Answered step by step

Verified Expert Solution

Question

1 Approved Answer

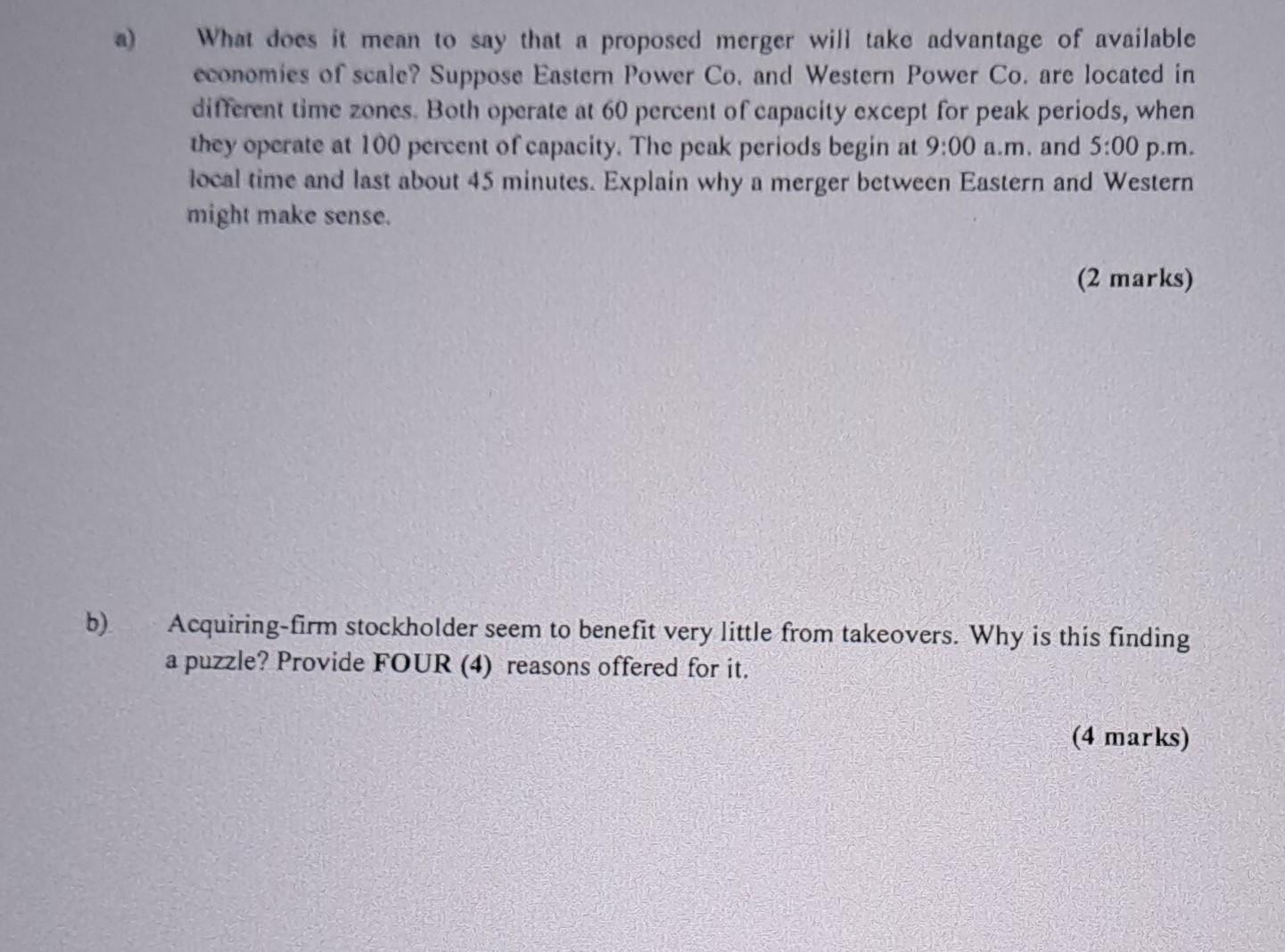

a) What does it mean to say that a proposed merger will take advantage of available economies of scale? Suppose Eastem Power Co, and Western

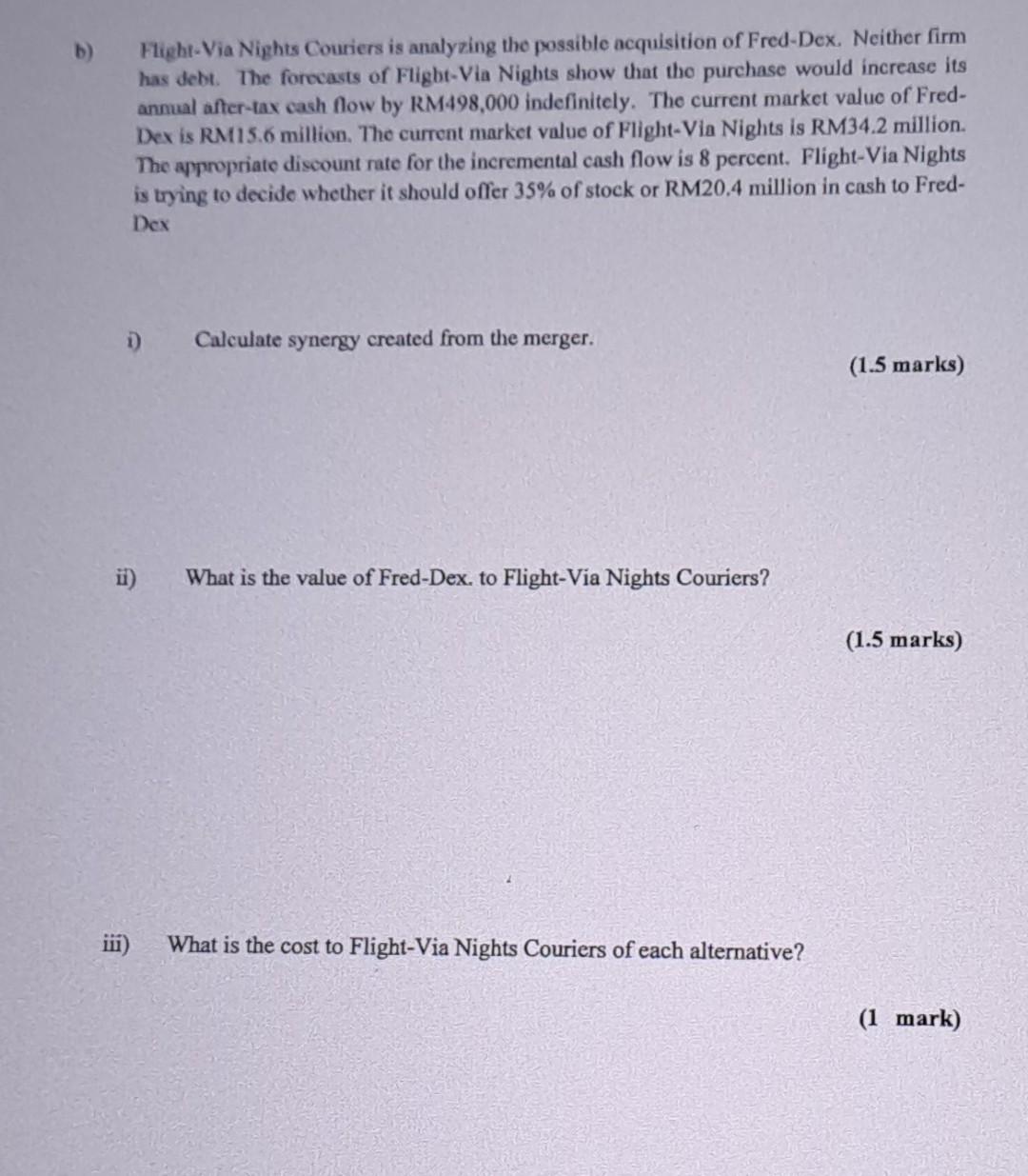

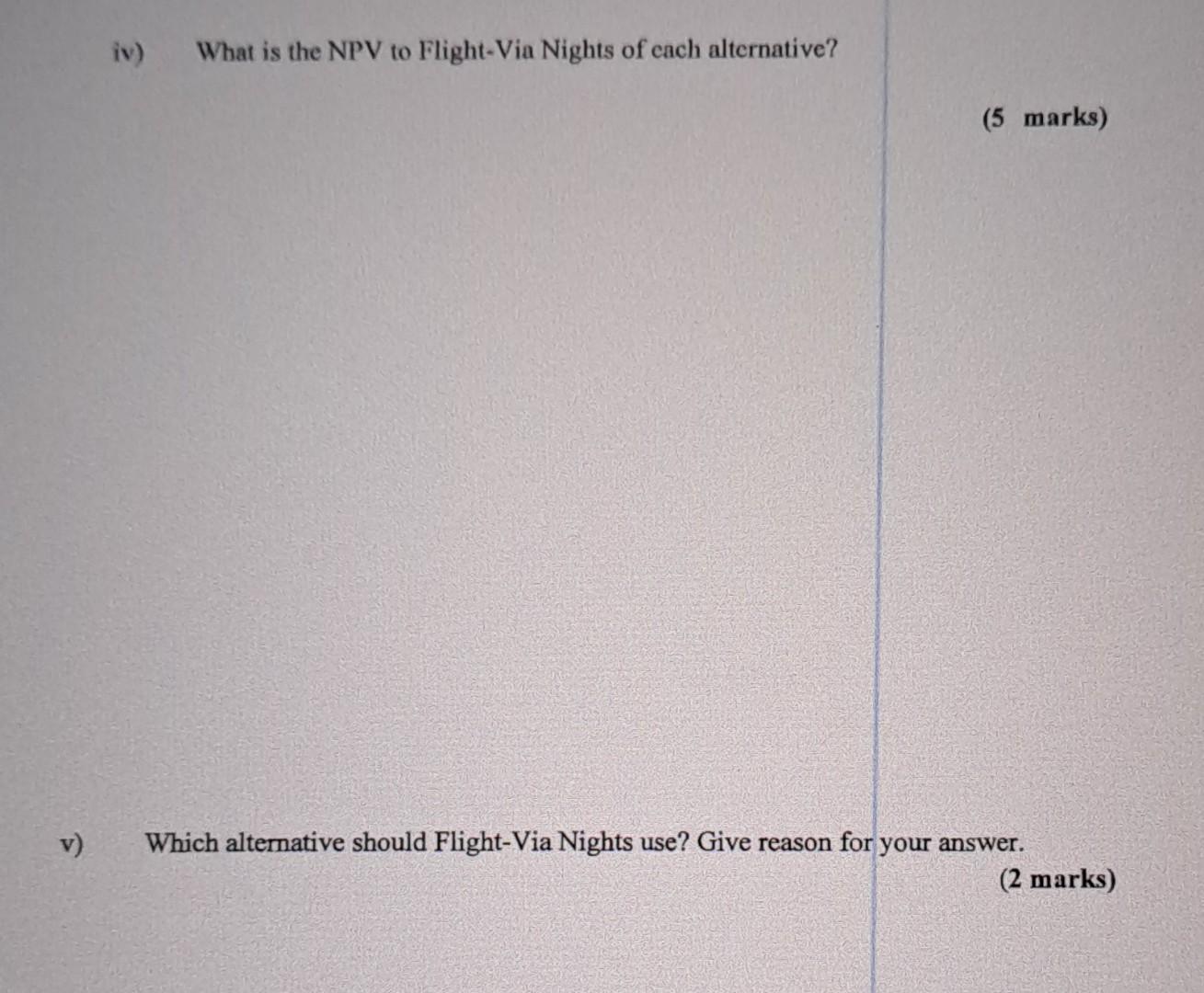

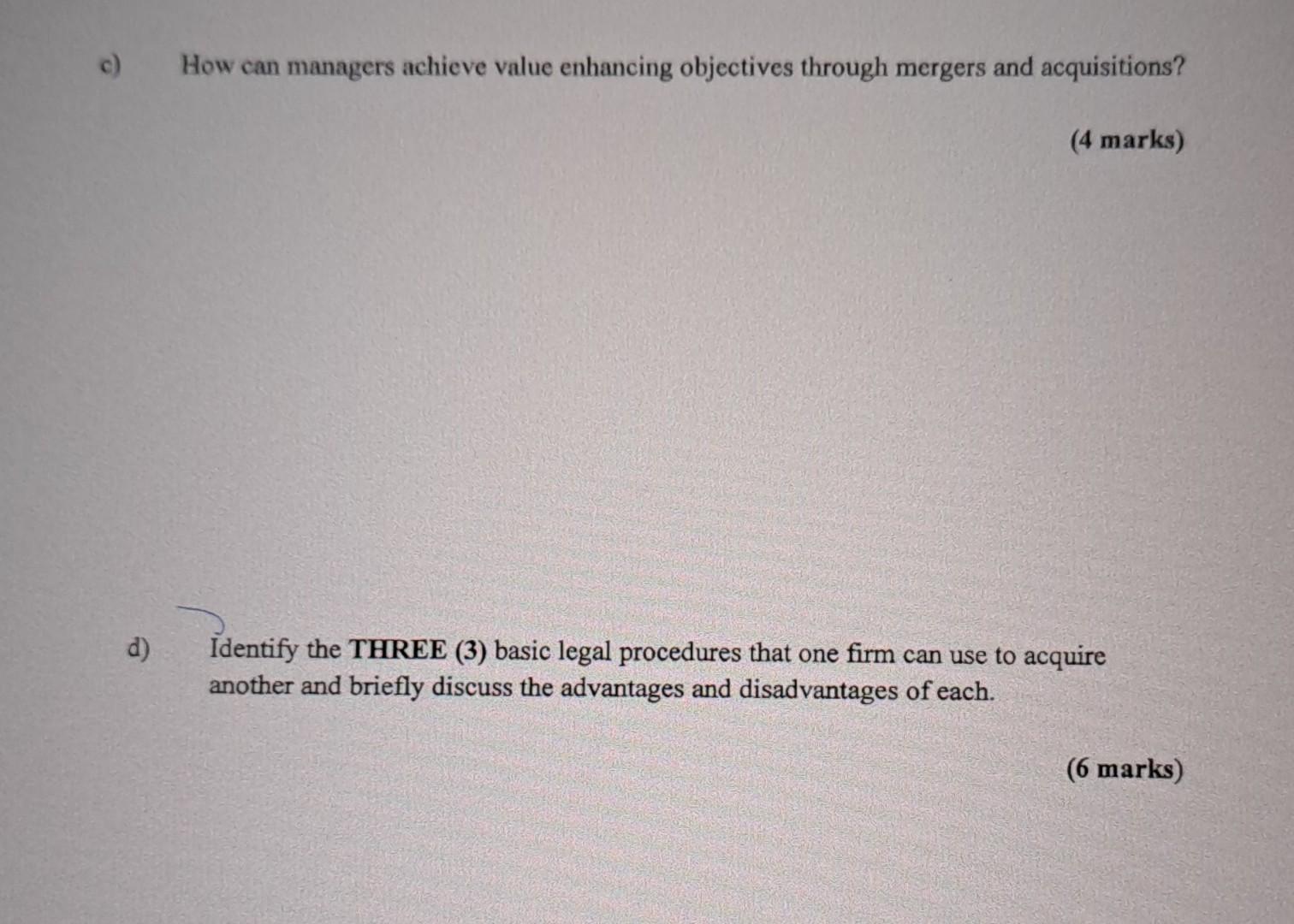

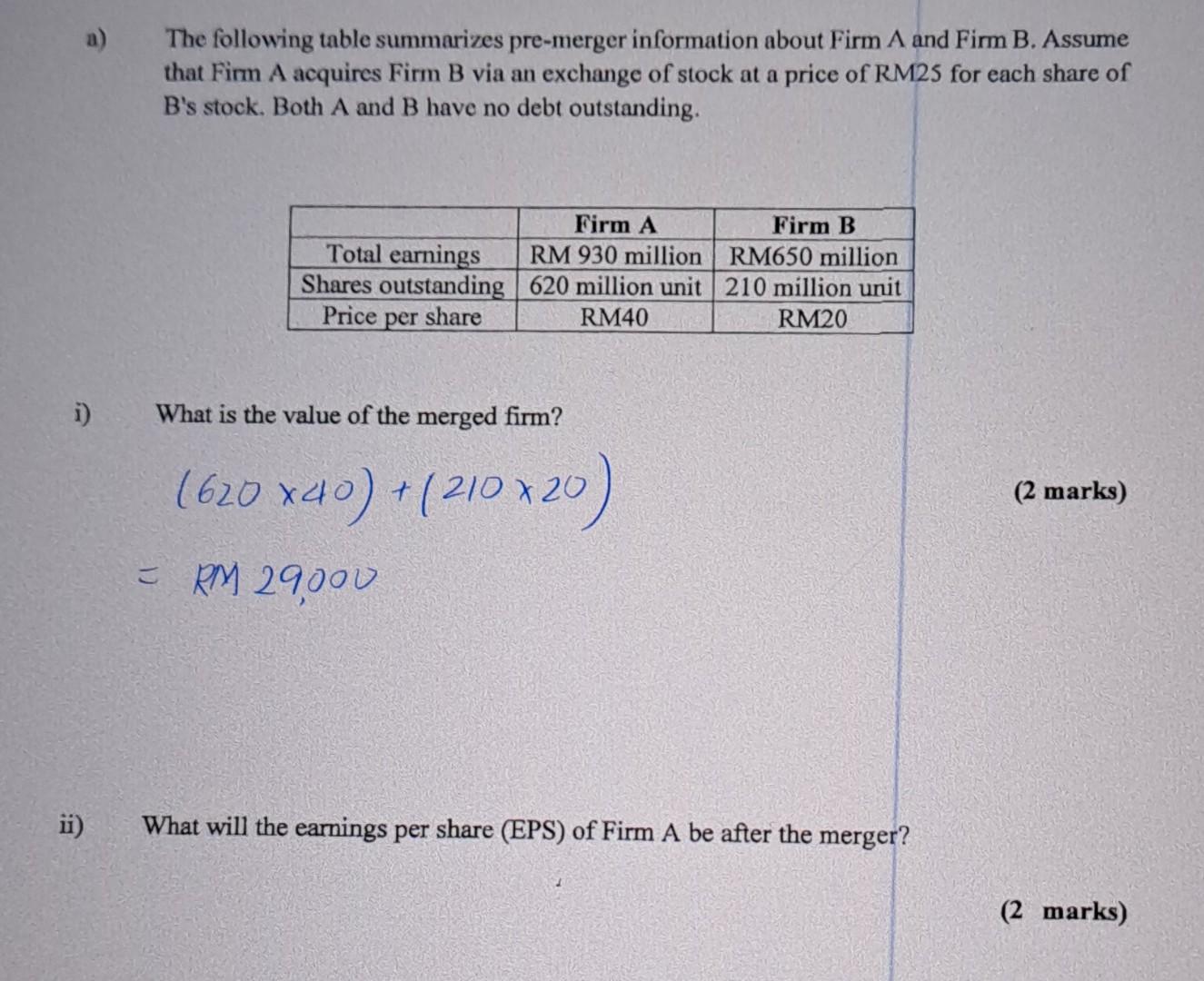

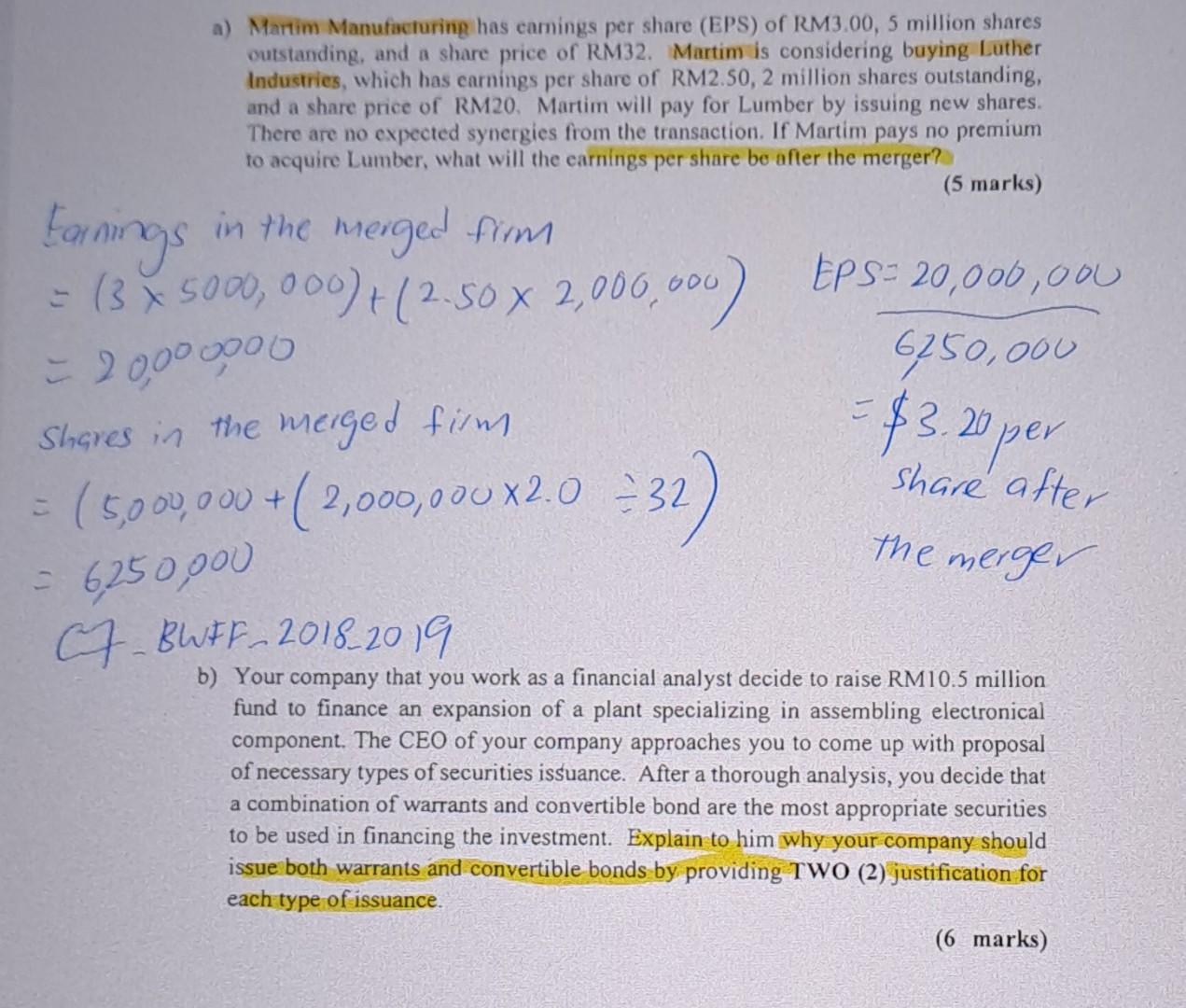

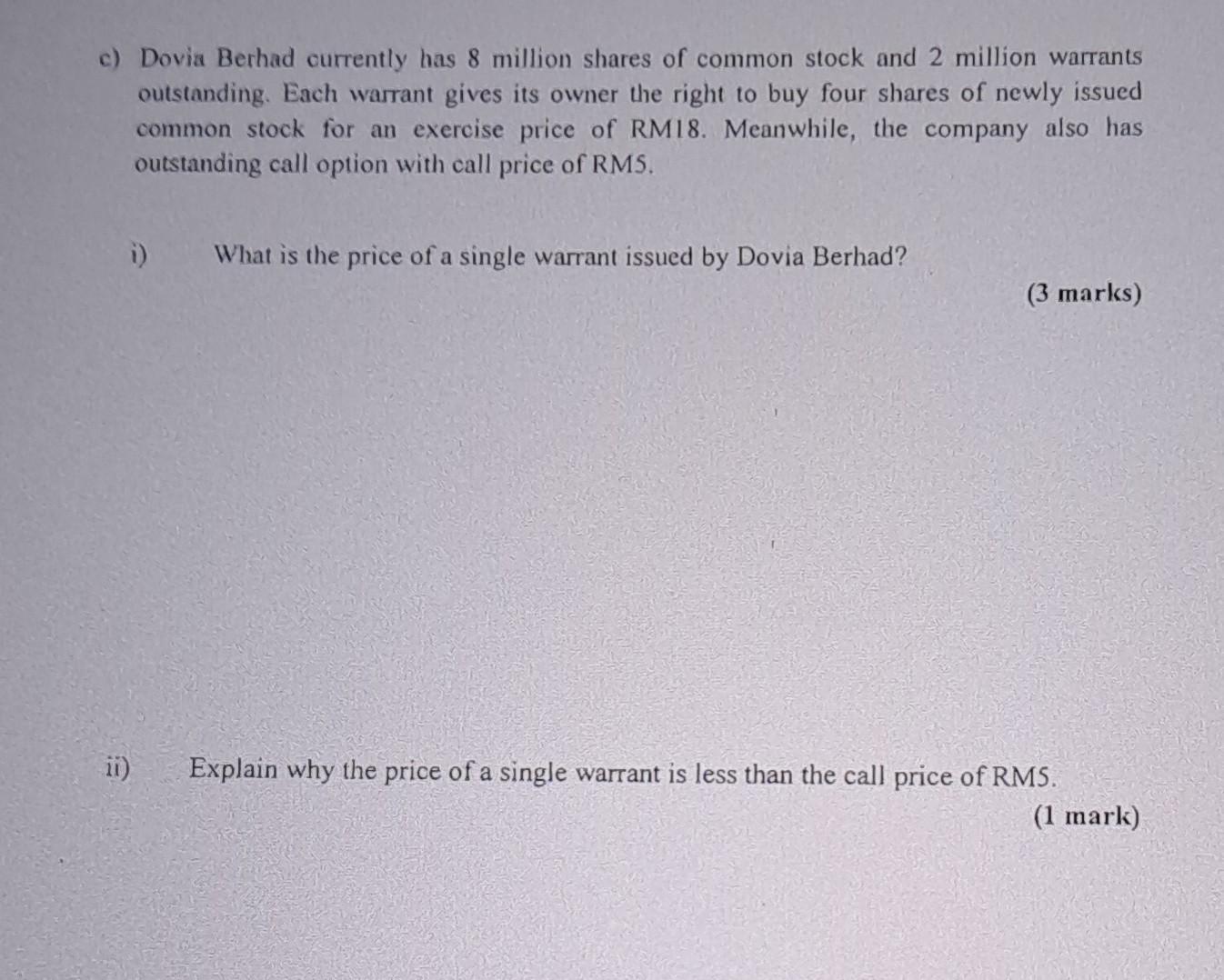

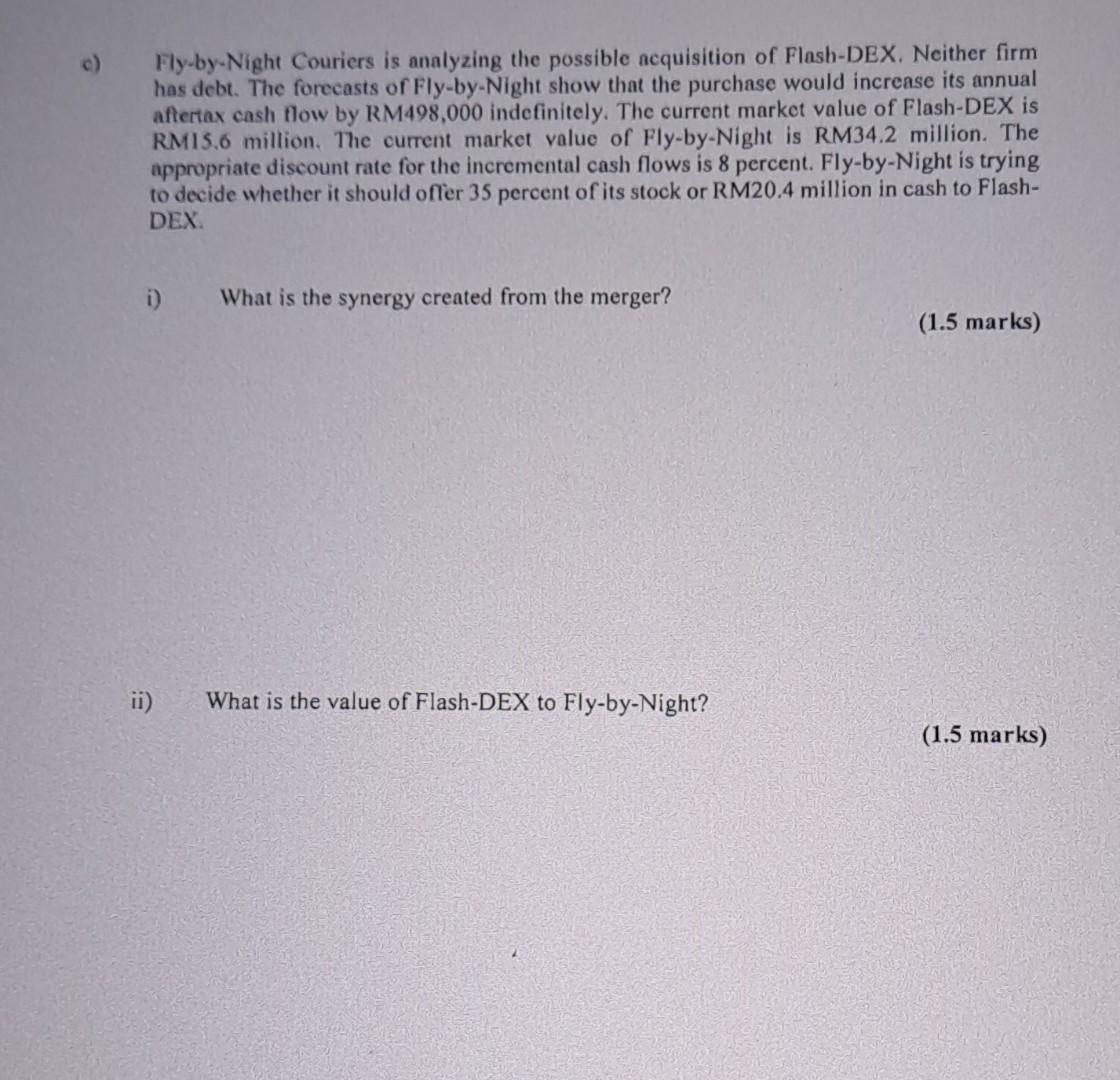

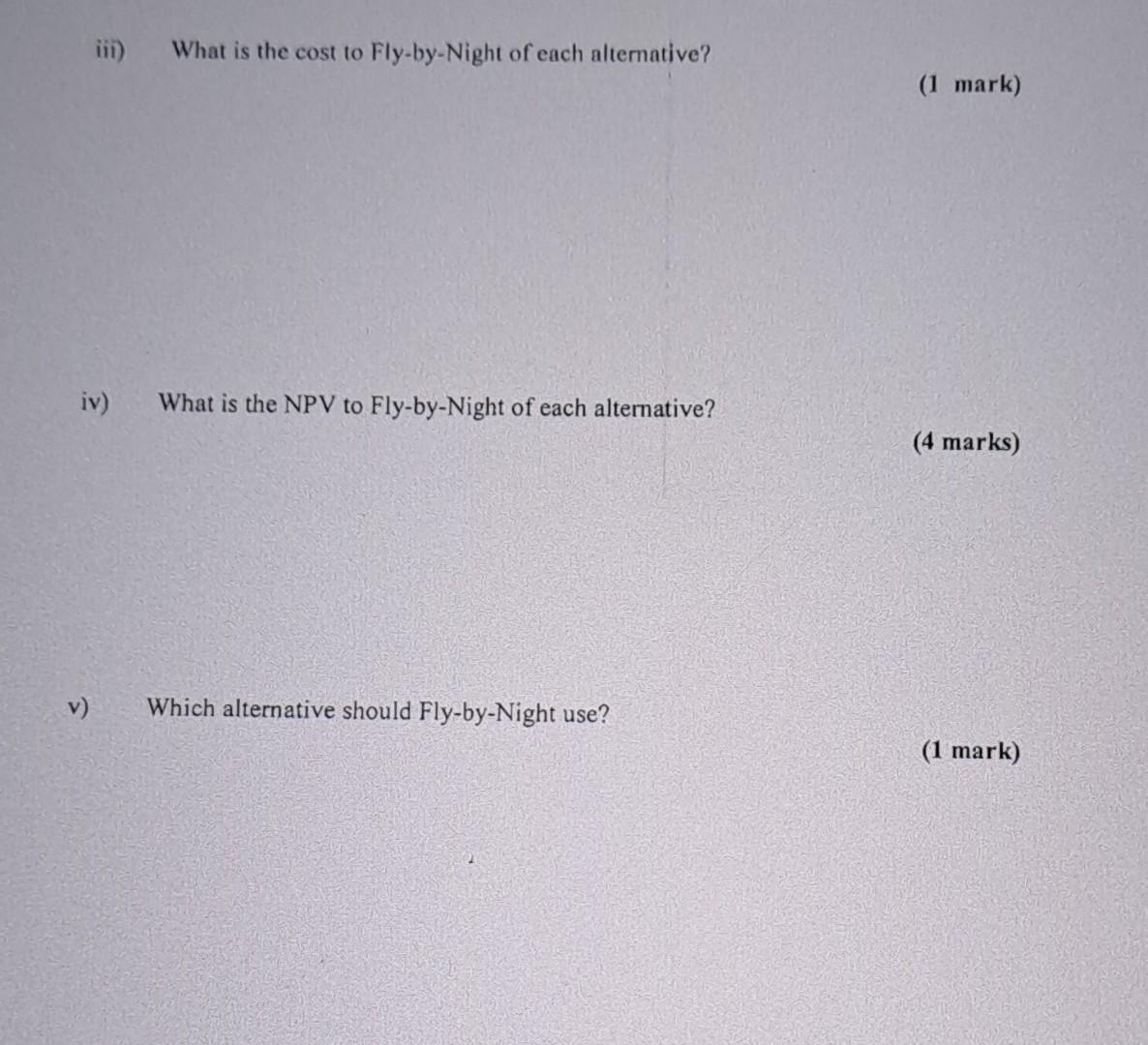

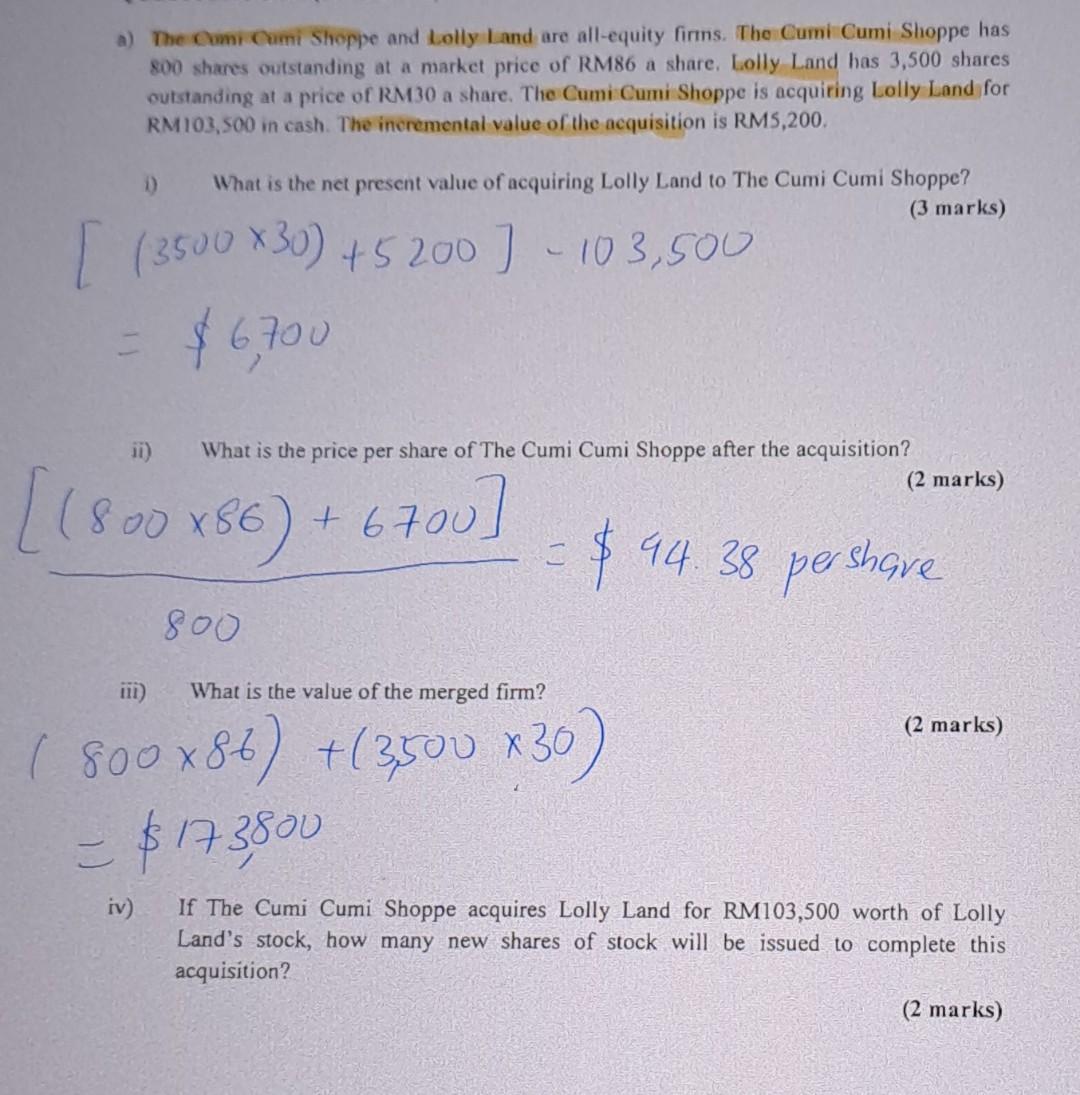

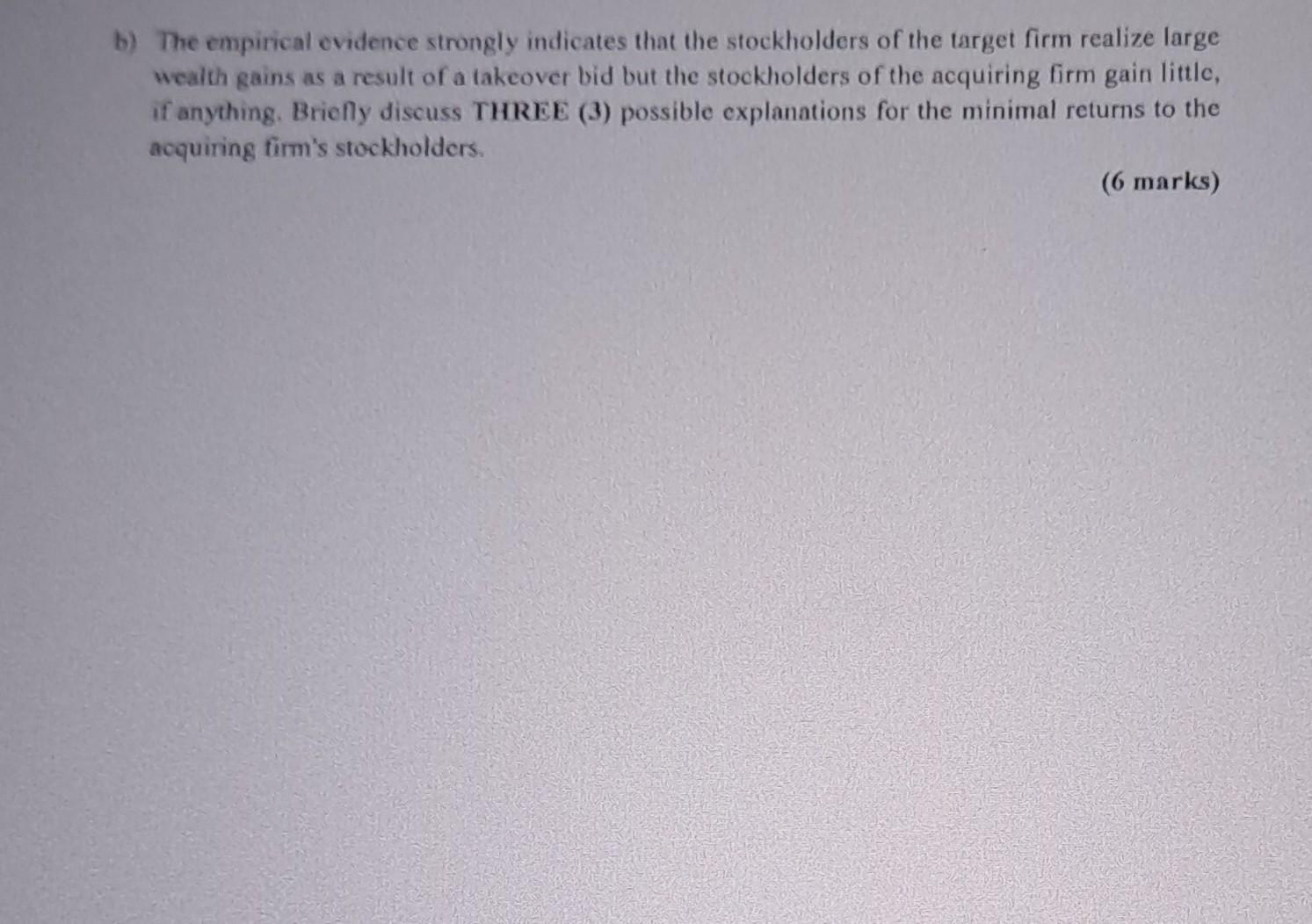

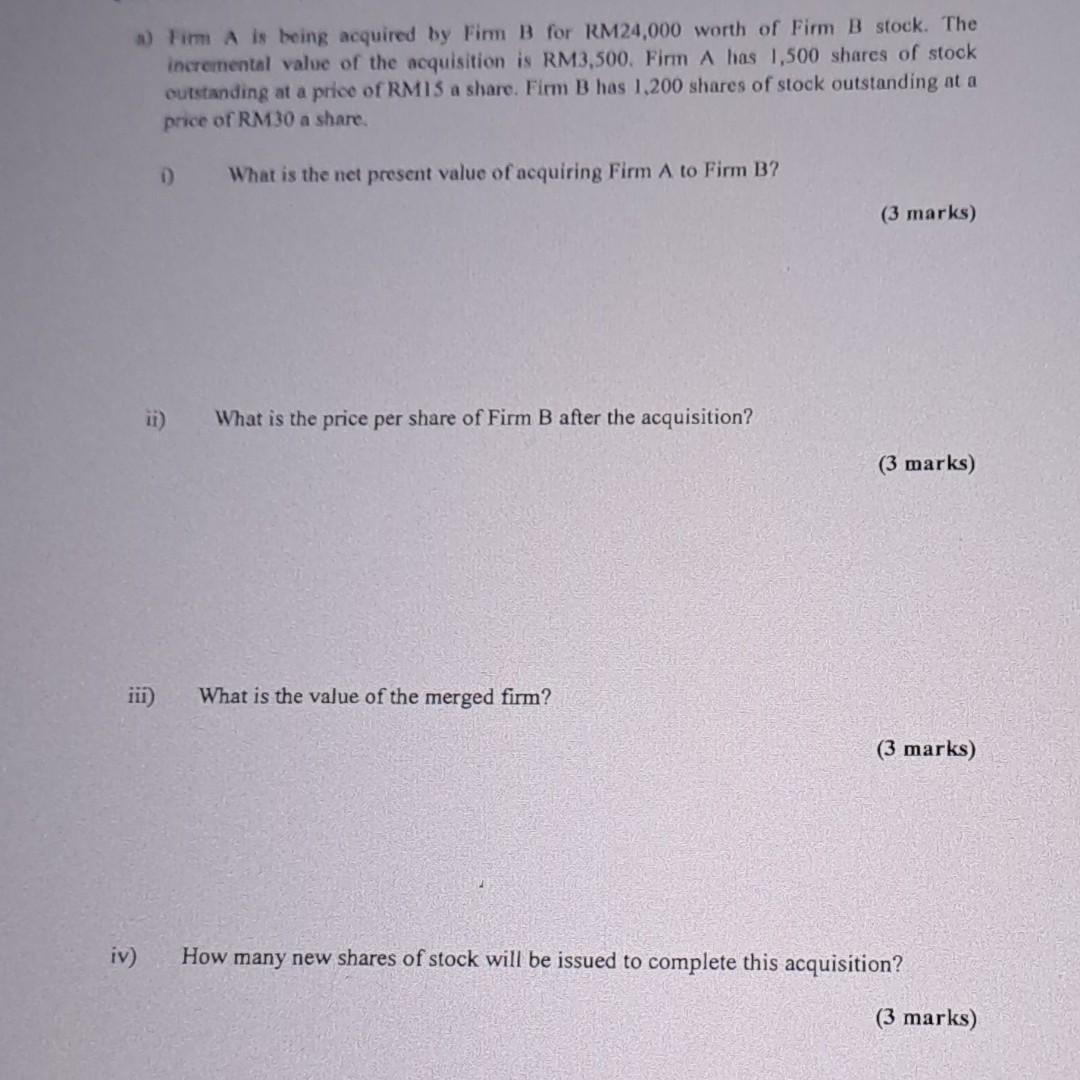

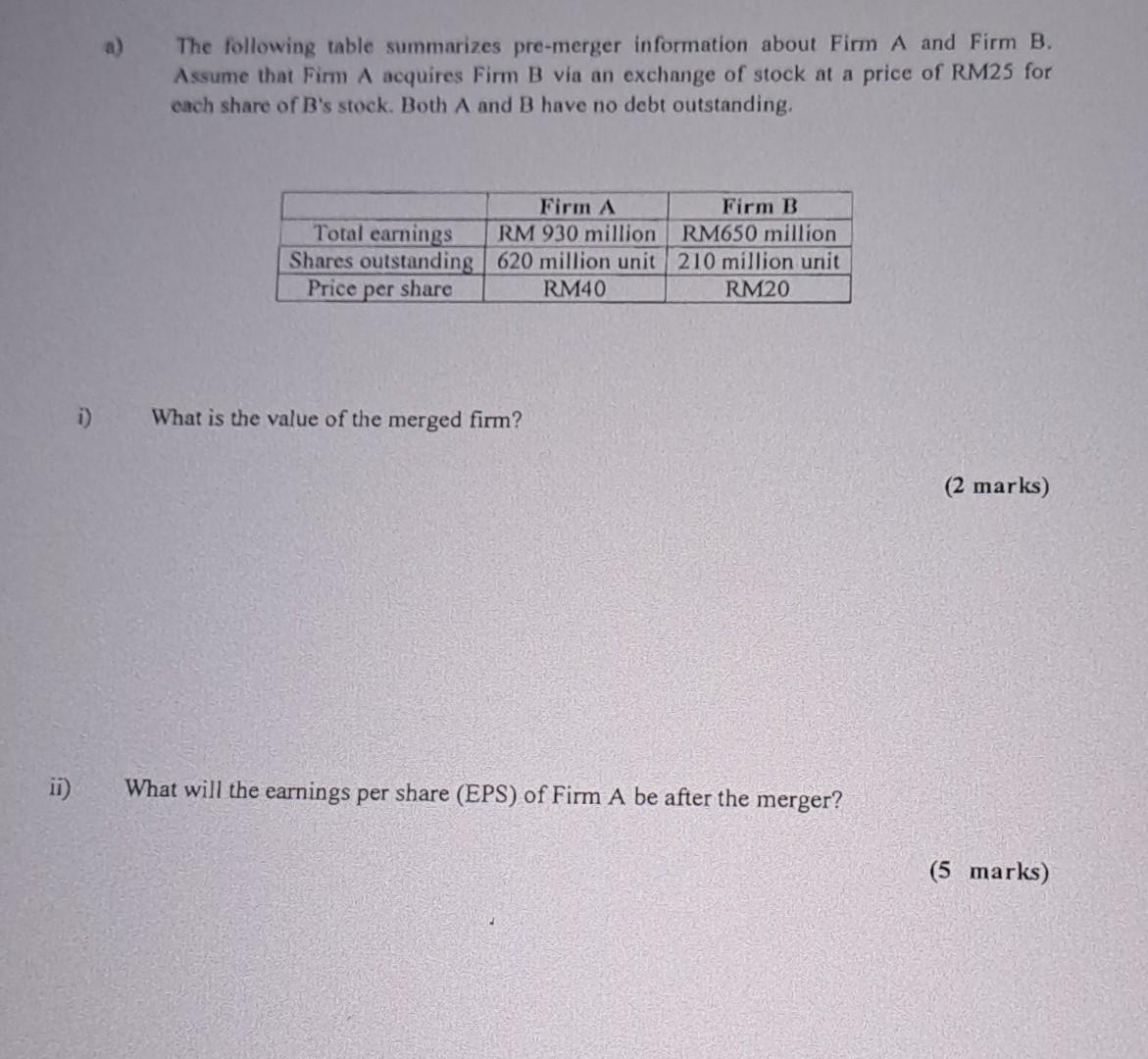

a) What does it mean to say that a proposed merger will take advantage of available economies of scale? Suppose Eastem Power Co, and Western Power Co, are located in different time zones. Both operate at 60 percent of capacity except for peak periods, when they operate at 100 percent of capacity. The peak periods begin at 9:00 a.m. and 5:00 p.m. local time and last about 45 minutes. Explain why a merger between Eastern and Western might make sense. (2 marks) Acquiring-firm stockholder seem to benefit very little from takeovers. Why is this finding a puzzle? Provide FOUR (4) reasons offered for it. A firm has a market value equal to its book value. Currently, the firm has excess cash of RM1,000 miltion and other assets of RM6,000 million. Equity is worth RM18,000 miltion. The firm has 700 million shares of stock outstanding and net income of RM1,200 milion. i) What will the new earnings per share be if the firm uses its excess cash to complete a stock repurchase? (5 marks) ii) There are a few benefits that accrue to companies which undergo share repurchase exercise. Explain THREE (3) possible benefits received by companies' stakeholders. (3 marks) b) The empirical evidence strongly indicates that the stockholders of the target firm realize large wealth gains as a result of a takeover bid but the stockholders of the acquiring firm gain little, if anything. Briefly discuss THREE (3) possible explanations for the minimal returns to the acquiring firm's stockholders. (6 marks) a) De Cumi Cami Shoppe and Lolly Land are all-equity firns. The Cumi Cumi Shoppe has 800 shares outstanding at a market price of RM86 a share. Lolly Land has 3,500 shares cutstanding at a price of RM30 a share. The Cumi Cumi Shoppe is acquiring Lolly Land for RM103,500 in cash. The incremental value of the acquisition is RMS,200. i) What is the net present value of acquiring Lolly Land to The Cumi Cumi Shoppe? (3 marks) (350030)+5200]103,500 =$6,700 ii) What is the price per share of The Cumi Cumi Shoppe after the acquisition? 80086)+6700]=$44.38pershave 800 iii) What is the value of the merged firm? 86)+(3,50030) (2 marks) $173,800 iv) If The Cumi Cumi Shoppe acquires Lolly Land for RM103,500 worth of Lolly Land's stock, how many new shares of stock will be issued to complete this acquisition? b) Flight-Via Nights Couriers is analyzing the possible acquisition of Fred-Dex. Neither firm has debt. The forecasts of Fligbt-Via Nights show that the purchase would increase its anmual after-tax cash flow by RM498,000 indefinitely. The current market value of FredDex is RM15.6 million. The current market value of Flight-Via Nights is RM34.2 million. The appropriate discount rate for the incremental cash flow is 8 percent. Flight-Via Nights is trying to decide whether it should offer 35\% of stock or RM20.4 million in cash to FredDex i) Calculate synergy created from the merger. (1.5 marks) ii) What is the value of Fred-Dex, to Flight-Via Nights Couriers? (1.5 marks) iii) What is the cost to Flight-Via Nights Couriers of each alternative? (1 mark) a) The following table summarizes pre-merger information about Firm A and Firm B. Assume that Firm A acquires Firm B via an exchange of stock at a price of RM25 for each share of B's stock. Both A and B have no debt outstanding. i) What is the value of the merged firm? (2 marks) What will the earnings per share (EPS) of Firm A be after the merger? a) Tim A is being acquired by Firm B for 12M24,000 worth of Firm B stock. The incremental value of the acquisition is RM3,500. Firm A has 1,500 shares of stock outstanding at a price of RM15 a share. Firm B has 1.200 shares of stock outstanding at a price of RM 30 a share. D) What is the net present value of acquiring Firm A to Firm B? (3 marks) ii) What is the price per share of Firm B after the acquisition? (3 marks) iii) What is the value of the merged firm? (3 marks) iv) How many new shares of stock will be issued to complete this acquisition? (3 marks) How can managers achieve value enhancing objectives through mergers and acquisitions? (4 marks) d) Identify the THREE (3) basic legal procedures that one firm can use to acquire another and briefly discuss the advantages and disadvantages of each. iii) What is the cost to Fly-by-Night of each alternative? (1 mark) iv) What is the NPV to Fly-by-Night of each alternative? (4 marks) Which alternative should Fly-by-Night use? (1 mark) b) How can managers achieve value enhancing objectives through mergers and acquisitions? (2 marks) Identify the THREE (3) basic legal procedures that one firm can use to acquire another and briefly discuss the advantages and disadvantages of each. Fly-by-Night Couriers is analyzing the possible acquisition of Flash-DEX. Neither firm has debt. The forecasts of Fly-by-Night show that the purchase would increase its annual aftertax cash flow by RM498,000 indefinitely. The current market value of Flash-DEX is RM15.6 million. The current market value of Fly-by-Night is RM34.2 million. The appropriate discount rate for the incremental cash flows is 8 percent. Fly-by-Night is trying to decide whether it should offer 35 percent of its stock or RM20.4 million in cash to FlashDEX. i) What is the synergy created from the merger? (1.5 marks) ii) What is the value of Flash-DEX to Fly-by-Night? (1.5 marks) c) Dovia Berhad currently has 8 million shares of common stock and 2 million warrants outstanding. Each warrant gives its owner the right to buy four shares of newly issued common stock for an exercise price of RM18. Meanwhile, the company also has outstanding call option with call price of RMS. i) What is the price of a single warrant issued by Dovia Berhad? (3 marks) ii) Explain why the price of a single warrant is less than the call price of RMS. (1 mark) iv) What is the NPV to Flight-Via Nights of each altcrnative? (5 marks) Which alternative should Flight-Via Nights use? Give reason for your answer. (2 marks) a) Martim Manufacturing has carnings per share (EPS) of RM3.00, 5 million shares outstanding, and a share price of RM32. Martim is considering buying Luther Industries, which has earnings per share of RM2.50, 2 million shares outstanding, and a share price of RM20. Martim will pay for Lumber by issuing new shares. There are no expected synergies from the transaction. If Martim pays no premium to acquire Lumber, what will the earnings per share be after the merger? (5 marks) Earnings in the merged firm =(35000,000)+(2.502,000,000) EPS =20,000,000 =20,000,000 6,50,000 Shares in the merged firm =(5,000,000+(2,000,0002.032) =$3.20per =6,250,000 share after the C7 BWFF-2018.2019 b) Your company that you work as a financial analyst decide to raise RM10.5 million fund to finance an expansion of a plant specializing in assembling electronical component. The CEO of your company approaches you to come up with proposal of necessary types of securities issuance. After a thorough analysis, you decide that a combination of warrants and convertible bond are the most appropriate securities to be used in financing the investment. Explain to him why your company should issue both warrants and convertible bonds by providing TWO (2) justification for each type of issuance. b) Briefly discuss FOUR (4) motives for merger. a) The following table summarizes pre-merger information about Firm A and Firm B. Assume that Firm A acquires Firm B via an exchange of stock at a price of RM25 for each share of B's stock. Both A and B have no debt outstanding. i) What is the value of the merged firm? =(62040)+(21020)RM29,000 ii) What will the earnings per share (EPS) of Firm A be after the merger? a) The Mega Petroleum Berhad. has 125,000 units shares of stock outstanding at a market price of RM93 a share. The company has just announced a 5 -for-3 stock split. i) How many shares of stock will be outstanding after the split? (2 marks) ii) What will the market price per share be after the split? (2 marks) iii) What is the primary reason managers tend to use stock splits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started