Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Wagar Ltd. Has supplied 2000 tons of steel to Shoaib Limited. The market Price of the supply is Rs. 2.8 million exclusive of

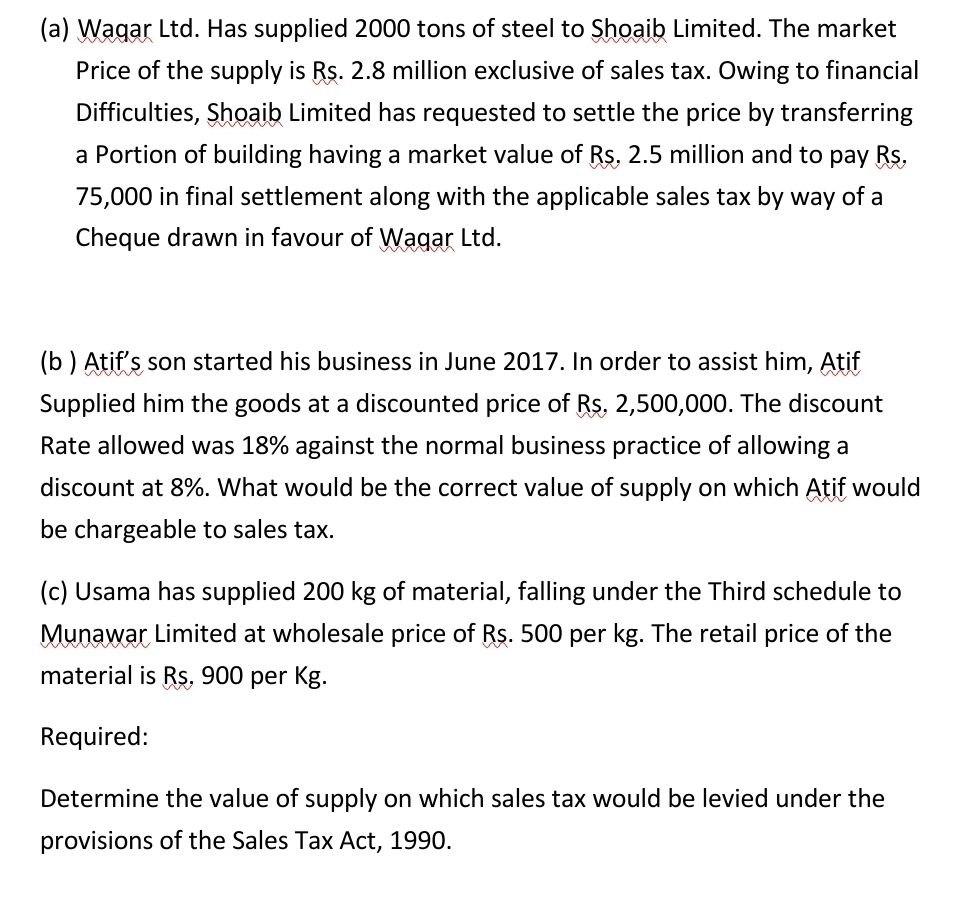

(a) Wagar Ltd. Has supplied 2000 tons of steel to Shoaib Limited. The market Price of the supply is Rs. 2.8 million exclusive of sales tax. Owing to financial Difficulties, Shoaib Limited has requested to settle the price by transferring a Portion of building having a market value of Rs, 2.5 million and to pay Rs. 75,000 in final settlement along with the applicable sales tax by way of a Cheque drawn in favour of Wagar Ltd. (b ) Atif's son started his business in June 2017. In order to assist him, Atif Supplied him the goods at a discounted price of Rs, 2,500,000. The discount Rate allowed was 18% against the normal business practice of allowing a discount at 8%. What would be the correct value of supply on which Atif would be chargeable to sales tax. (c) Usama has supplied 200 kg of material, falling under the Third schedule to Munawar Limited at wholesale price of Rs. 500 per kg. The retail price of the material is Rs, 900 per Kg. Required: Determine the value of supply on which sales tax would be levied under the provisions of the Sales Tax Act, 1990.

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Supply partly in kind In case the consideration for a supply is in kind or is partly in kind and p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started