Answered step by step

Verified Expert Solution

Question

1 Approved Answer

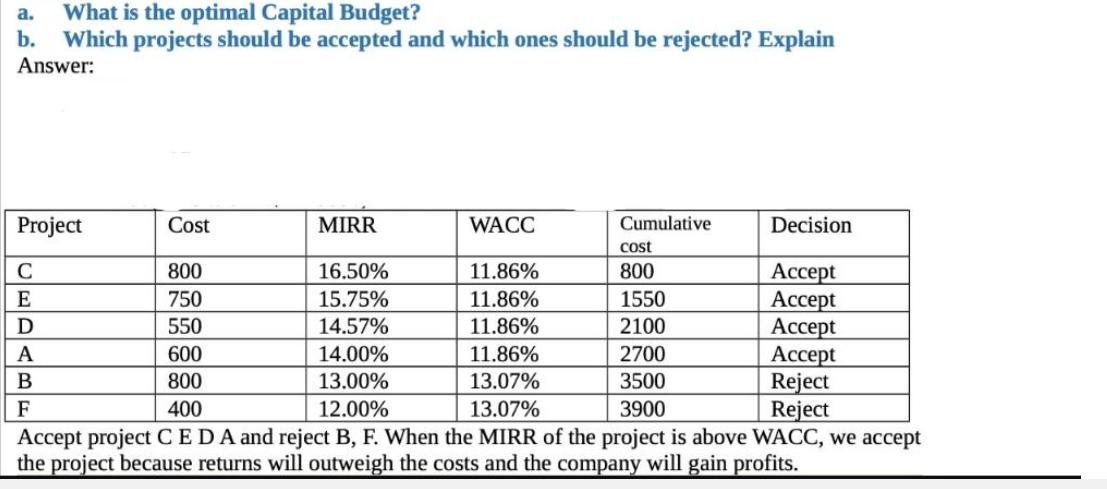

a. What is the optimal Capital Budget? b. Which projects should be accepted and which ones should be rejected? Explain Answer: Project Cost MIRR

a. What is the optimal Capital Budget? b. Which projects should be accepted and which ones should be rejected? Explain Answer: Project Cost MIRR WACC Cumulative Decision cost C 800 16.50% 11.86% 800 Accept E 750 15.75% 11.86% 1550 Accept D 550 14.57% 11.86% 2100 Accept A 600 14.00% 11.86% 2700 Accept B 800 13.00% 13.07% 3500 Reject F 400 12.00% 13.07% 3900 Reject Accept project C E DA and reject B, F. When the MIRR of the project is above WACC, we accept the project because returns will outweigh the costs and the company will gain profits.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The optimal capital budget would be to accept projects C E and D while rejecting proje...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started