Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. What is the benefit of scenario analysis if it does not produce an accept or reject decision for a proposed project? (3 marks) B.

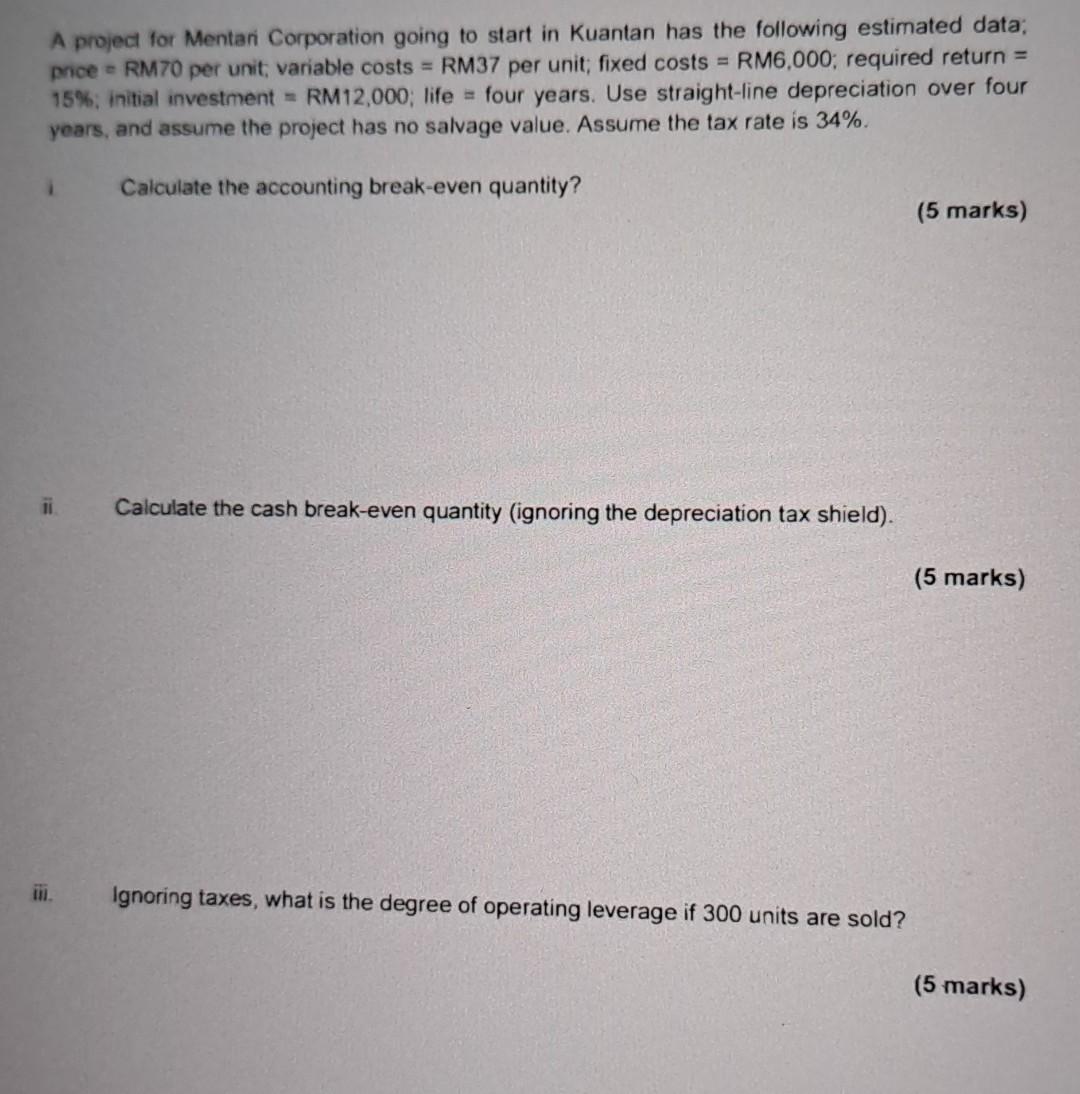

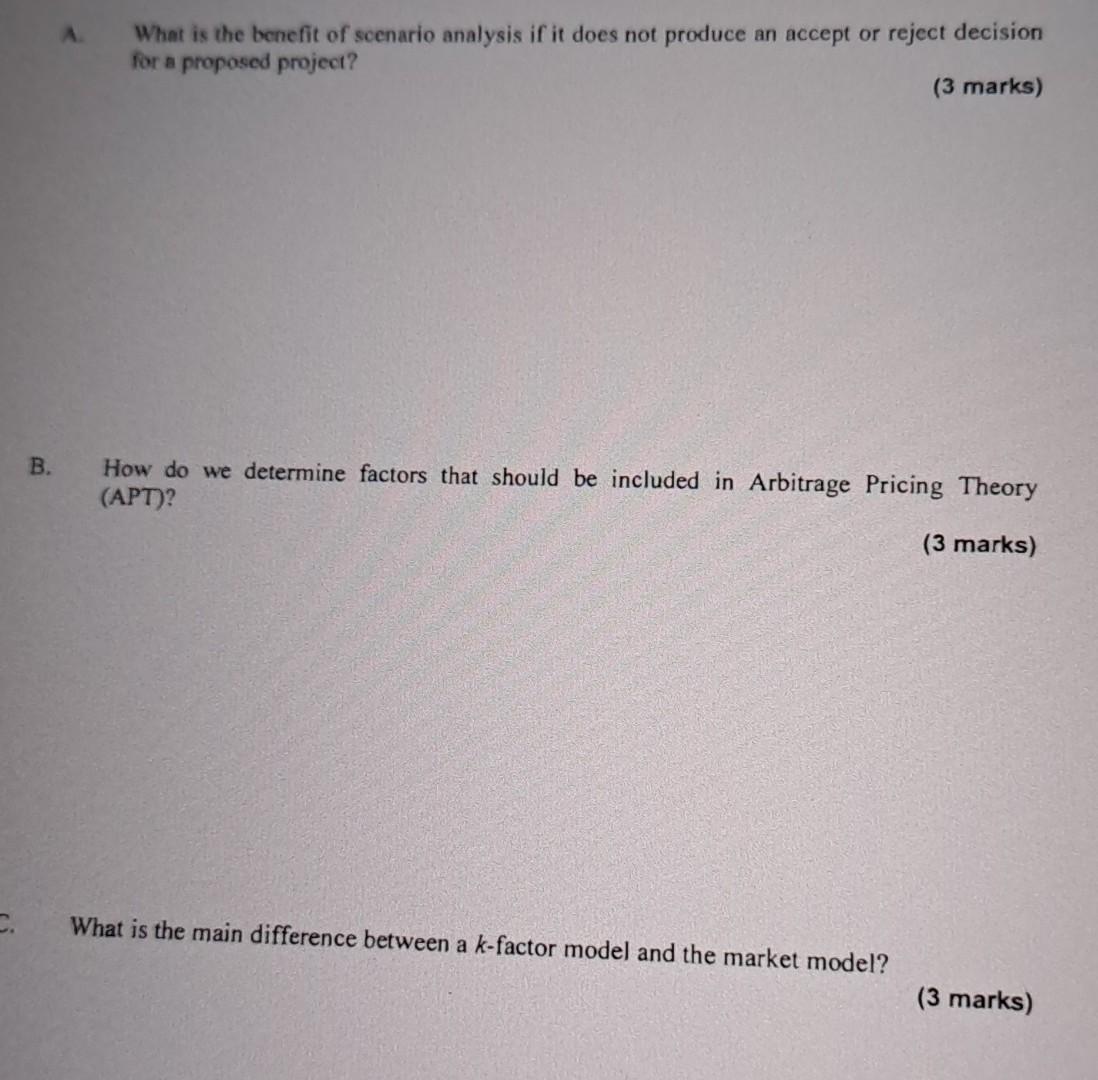

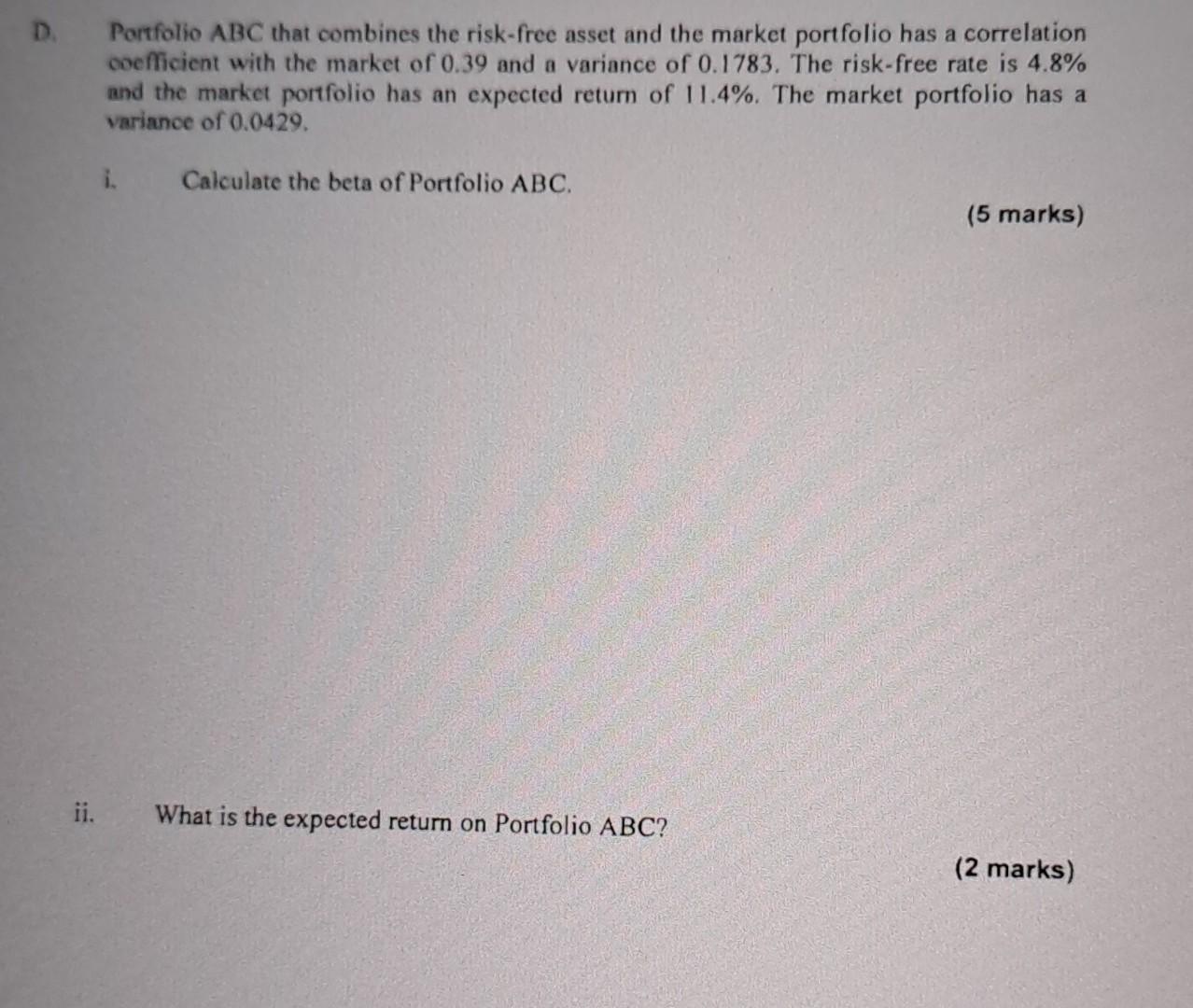

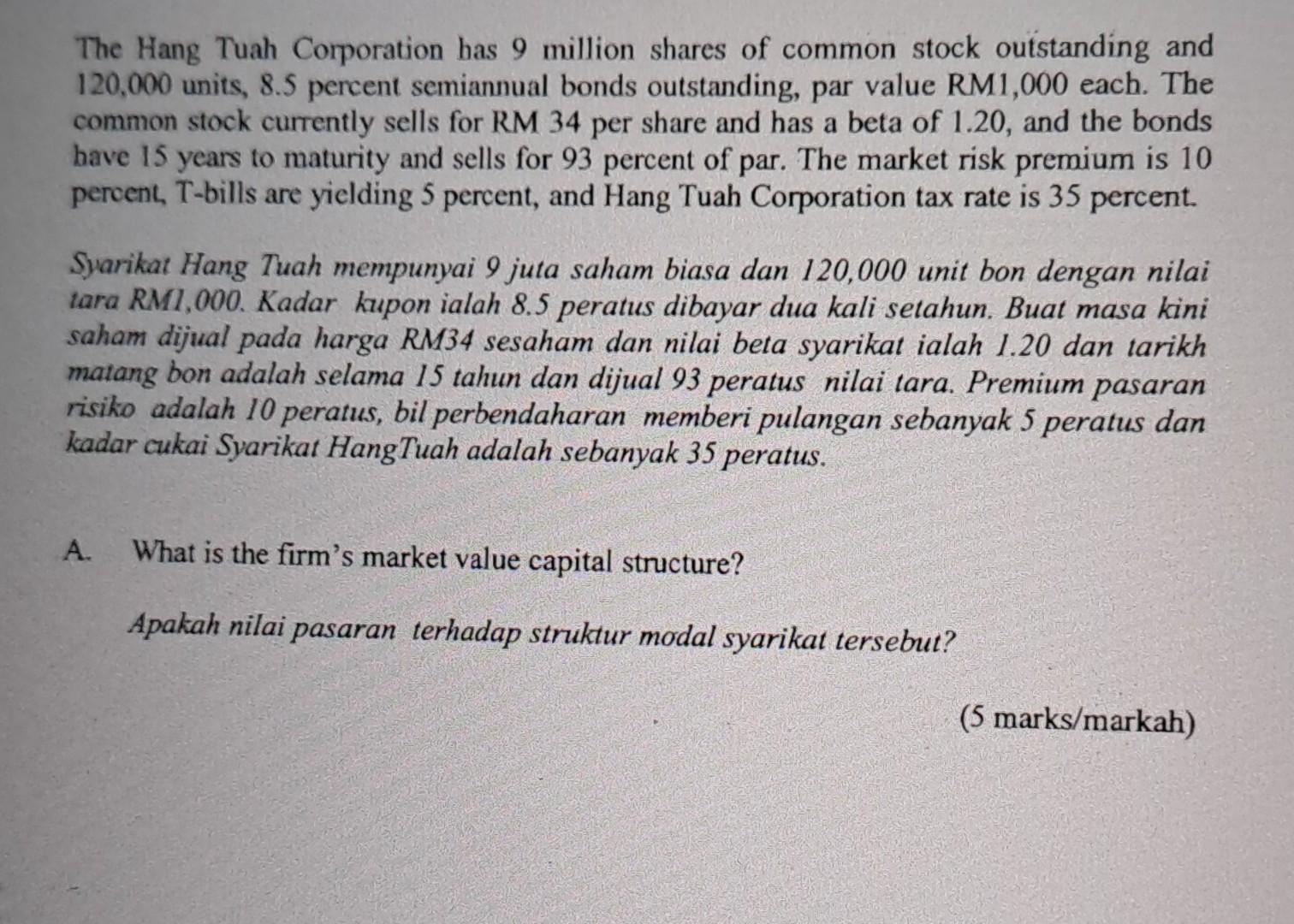

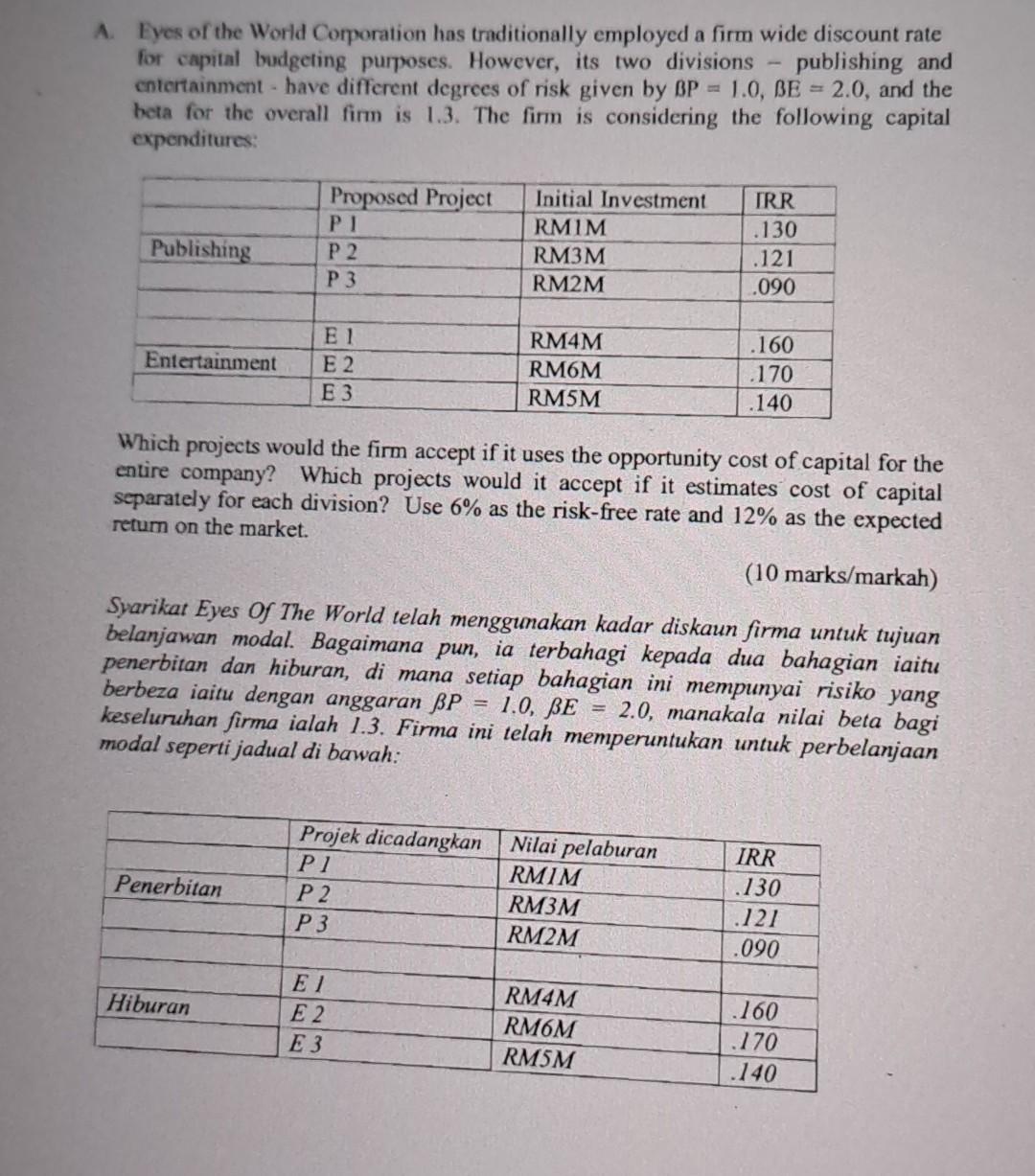

A. What is the benefit of scenario analysis if it does not produce an accept or reject decision for a proposed project? (3 marks) B. How do we determine factors that should be included in Arbitrage Pricing Theory (APT)? (3 marks) What is the main difference between a k-factor model and the market model? (3 marks) B. Edie's Health and Beauty Supply has 125,000 shares of common stock outstanding with a par value of RM1 per share and a market value of RM5 a share. The company has retained earnings of RM76,500 and capital in excess of par of RM340,000. The company just announced al-for-5 reverse stock split. What will the market value per share be after the split? Syarikat Pembekal Produk Kecantikan dan Kesihatan Edie mempunyai 125,000 syer saham semasa belum jelas dengan nilai par RMI setiap satu syer manakala nilai pasaran ialah RMS setiap satu syer. Pihak syarikat telah menyimpan keuntungan sebanyak RM76,500 dan lebihan modal ialah RM340,000. Syarikat telah mengumumkan 1 untuk 5 pembalikan "stock split". Apakah nilai pasaran setiap satu syer selepas "split"? (2 marks/markah) B. Kasim Sdn. Bhd. is considering a project with a discounted payback just equal to the project's life. The projections include a sales price of RM11, variable cost per unit of RM8.50, and fixed costs of RM4,500. The operating cash flow is RM6,200. What is the break-even quantity? Syarikat Kasim sedang mempertimbangkan satu projek dengan menggunakan tempoh bayar balik terdiskaun yang bersamaan dengan jangka hayat projek tersebut. Jangkaan projek tersebut meliputi harga jualan sebanyak RMI1, kos berubah seunit ialah RM8.50 dan kos tetap adalah RM4,500. Aliran tunai operasi ialah RM6,200. Apakah kuantiti break-even? D. Portfolio ABC that combines the risk-free asset and the market portfolio has a correlation coefficient with the market of 0.39 and a variance of 0.1783 . The risk-free rate is 4.8% and the market portfolio has an expected retum of 11.4%. The market portfolio has a variance of 0.0429 . i. Calculate the beta of Portfolio ABC. (5 marks) ii. What is the expected return on Portfolio ABC ? (2 marks) B. If Hang Tuah Corporation is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cashflows? Jika Syarikat Hang Tuah sedang menentukan projek pelaburan baru yang mempunyai risiko yang sama dengan projek biasa, apakah kadar diskaun yang patut syarikat gunakan dalam pengiraan aliran tunai projek? (5 marks/markah) A. Eyes of the World Corporation has traditionally employed a firm wide discount rate for capital budgeting purposes. However, its two divisions - publishing and entertainment - have different degrees of risk given by BP=1.0,E=2.0, and the beta for the overall firm is 1.3. The firm is considering the following capital expenditures: Which projects would the firm accept if it uses the opportunity cost of capital for the entire company? Which projects would it accept if it estimates cost of capital separately for each division? Use 6% as the risk-free rate and 12% as the expected retum on the market. (10 marks/markah) Syarikat Eyes Of The World telah menggumakan kadar diskaun firma untuk tujuan belanjawan modal. Bagaimana pun, ia terbahagi kepada dua bahagian iaitu penerbitan dan hiburan, di mana setiap bahagian ini mempunyai risiko yang berbeza iaitu dengan anggaran P=1.0,E=2.0, manakala nilai beta bagi keseluruhan firma ialah 1.3. Firma ini telah memperuntukan untuk perbelanjaan modal seperti jadual di bawah: Projek manakah yang perlu firma pilih jika pihak firma menggunakan peluang kos modal keseluruhan syarikat? Projek manakah yang perlu diterima jika harga kos anggaran modal dibahagikan untuk setiap bahagian? Gunakan 6\% sebagai kadar bebas risiko and 12\% sebagai kadar pulangan yang dijangka dalam pasaran. A project for Mentari Corporation going to start in Kuantan has the following estimated data; price = RM70 per unit, variable costs = RM37 per unit; fixed costs = RM6,000; required return = 15\%; initial investment = RM 12,000; life = four years. Use straight-line depreciation over four yoars, and assume the project has no salvage value. Assume the tax rate is 34%. Calculate the accounting break-even quantity? (5 marks) ii. Calculate the cash break-even quantity (ignoring the depreciation tax shield). (5 marks) iii. Ignoring taxes, what is the degree of operating leverage if 300 units are sold? (5 marks) The Hang Tuah Corporation has 9 million shares of common stock outstanding and 120,000 units, 8.5 percent semiannual bonds outstanding, par value RM1,000 each. The common stock currently sells for RM 34 per share and has a beta of 1.20 , and the bonds have 15 years to maturity and sells for 93 percent of par. The market risk premium is 10 percent, T-bills are yielding 5 percent, and Hang Tuah Corporation tax rate is 35 percent. Syarikat Hang Tuah mempunyai 9 juta saham biasa dan 120,000 unit bon dengan nilai tara RM1,000. Kadar kupon ialah 8.5 peratus dibayar dua kali setahun. Buat masa kini saham dijual pada harga RM34 sesaham dan nilai beta syarikat ialah 1.20 dan tarikh matang bon adalah selama 15 tahun dan dijual 93 peratus nilai tara. Premium pasaran risiko adalah 10 peratus, bil perbendaharan memberi pulangan sebanyak 5 peratus dan kadar cukai Syarikat HangTuah adalah sebanyak 35 peratus. A. What is the firm's market value capital structure? Apakah nilai pasaran terhadap struktur modal syarikat tersebut? (5 marks/markah) A It is sometimes suggested that firms should follow a "residual" dividend policy. With such policy, the main idea is that a firm should focus on meeting its investment needs and maintaining its desired debt- equity ratio. Having done so, a firm pays out any left over, or residual, income as dividends. What do you think would be the main drawback to a residual dividend policy? Ada masanya sesebuah firma perlu berlandaskan polisi dividen "residual". Melalui polisi ini, perkara utama yang perlu firma memberi tumpuan ialah terhadap perbincangan dalam keperluan pelaburan dan mengekalkan nilai nisbah hutang dan ekuiti. Firma akan membayar semula, atau "residual", di mana pendapatan adalah dalam bentuk dividen. Apakah kelemahan yang boleh anda fikirkan jika perlu menggunakan polisi dividen "residual"? (5 marks/markah) C. Southport Shippers announced that on July 1st,2008, it will pay a dividend of RM5.00 per share on August 15 to all holders on record as of July 31st. The firm's stock price is currently at RM70 per share. Assume that all investors are in the 27% tax bracket. Given that the ex-dividend date is July 29. Theoretically, what should happen to Southport's stock price on July 29 ? Syarikat Perkapalan Southport telah mengumumkan pada 1 Julai 2008, syarikat ini akan membayar dividen yang bernilai RM5 satu syer pada tarikh 15 Ogos kepada semua pemegang saham seperti yang direkodkan pada 31 Julai. Harga semasa saham syarikat ialah RM70 satu syer. Andaikan semua pelabur dikenakan cukai sebanyak 27\% Kadar dividen terdahulu adalah bertarikh 29 Julai. Secara teoritikal, apa yang akan berlaku terhadap harga saham syarikat ini pada 29 Julai? (3 marks/markah)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started