Answered step by step

Verified Expert Solution

Question

1 Approved Answer

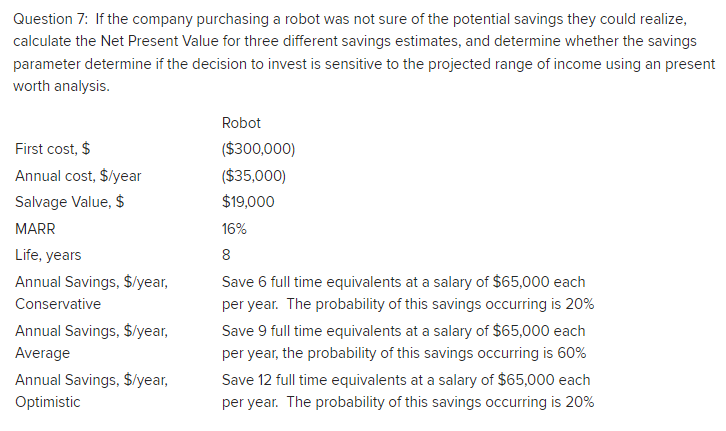

a) What is the Net Present Value for conservative savings? b) What is the Net Present Value for average savings? c) What is the Net

a) What is the Net Present Value for conservative savings?

b) What is the Net Present Value for average savings?

c) What is the Net Present Value for optimistic savings?

d) What is the expected Net Present Value across all of the savings scenarios?

Would you invest in the robot if your MARR was 16%?

f) What would be the IRR for the conservative savings?

g) What would be the IRR for the average savings?

h) What would be the IRR for the optimistic savings?

Question 7: If the company purchasing a robot was not sure of the potential savings they could realize, calculate the Net Present Value for three different savings estimates, and determine whether the savings parameter determine if the decision to invest is sensitive to the projected range of income using an present worth analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started