Question

A) What is the risk free rate? (rf) B) What is the yield to maturity of Corporation A's bond issue? C) What is the 20

A) What is the risk free rate? (rf)

B) What is the yield to maturity of Corporation A's bond issue?

C) What is the 20 year maturity risk premium? (rmp)

D) What is the A rated bonds default risk premium? (rdp)

E) What price would you pay for a 10 year AA-rated bond with a face value of $1,000 and a coupon rate of 7.10%?

F) What price would you pay for a 5 year, BB-bond with a face value of $1,000 and a coupon rate of 9.75%?

G) Why is the maturity risk premium for 20 years greater than that for 5 years?

H) What would most likely happen if the AA-Bond were to be downgraded to a rating of A?

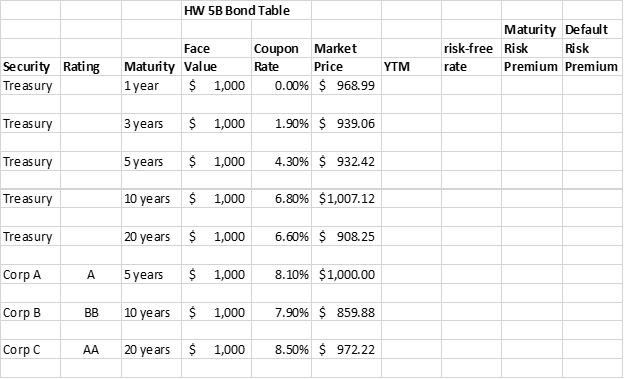

HW 5B Bond Table Face Maturity Value 1 year $ 1,000 Security Rating Treasury Maturity Default risk-free Risk Risk rate Premium Premium Coupon Market Rate Price YTM 0.00% $ 968.99 Treasury 3 years $ 1,000 1.90% $ 939.06 Treasury 5 years $ 1,000 4.30% $ 932.42 Treasury 10 years $ 1,000 6.80% $1,007.12 Treasury 20 years $ 1,000 6.60% $ 908.25 Corp A A 5 years $1,000 8.10% $1,000.00 Corp B BB 10 years $ 1,000 7.90% $ 859.88 Corpc AA 20 years $ 1,000 8.50% $ 972.22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started