Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) What is the Black-Scholes partial differential equation (PDE) for the price f(t, S) at time t of a European derivative security on a

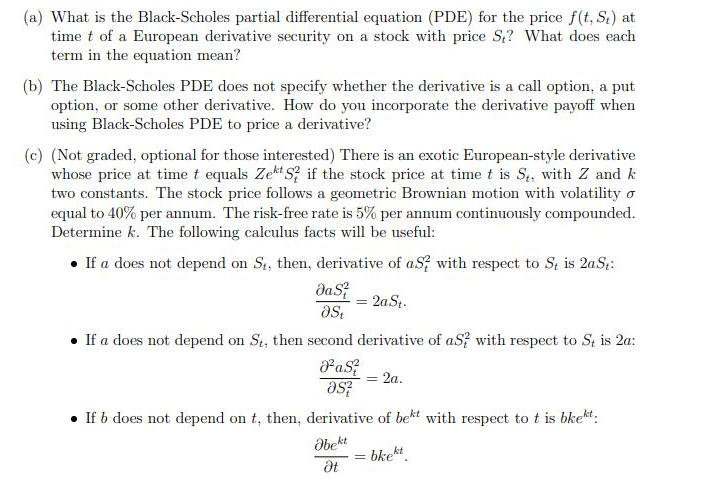

(a) What is the Black-Scholes partial differential equation (PDE) for the price f(t, S) at time t of a European derivative security on a stock with price S,? What does each term in the equation mean? (b) The Black-Scholes PDE does not specify whether the derivative is a call option, a put option, or some other derivative. How do you incorporate the derivative payoff when using Black-Scholes PDE to price a derivative? (c) (Not graded, optional for those interested) There is an exotic European-style derivative whose price at time t equals Zekt S2 if the stock price at time t is St, with Z and k two constants. The stock price follows a geometric Brownian motion with volatility o equal to 40% per annum. The risk-free rate is 5% per annum continuously compounded. Determine k. The following calculus facts will be useful: If a does not depend on St, then, derivative of as with respect to St is 2aSt: Jas ast =2aSt. If a does not depend on St, then second derivative of as? with respect to S+ is 2a: Pas as = 2a. If b does not depend on t, then, derivative of bet with respect to t is bkekt. Obekt t = bkekt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The BlackScholes partial differential equation PDE for the price ft S at time t of a European deri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started