Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A web design company has to decide whether to upgrade their IT to handle demand for their services. This will increase revenue by $40K

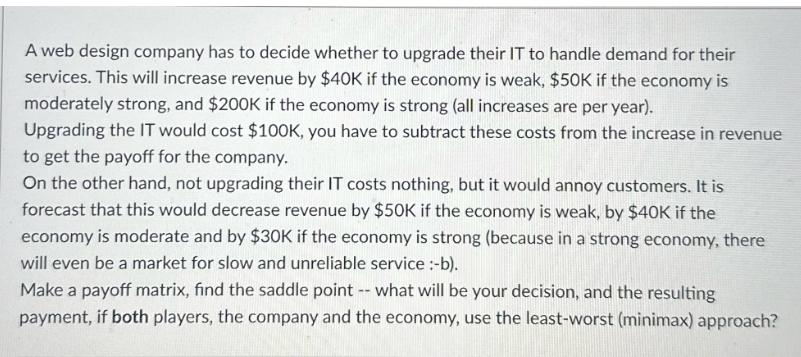

A web design company has to decide whether to upgrade their IT to handle demand for their services. This will increase revenue by $40K if the economy is weak, $50K if the economy is moderately strong, and $200K if the economy is strong (all increases are per year). Upgrading the IT would cost $100K, you have to subtract these costs from the increase in revenue to get the payoff for the company. On the other hand, not upgrading their IT costs nothing, but it would annoy customers. It is forecast that this would decrease revenue by $50K if the economy is weak, by $40K if the economy is moderate and by $30K if the economy is strong (because in a strong economy, there will even be a market for slow and unreliable service :-b). Make a payoff matrix, find the saddle point -- what will be your decision, and the resulting payment, if both players, the company and the economy, use the least-worst (minimax) approach?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To create a payoff matrix for the web design companys decision on upgrading their IT system based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started