value. a) The optimal number of put option contracts is given by: (Portfolio_Value/Contract_Size)*beta Thus N= b) The new portfolio value resulting from the decrease in the S&P 500 index is: Initial Index Value: Terminal Index Value: Change in Index Value: Dividends Earned by the Index Total Index Return: CAPM gives corresponding Portfolio return of: Dividends Earned by the Portfolio: Change in Portfolio Value Terminal Portfolio Value Loss on the Portfolio: Gain on the Put contracts = (Strike Price - Terminal Index Value)*N*100 Thus the gain on the protective put contracts is Net gain/loss on the portfolio+hedge = Resulting net Value of the Portfolio =