Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What is the cost of debt for the firm? b. What is the WACC for the firm? c. What is the NPV of the

a. What is the cost of debt for the firm?

b. What is the WACC for the firm?

c. What is the NPV of the project? (Express answer in millions, so 1,000,000 would be 1.00)

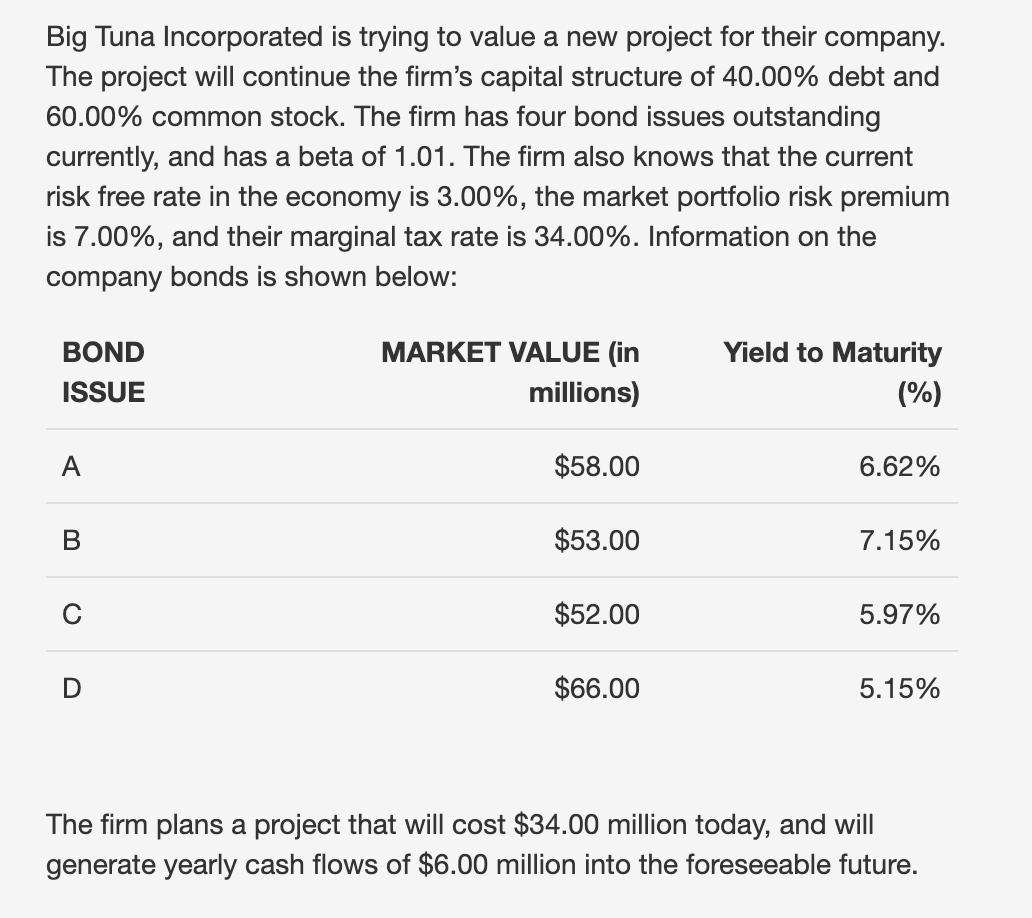

Big Tuna Incorporated is trying to value a new project for their company. The project will continue the firm's capital structure of 40.00% debt and 60.00% common stock. The firm has four bond issues outstanding currently, and has a beta of 1.01. The firm also knows that the current risk free rate in the economy is 3.00%, the market portfolio risk premium is 7.00%, and their marginal tax rate is 34.00%. Information on the company bonds is shown below: BOND ISSUE MARKET VALUE (in millions) Yield to Maturity (%) $58.00 6.62% $53.00 7.15% $52.00 5.97% $66.00 5.15% The firm plans a project that will cost $34.00 million today, and will generate yearly cash flows of $6.00 million into the foreseeable future

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started