Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Wayne Company Limited's next annual dividend will be 2.40 per share. Its current stock price is 32= per share and growth rate of

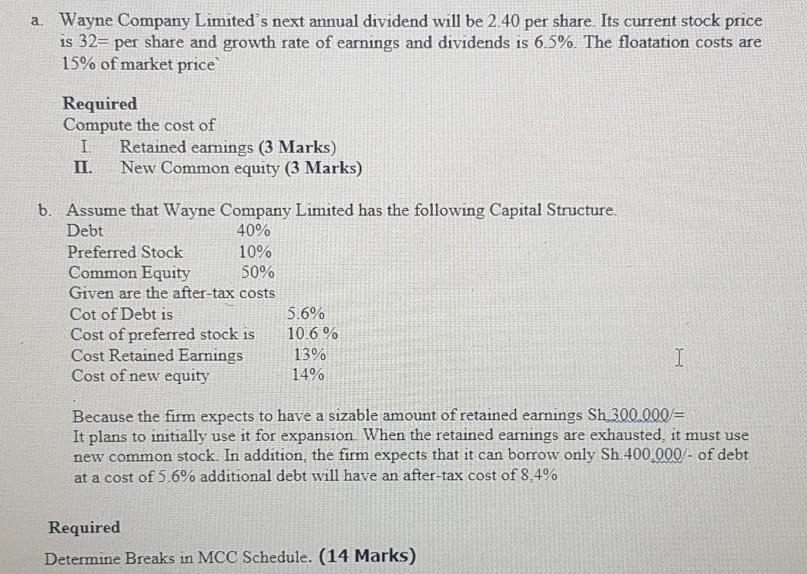

a. Wayne Company Limited's next annual dividend will be 2.40 per share. Its current stock price is 32= per share and growth rate of earnings and dividends is 6.5%. The floatation costs are 15% of market price Required Compute the cost of . Retained earnings (3 Marks) II. New Common equity (3 Marks) b. Assume that Wayne Company Limited has the following Capital Structure. Debt Preferred Stock 40% 10% Common Equity 50% Given are the after-tax costs Cot of Debt is 5.6% Cost of preferred stock is 10.6 % Cost Retained Earnings Cost of new equity 13% 14% I Because the firm expects to have a sizable amount of retained earnings Sh.300.000/= It plans to initially use it for expansion. When the retained earnings are exhausted, it must use new common stock. In addition, the firm expects that it can borrow only Sh.400.000/- of debt at a cost of 5.6% additional debt will have an after-tax cost of 8,4% Required Determine Breaks in MCC Schedule. (14 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Wayne Company Limited Capital Cost Calculations a Cost of Capital I Retained Earnings Cost of Retained Earnings or Ke We are given the growth rate g 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started