Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let the following represent the structure of a SMALL OPEN ECONOMY with PERFECT CAPITAL MOBILITY and FIXED EXCHANGE RATE REGIME: C=C+0.75(Y-T), C = 90,

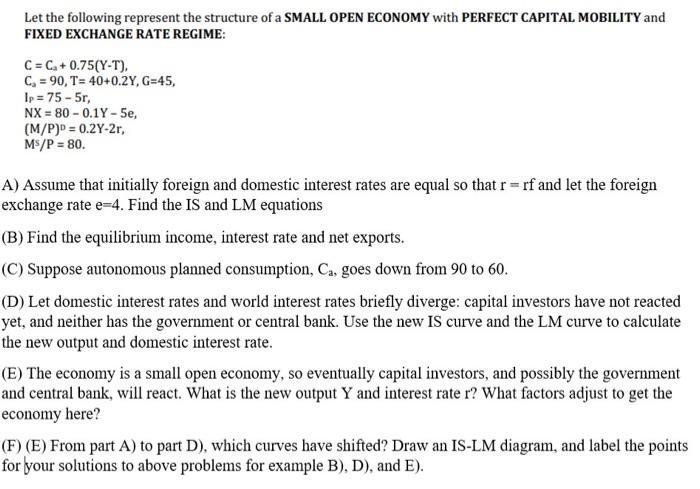

Let the following represent the structure of a SMALL OPEN ECONOMY with PERFECT CAPITAL MOBILITY and FIXED EXCHANGE RATE REGIME: C=C+0.75(Y-T), C = 90, T=40+0.2Y, G=45, Ip = 75-5r, NX = 80 -0.1Y - 5e, (M/P)D = 0.2Y-2r, Ms/P = 80. A) Assume that initially foreign and domestic interest rates are equal so that r = rf and let the foreign exchange rate e=4. Find the IS and LM equations (B) Find the equilibrium income, interest rate and net exports. (C) Suppose autonomous planned consumption, Ca, goes down from 90 to 60. (D) Let domestic interest rates and world interest rates briefly diverge: capital investors have not reacted yet, and neither has the government or central bank. Use the new IS curve and the LM curve to calculate the new output and domestic interest rate. (E) The economy is a small open economy, so eventually capital investors, and possibly the government and central bank, will react. What is the new output Y and interest rate r? What factors adjust to get the economy here? (F) (E) From part A) to part D), which curves have shifted? Draw an IS-LM diagram, and label the points for your solutions to above problems for example B), D), and E).

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A Assume that initially foreign and domestic interest rates are equal so that r rf and let the foreign exchange rate e4 Find the IS and LM equations Assuming that the initial foreign and domestic inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started