Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) value of loan after 5 years b) how mych cheapet is it to finance the car over a 5 year period from the dealer

a) value of loan after 5 years

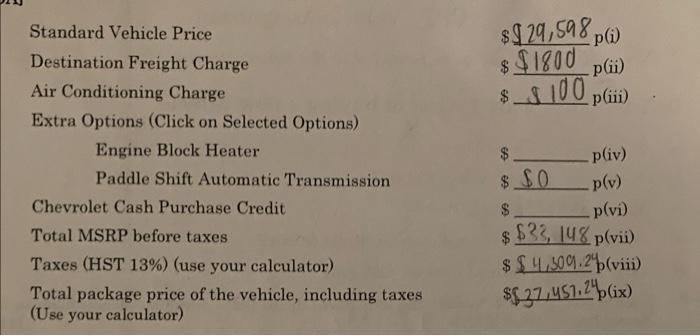

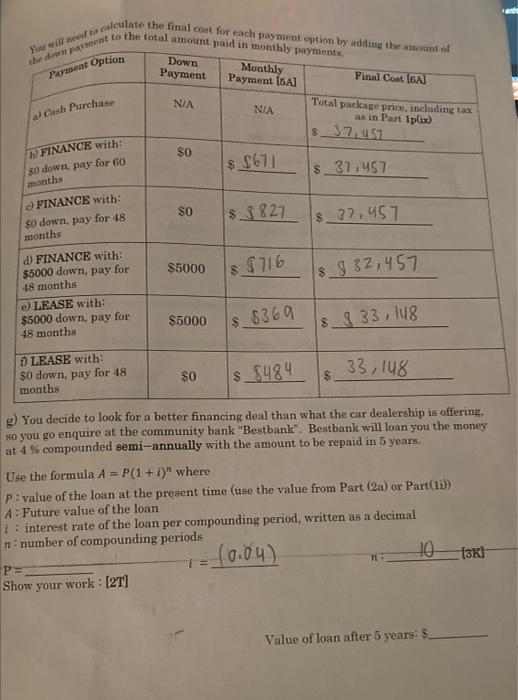

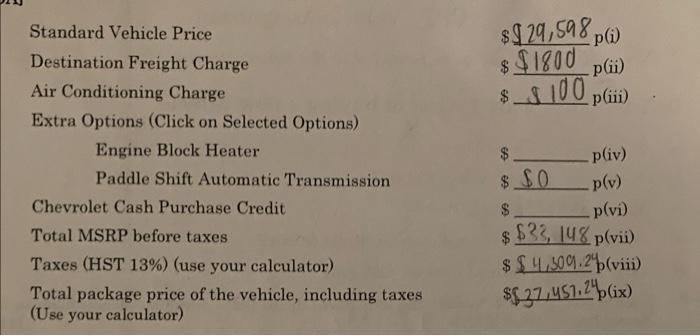

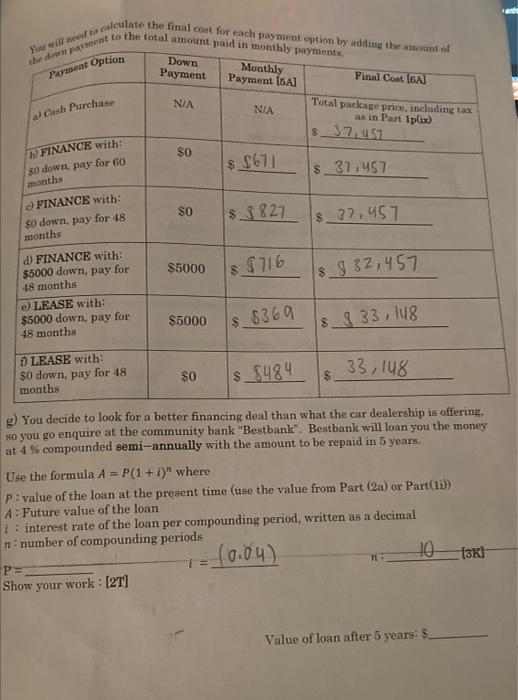

Standard Vehicle Price Destination Freight Charge Air Conditioning Charge Extra Options (Click on Selected Options) Engine Block Heater Paddle Shift Automatic Transmission Chevrolet Cash Purchase Credit Total MSRP before taxes Taxes (HST 13% ) ( use your calculator) Total package price of the vehicle, including taxes (Use your calculator) $29,598 p() p(ii) $$1800 $ $ 100 p(iii) p(iv) $ SO $ S .p(v) .p(vi) $33, 148 p(vii) $$4,509.24(viii) $$ 37,457.24p(ix) the down payment to the total amount paid in monthly payments. You will need to calculate the final cost for each payment option by adding the amount of Payment Option Down Payment Monthly Payment [5A] Final Cost [GA] N/A al Cash Purchase NIA Total package price, including tax as in Part Ip(ix) $ 37, 457 b) FINANCE with: $0 so down, pay for 60 months $ $671 $ 37,457 FINANCE with: $0 $$827 $0 down, pay for 48 months $ 37,457 d) FINANCE with: $5000 down, pay for 48 months $5000 $ $716 $$ 32,457 e) LEASE with: $5000 down, pay for 48 months i $5000 $ 8369 $ 33,148 D LEASE with: $0 down, pay for 48 months $0 $ $484 33,148 $ g) You decide to look for a better financing deal than what the car dealership is offering. so you go enquire at the community bank "Bestbank". Bestbank will loan you the money at 4 % compounded semi-annually with the amount to be repaid in 5 years. Use the formula A = P(1 + i)" where P: value of the loan at the present time (use the value from Part (2a) or Part(11)) A: Future value of the loan i interest rate of the loan per compounding period, written as a decimal n number of compounding periods (0.04) P= 1 = 10 (3K) Show your work: [27] Value of loan after 5 years: $ Standard Vehicle Price Destination Freight Charge Air Conditioning Charge Extra Options (Click on Selected Options) Engine Block Heater Paddle Shift Automatic Transmission Chevrolet Cash Purchase Credit Total MSRP before taxes Taxes (HST 13% ) ( use your calculator) Total package price of the vehicle, including taxes (Use your calculator) $29,598 p() p(ii) $$1800 $ $ 100 p(iii) p(iv) $ SO $ S .p(v) .p(vi) $33, 148 p(vii) $$4,509.24(viii) $$ 37,457.24p(ix) the down payment to the total amount paid in monthly payments. You will need to calculate the final cost for each payment option by adding the amount of Payment Option Down Payment Monthly Payment [5A] Final Cost [GA] N/A al Cash Purchase NIA Total package price, including tax as in Part Ip(ix) $ 37, 457 b) FINANCE with: $0 so down, pay for 60 months $ $671 $ 37,457 FINANCE with: $0 $$827 $0 down, pay for 48 months $ 37,457 d) FINANCE with: $5000 down, pay for 48 months $5000 $ $716 $$ 32,457 e) LEASE with: $5000 down, pay for 48 months i $5000 $ 8369 $ 33,148 D LEASE with: $0 down, pay for 48 months $0 $ $484 33,148 $ g) You decide to look for a better financing deal than what the car dealership is offering. so you go enquire at the community bank "Bestbank". Bestbank will loan you the money at 4 % compounded semi-annually with the amount to be repaid in 5 years. Use the formula A = P(1 + i)" where P: value of the loan at the present time (use the value from Part (2a) or Part(11)) A: Future value of the loan i interest rate of the loan per compounding period, written as a decimal n number of compounding periods (0.04) P= 1 = 10 (3K) Show your work: [27] Value of loan after 5 years: $ b) how mych cheapet is it to finance the car over a 5 year period from the dealer compared to the loan from Bestbank (assuming $0 down payment)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started