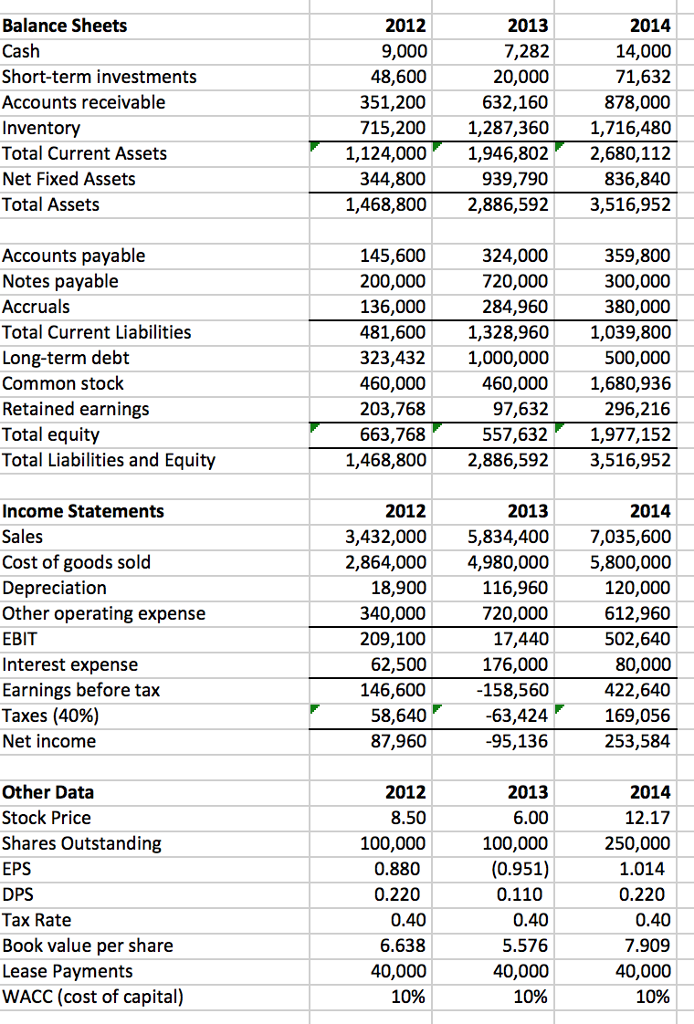

a) What is the Net Operating Profit After Tax for 2012, 2013, and 2014? b) What is the Operating Current Assets for 2012, 2013, and

a) What is the Net Operating Profit After Tax for 2012, 2013, and 2014?

b) What is the Operating Current Assets for 2012, 2013, and 2014?

c) What is Operating Current Liabilities for 2012, 2013, and 2014?

d) What is Net Operating Working Capital for 2012, 2013, and 2014?

e) What is operating Long-term Assets for 2012, 2013, and 2014?

f) What is Net Operating Capital for 2012, 2013, and 2014?

g) What is Net investment for 2013 and 2014?

h) What is Free Cash flow for 2013 and 2014?

Balance Sheets Cash Short-term investments Accounts receivable Inventory Total Current Assets Net Fixed Assets Total Assets Accounts payable Notes payable Accruals Total Current Liabilities Long-term debt Common stock Retained earnings Total equity Total Liabilities and Equity Income Statements Sales Cost of goods sold Depreciation Other operating expense EBIT Interest expense Earnings before tax Taxes (40%) Net income Other Data Stock Price Shares Outstanding EPS DPS Tax Rate Book value per share Lease Payments WACC (cost of capital) 2012 2013 9,000 7,282 48,600 20,000 351,200 632,160 715,200 1,287,360 1,124,000 1,946,802 344,800 1,468,800 145,600 200,000 136,000 481,600 323,432 460,000 203,768 663,768 1,468,800 18,900 340,000 209,100 62,500 146,600 58,640 87,960 2012 2013 3,432,000 5,834,400 2,864,000 4,980,000 2012 8.50 100,000 0.880 0.220 939,790 2,886,592 0.40 6.638 40,000 10% 324,000 720,000 284,960 1,328,960 1,000,000 460,000 97,632 557,632 2,886,592 116,960 720,000 17,440 176,000 -158,560 -63,424 -95,136 2013 6.00 100,000 (0.951) 0.110 0.40 5.576 40,000 10% 2014 14,000 71,632 878,000 1,716,480 2,680,112 836,840 3,516,952 359,800 300,000 380,000 1,039,800 500,000 1,680,936 296,216 1,977,152 3,516,952 2014 7,035,600 5,800,000 120,000 612,960 502,640 80,000 422,640 169,056 253,584 2014 12.17 250,000 1.014 0.220 0.40 7.909 40,000 10%

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Net operating profit after tax For 201287960 201395136 2014253584 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started