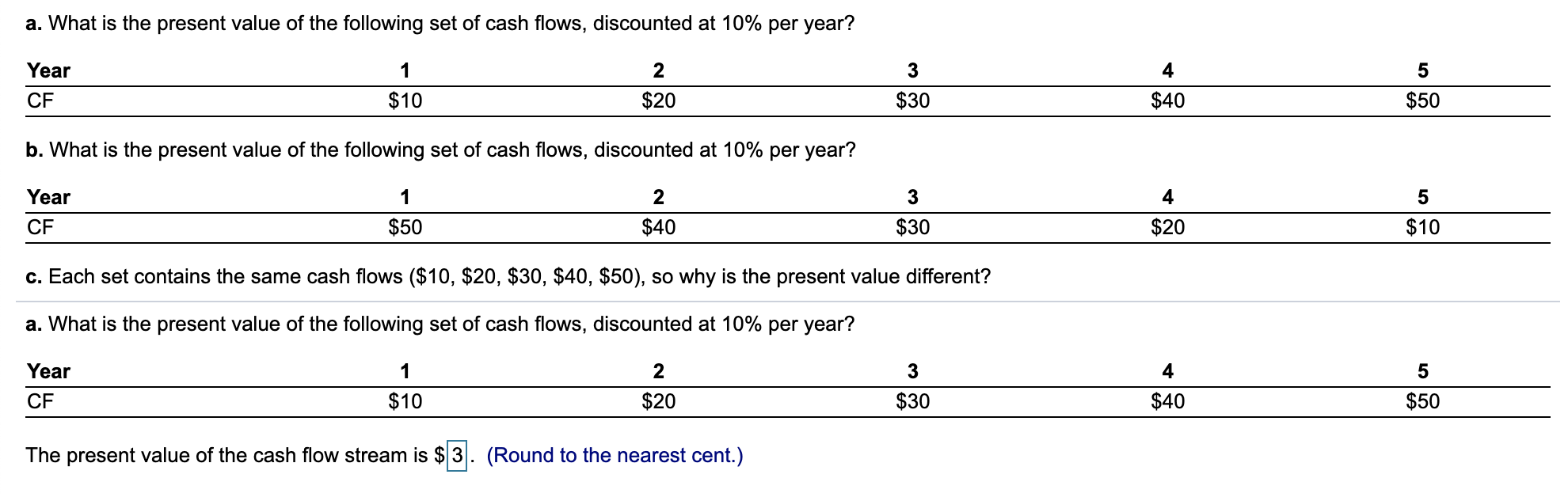

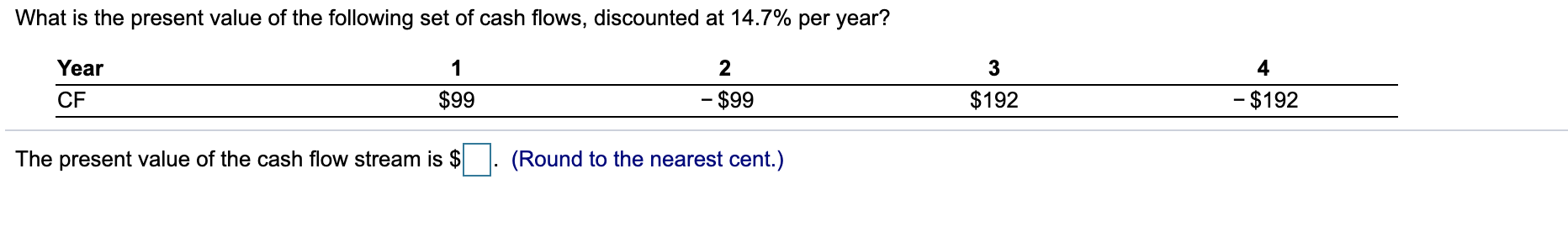

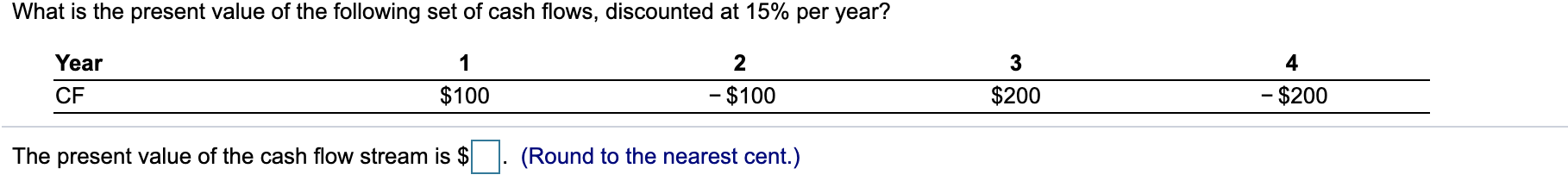

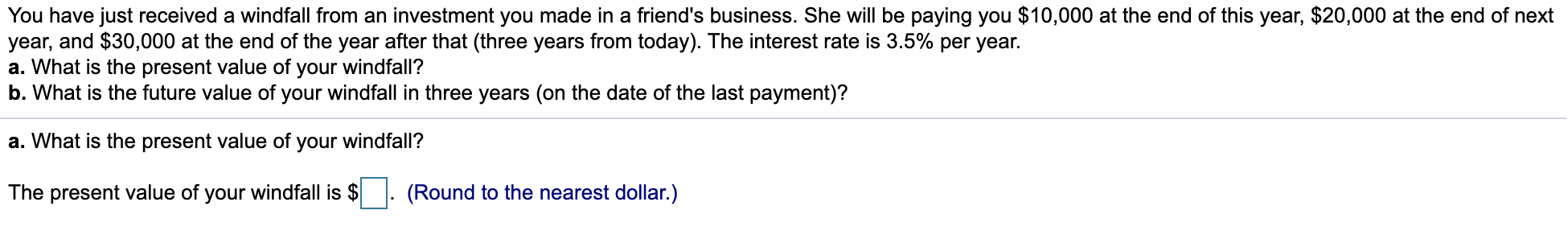

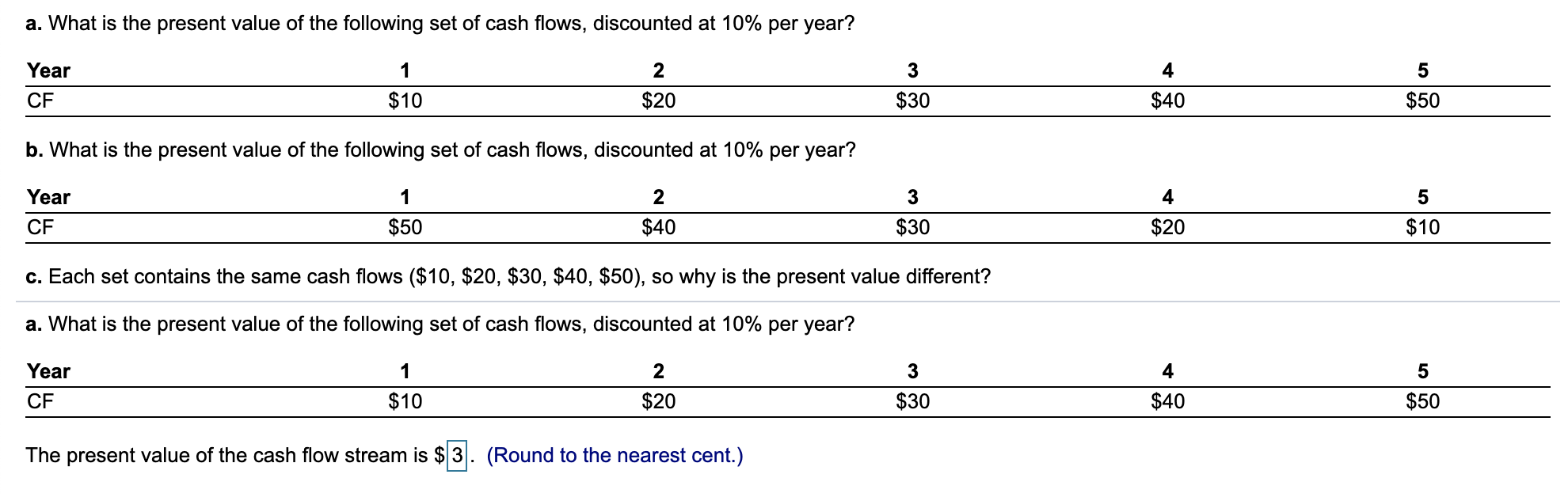

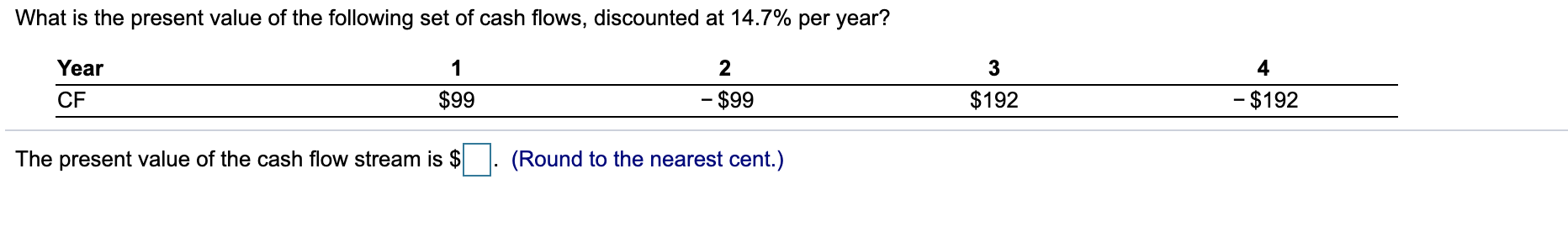

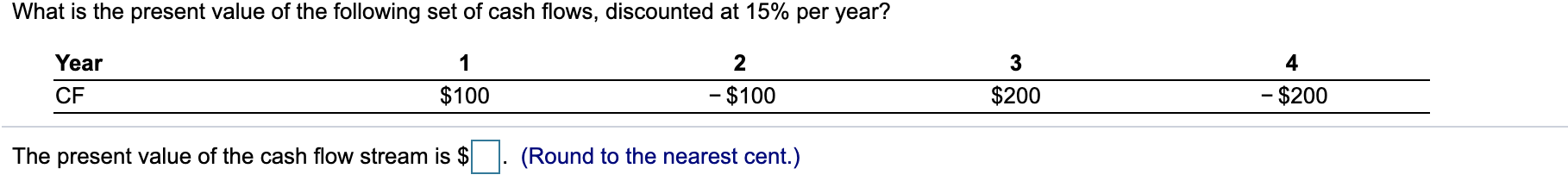

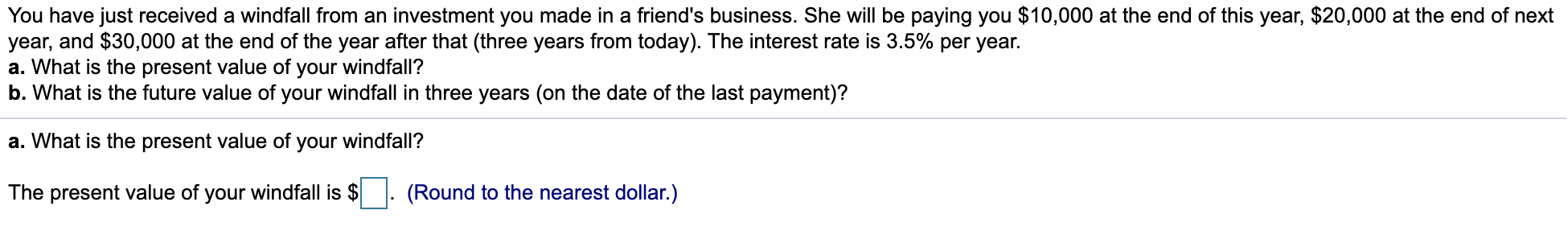

a. What is the present value of the following set of cash flows, discounted at 10% per year? 1 2 5 Year CF 3 $30 4 $40 $10 $20 $50 b. What is the present value of the following set of cash flows, discounted at 10% per year? 1 Year CF 2 $40 3 $30 4 $20 5 $10 $50 c. Each set contains the same cash flows ($10, $20, $30, $40, $50), so why is the present value different? a. What is the present value of the following set of cash flows, discounted at 10% per year? 1 2 5 Year CF 3 $30 4 $40 $10 $20 $50 The present value of the cash flow stream is $3. (Round to the nearest cent.) What is the present value of the following set of cash flows, discounted at 14.7% per year? 1 4 Year CF 2 - $99 3 $192 $99 - $192 The present value of the cash flow stream is $ (Round to the nearest cent.) What is the present value of the following set of cash flows, discounted at 15% per year? 1 4 Year CF 2 - $100 3 $200 $100 - $200 The present value of the cash flow stream is $ (Round to the nearest cent.) You have just received a windfall from an investment you made in a friend's business. She will be paying you $10,000 at the end of this year, $20,000 at the end of next year, and $30,000 at the end of the year after that (three years from today). The interest rate is 3.5% per year. a. What is the present value of your windfall? b. What is the future value of your windfall in three years (on the date of the last payment)? a. What is the present value of your windfall? The present value of your windfall is $ (Round to the nearest dollar.) a. What is the present value of the following set of cash flows, discounted at 10% per year? 1 2 5 Year CF 3 $30 4 $40 $10 $20 $50 b. What is the present value of the following set of cash flows, discounted at 10% per year? 1 Year CF 2 $40 3 $30 4 $20 5 $10 $50 c. Each set contains the same cash flows ($10, $20, $30, $40, $50), so why is the present value different? a. What is the present value of the following set of cash flows, discounted at 10% per year? 1 2 5 Year CF 3 $30 4 $40 $10 $20 $50 The present value of the cash flow stream is $3. (Round to the nearest cent.) What is the present value of the following set of cash flows, discounted at 14.7% per year? 1 4 Year CF 2 - $99 3 $192 $99 - $192 The present value of the cash flow stream is $ (Round to the nearest cent.) What is the present value of the following set of cash flows, discounted at 15% per year? 1 4 Year CF 2 - $100 3 $200 $100 - $200 The present value of the cash flow stream is $ (Round to the nearest cent.) You have just received a windfall from an investment you made in a friend's business. She will be paying you $10,000 at the end of this year, $20,000 at the end of next year, and $30,000 at the end of the year after that (three years from today). The interest rate is 3.5% per year. a. What is the present value of your windfall? b. What is the future value of your windfall in three years (on the date of the last payment)? a. What is the present value of your windfall? The present value of your windfall is $ (Round to the nearest dollar.)