Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What is Graysons net short-term capital gain or loss from these transactions? b. What is Graysons net long-term gain or loss from these transactions?

a. What is Graysons net short-term capital gain or loss from these transactions?

b. What is Graysons net long-term gain or loss from these transactions?

c. What is Graysons overall net gain or loss from these transactions?

d. What amount of the gain, if any, is subject to the preferential rate for certain capital gains?

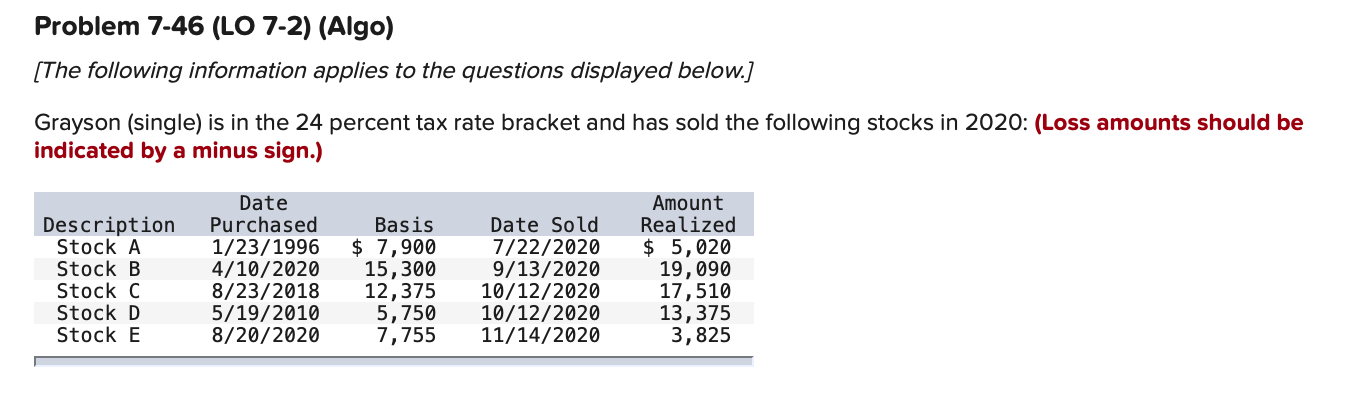

Problem 7-46 (LO 7-2) (Algo) [The following information applies to the questions displayed below.] Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2020: (Loss amounts should be indicated by a minus sign.) Description Stock A Stock B Stock C Stock D Stock E Date Purchased 1/23/1996 4/10/2020 8/23/2018 5/19/2010 8/20/2020 Basis $ 7,900 15,300 12,375 5,750 7,755 Date Sold 7/22/2020 9/13/2020 10/12/2020 10/12/2020 11/14/2020 Amount Realized $ 5,020 19,090 17,510 13,375 3,825Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started