Question

A vertical spread involves buying an option at one exercise price while selling another option on the same stock at a different exercise price but

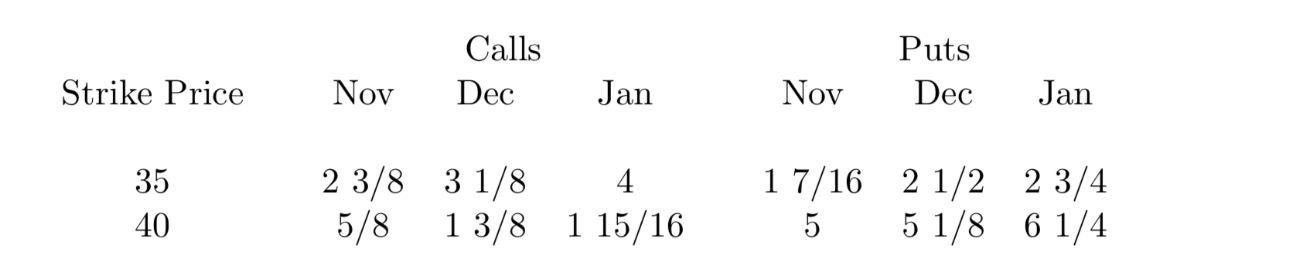

A vertical spread involves buying an option at one exercise price while selling another option on the same stock at a different exercise price but with the same maturity date. Polaroid option prices on October 27, 1988 as quoted in the WSJ are given below.

Last Transaction Prices (USD)

The stock price closed at 35 3/8 on October 27th. Ignore transactions costs.

(a) Draw the value diagram at maturity of a vertical spread created by buying one December 35 call and selling one December 40 call of Polaroid.

(b) How much investment is needed to set up the vertical spread?

(c) Suppose you hold this position until maturity. In order to recover your investment, what should the minimum stock price be?

(d) Draw the value diagram at maturity of a vertical spread created by buying one December 40 put and selling one December 35 put of Polaroid.

(e) How much investment is needed to set up the vertical spread?(f) Suppose you hold this position until maturity. If the stock price of Polaroid at maturity is $37, did you make a profit or loss?

Strike Price Nov Calls Dec Jan Nov Puts Dec Jan 35 2 3/8 5/8 3 1/8 13/8 4 1 15/16 17/16 5 2 1/2 5 1/8 2 3/4 6 1/4 40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started