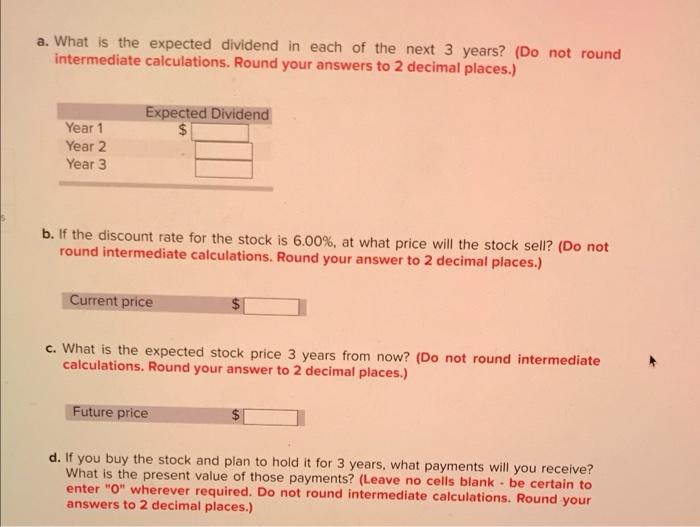

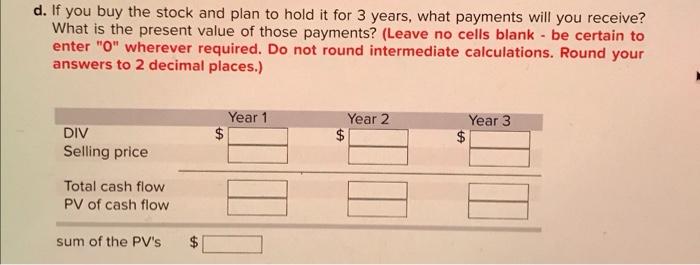

a. What is the expected dividend in each of the next 3 years? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected Dividend $ Year 1 Year 2 Year 3 b. If the discount rate for the stock is 6.00%, at what price will the stock sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current price c. What is the expected stock price 3 years from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Future price d. If you buy the stock and plan to hold it for 3 years, what payments will you receive? What is the present value of those payments? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) d. If you buy the stock and plan to hold it for 3 years, what payments will you receive? What is the present value of those payments? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 $ Year 2 $ Year 3 DIV Selling price $ Total cash flow PV of cash flow sum of the PV's $ a. What is the expected dividend in each of the next 3 years? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected Dividend $ Year 1 Year 2 Year 3 b. If the discount rate for the stock is 6.00%, at what price will the stock sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current price c. What is the expected stock price 3 years from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Future price d. If you buy the stock and plan to hold it for 3 years, what payments will you receive? What is the present value of those payments? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) d. If you buy the stock and plan to hold it for 3 years, what payments will you receive? What is the present value of those payments? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 $ Year 2 $ Year 3 DIV Selling price $ Total cash flow PV of cash flow sum of the PV's $