Question

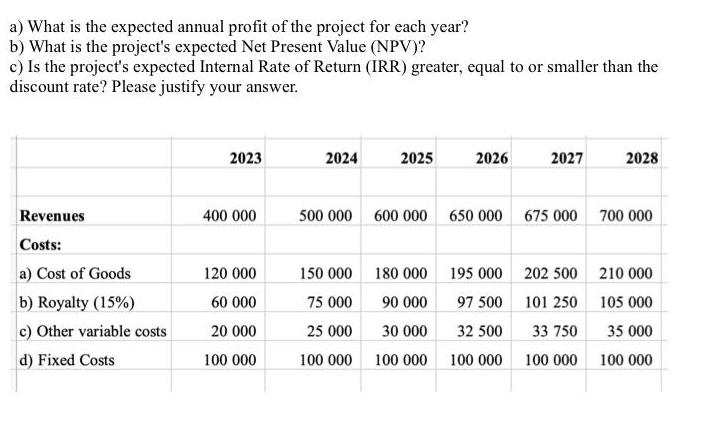

a) What is the expected annual profit of the project for each year? b) What is the project's expected Net Present Value (NPV)? c)

a) What is the expected annual profit of the project for each year? b) What is the project's expected Net Present Value (NPV)? c) Is the project's expected Internal Rate of Return (IRR) greater, equal to or smaller than the discount rate? Please justify your answer. Revenues Costs: a) Cost of Goods b) Royalty (15%) c) Other variable costs d) Fixed Costs 2023 400 000 120 000 60 000 20 000 100 000 2024 2025 500 000 600 000 150 000 75 000 25 000 100 000 180 000 90 000 30 000 100 000 2026 2027 650 000 675 000 195 000 97 500 32 500 100 000 202 500 101 250 33 750 100 000 2028 700 000 210 000 105 000 35 000 100 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected annual profit for each year we need to subtract the total costs from the r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting Information for Decision-Making and Strategy Execution

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young

6th Edition

137024975, 978-0137024971

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App