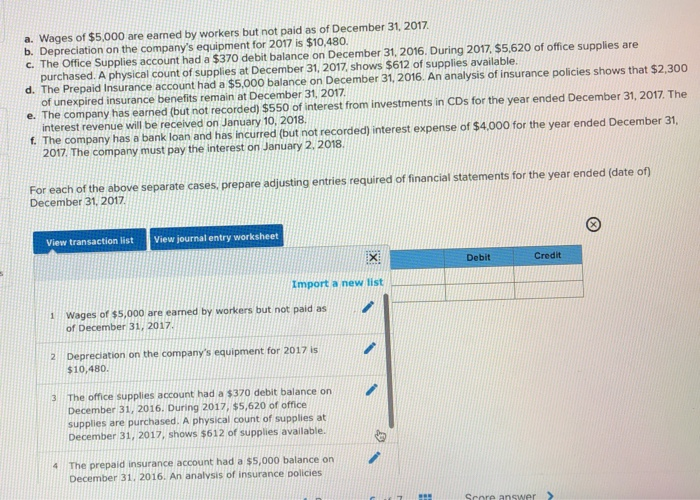

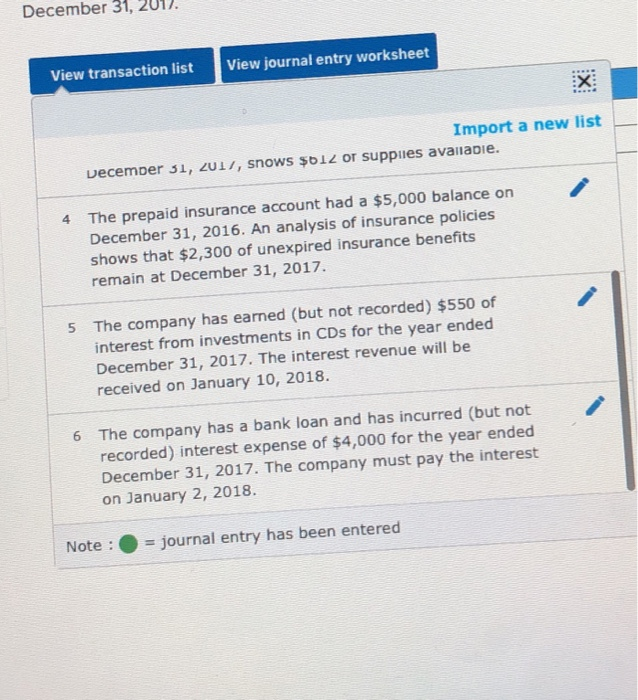

a. Wages of $5,000 are earned by workers but not paid as of December 31. 2017 b. Depreciation on the company's equipment for 2017 is $10,480 c. The Office Supplies account had a $370 debit balance on December 31, 2016. During 2017, $5.620 of office supplies are purchased. A physical count of supplies at December 31, 2017, shows $612 of supplies available. d. The Prepaid Insurance account had a $5,000 balance on December 31. 2016. An analysis of insurance policies shows that $2,300 of unexpired insurance benefits remain at December 31, 2017 e. The company has earned (but not recorded) $550 of interest from investments in CDs for the year ended December 31, 2017. The interest revenue will be received on January 10, 2018. t. The company has a bank loan and has incurred (but not recorded) interest expense of $4.000 for the year ended December 31, 2017 The company must pay the interest on January 2. 2018 For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31. 2017 View transaction list View journal entry worksheet Debit Credit Import a new list 1 Wages of ss.o00 are eamed by workers but not paid as of December 31, 2017 Depreciation on the company's equipment for 2017 is $10,480 2 3 The office supplies account had a $370 debit balance on December 31, 2016. During 2017, $5,620 of office supplies are purchased. A physical count of supplies at December 31. 2017, shows $612 of supplies available. 4 The prepaid insurance account had a $5,000 balance on December 31. 2016. An analvsis of insurance policies Score answer December 31, 2017. View transaction list View journal entry worksheet X: Import a new list uecemper 31, zUL/, snows $61Z Or suppiies avaiapie The prepaid insurance account had a $5,000 balance on December 31, 2016. An analysis of insurance policies shows that $2,300 of unexpired insurance benefits remain at December 31, 2017. 4 5 The company has earned (but not recorded) $550 of interest from investments in CDs for the year ended December 31, 2017. The interest revenue will be received on January 10, 2018. 6 The company has a bank loan and has incurred (but not recorded) interest expense of $4,000 for the year ended December 31, 2017. The company must pay the interest on January 2, 2018. Note : = journal entry has been entered