Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What are the amount and character of Adam's recognized gain or loss? b. What is Adam's remaining basis in his partnership interest? c. What

a. What are the amount and character of Adam's recognized gain or loss?

b. What is Adam's remaining basis in his partnership interest?

c. What are the amount and character of Alyssa's recognized gain or loss?

d. What is Alyssa's basis in the distributed assets?

e. What is Alyssa's remaining basis in her partnership interest?

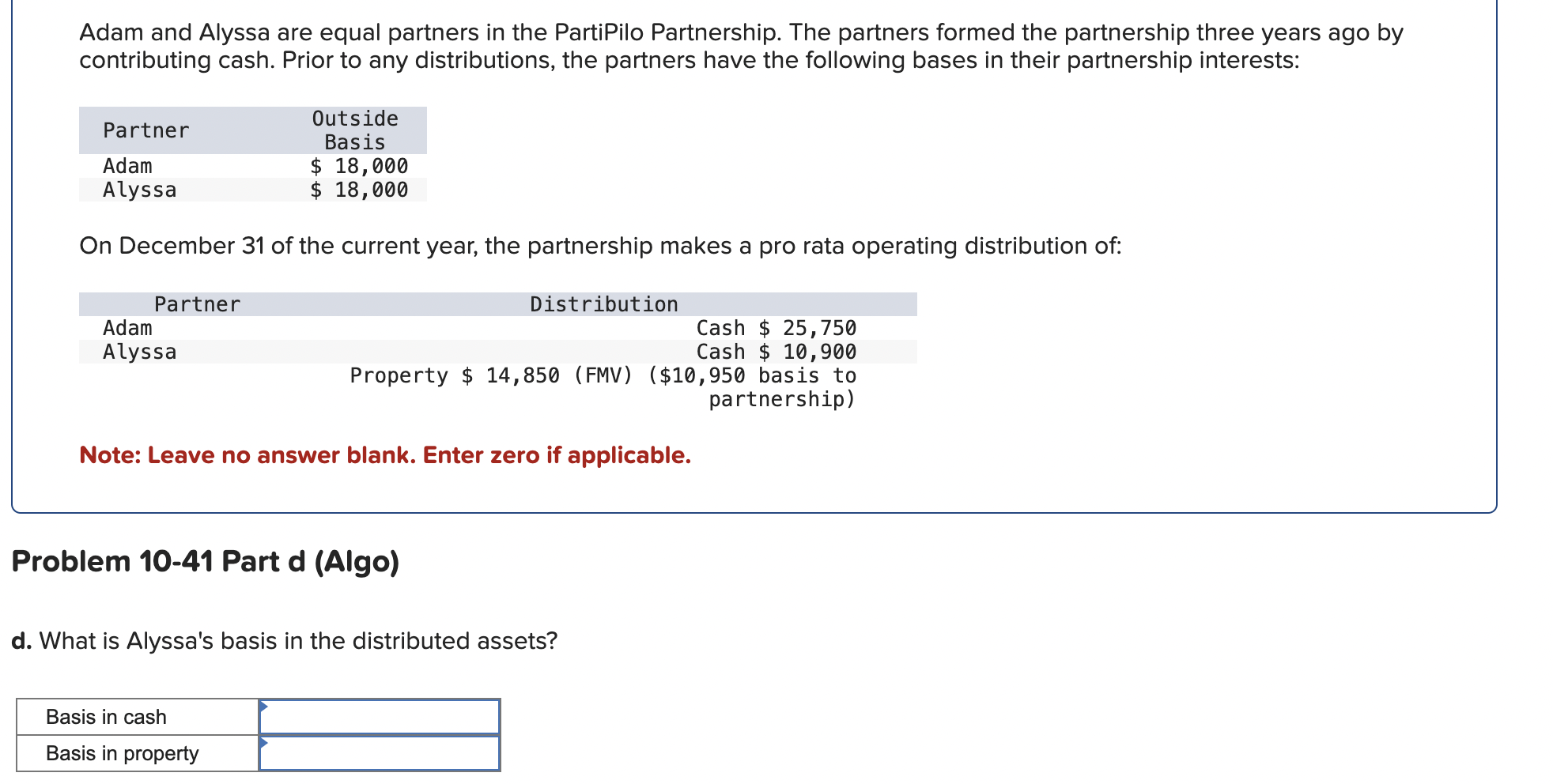

Adam and Alyssa are equal partners in the PartiPilo Partnership. The partners formed the partnership three years ago by contributing cash. Prior to any distributions, the partners have the following bases in their partnership interests: On December 31 of the current year, the partnership makes a pro rata operating distribution of: Note: Leave no answer blank. Enter zero if applicable. Problem 10-41 Part d (Algo) d. What is Alyssa's basis in the distributed assets

Adam and Alyssa are equal partners in the PartiPilo Partnership. The partners formed the partnership three years ago by contributing cash. Prior to any distributions, the partners have the following bases in their partnership interests: On December 31 of the current year, the partnership makes a pro rata operating distribution of: Note: Leave no answer blank. Enter zero if applicable. Problem 10-41 Part d (Algo) d. What is Alyssa's basis in the distributed assets Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started