Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. What is the project cash flow for year 1? B. What is the project cash flow for year 2? C. What is the NPV

A. What is the project cash flow for year 1?

B. What is the project cash flow for year 2?

C. What is the NPV of this project?

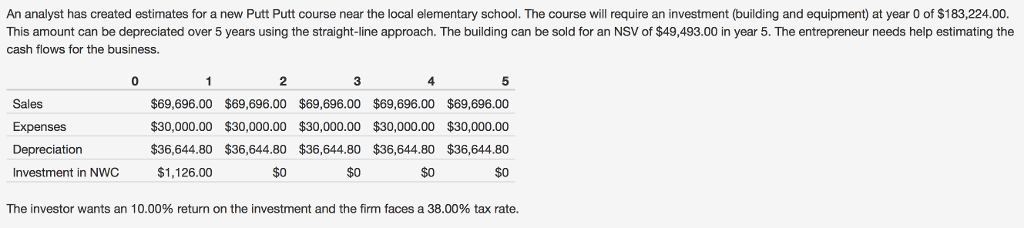

An analyst has created estimates for a new Putt Putt course near the local elementary school. The course will require an investment (building and equipment) at year 0 of $183,224.00 This amount can be depreciated over 5 years using the straight-line approach. The building can be sold for an NSV of $49,493.00 in year 5. The entrepreneur needs help estimating the cash flows for the business. 5 $69,696.00 $69,696.00 $69,696.00 $69,696.00 $69,696.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $36,644.80 $36,644.80 $36,644.80 $36,644.80 $36,644.80 $0 3 Sales Expenses Depreciation nvestment in NWC $1,126.00 $0 $0 $0 The investor wants an 10.00% return on the investment and the firm faces a 38.00% tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started