Question

A venture in an ice-cream franchise store will generate the cash flow (on $000) shown in the table below. A similar flyer in a

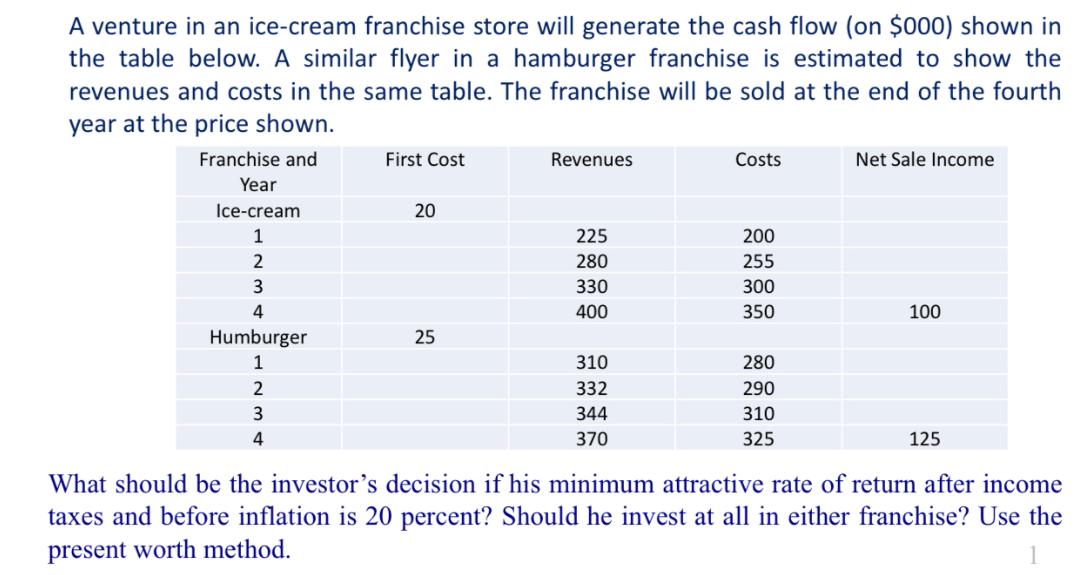

A venture in an ice-cream franchise store will generate the cash flow (on $000) shown in the table below. A similar flyer in a hamburger franchise is estimated to show the revenues and costs in the same table. The franchise will be sold at the end of the fourth year at the price shown. Franchise and Year Ice-cream First Cost Revenues Costs Net Sale Income 20 1 225 200 2 280 255 3 330 300 4 400 350 100 Humburger 25 1 310 280 2 332 290 3 4 344 310 370 325 125 What should be the investor's decision if his minimum attractive rate of return after income taxes and before inflation is 20 percent? Should he invest at all in either franchise? Use the present worth method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App