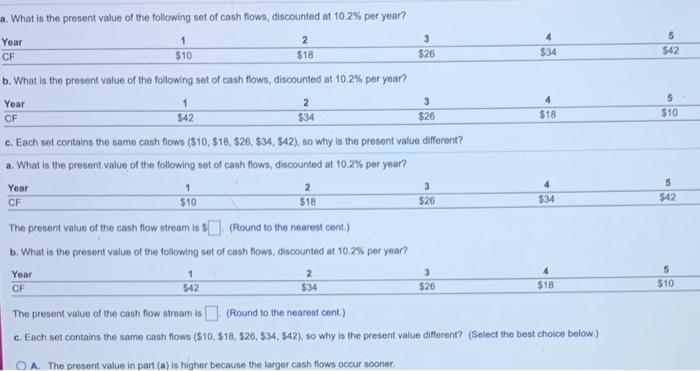

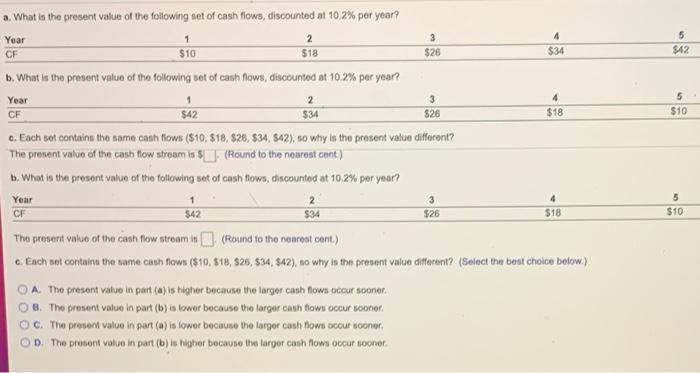

a. What is the prosent value of the following set of cash flows, discounted at 102% per year? Year 2 $10 $18 4 3 $26 5 $42 CF $34 b. What is the present value of the following set of cash flows, discounted at 10.2% per year? 4 Year 1 3 5 $10 2 $34 CF $42 $26 $18 e. Each set contains the same cash flows ($10,518, 526, 534, 542), so why is the present value different? a. What is the present value of the following set of cash flows, discounted at 10.2% per year? 5 2 4 Year CF 3 $26 $10 $18 $42 $34 The present value of the conth flow stroom in (Round to the nearest cont.) b. What is the present value of the following set of cash flowe, discounted at 10.2% per year? Year 5 1 2 3 CF $42 $34 $26 $10 $18 The present value of the cash flow stream is (Round to the nearent cent.) c. Each set contains the same cash flows ($10,518, 526, $34, 942), so why is the present value different? (Select the best choice below.) OA. The present value in part (a) is higher because the larger cash flows occur sooner a. What is the present value of the following set of cash flows, discounted at 10.2% per year? 2 510 Year 5 3 CF $18 $26 $34 $42 b. What is the present value of the following set of cash flows, discounted at 10.2% per year? Year 2 3 5 4 CF $42 $34 $26 $10 $18 c. Each set contain the same cash flows ($10, 518, 526, $34. 42), so why is the present value different? The present value of the cash flow stream in $(Round to the nearest cent) b. What is the prosent value of the following set of cash flows, discounted at 10.2% per year? Year 2 4 5 3 $26 CF $42 $34 $18 $10 The present value of the cash flow stroom in (Round to the nearest cont.) c. Each set contain the same cash flows ($10.518, $20, $34, 842), so why is the present value different? (Select the best choice below.) OA. The present value in part() is higher because the larger cash flows occur sooner. O B. The present value in part(b) is lower because the larger cash flown occur sooner. OC. The present value in part() is lower because the larger cash flows occur sooner. OD. The present value in part(b) is higher because the larger cash flows occur sooner