Answered step by step

Verified Expert Solution

Question

1 Approved Answer

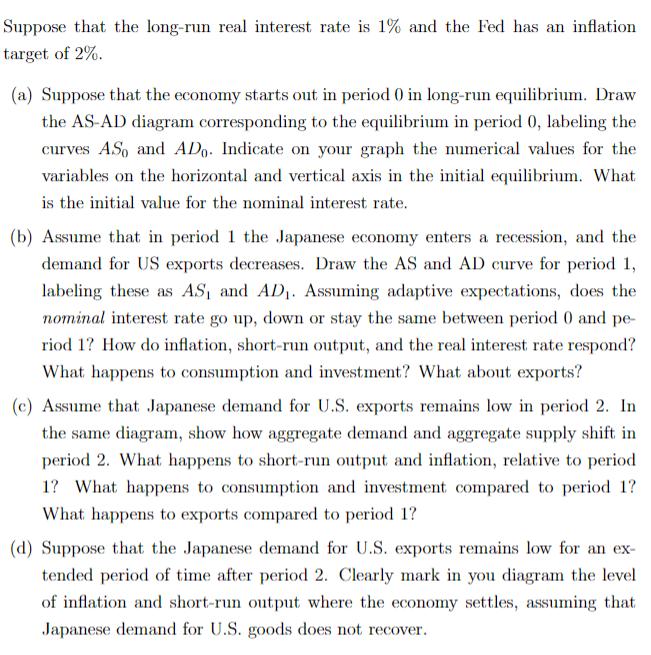

Suppose that the long-run real interest rate is 1% and the Fed has an inflation target of 2%. (a) Suppose that the economy starts

Suppose that the long-run real interest rate is 1% and the Fed has an inflation target of 2%. (a) Suppose that the economy starts out in period 0 in long-run equilibrium. Draw the AS-AD diagram corresponding to the equilibrium in period 0, labeling the curves AS and AD. Indicate on your graph the numerical values for the variables on the horizontal and vertical axis in the initial equilibrium. What is the initial value for the nominal interest rate. (b) Assume that in period 1 the Japanese economy enters a recession, and the demand for US exports decreases. Draw the AS and AD curve for period 1, labeling these as AS, and AD. Assuming adaptive expectations, does the nominal interest rate go up, down or stay the same between period 0 and pe- riod 1? How do inflation, short-run output, and the real interest rate respond? What happens to consumption and investment? What about exports? (c) Assume that Japanese demand for U.S. exports remains low in period 2. In the same diagram, show how aggregate demand and aggregate supply shift in period 2. What happens to short-run output and inflation, relative to period 1? What happens to consumption and investment compared to period 1? What happens to exports compared to period 1? (d) Suppose that the Japanese demand for U.S. exports remains low for an ex- tended period of time after period 2. Clearly mark in you diagram the level of inflation and short-run output where the economy settles, assuming that Japanese demand for U.S. goods does not recover.

Step by Step Solution

★★★★★

3.42 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a The ASAD diagram corresponding to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started