Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What is the share price of this company right at the beginning of the year 2019 b. If the CEO of this company was

a. What is the share price of this company right at the beginning of the year 2019

b. If the CEO of this company was offered $75 per share for the equity in the company, should the offer be accepted? Explain in one sentence why/why not?

c. If the CEO of this comp was being offered $500 million, and the CEO was responsible for paying off the debt prior to the companys new ownership taking over, should the offer be accepted, please explain why your answer briefly.

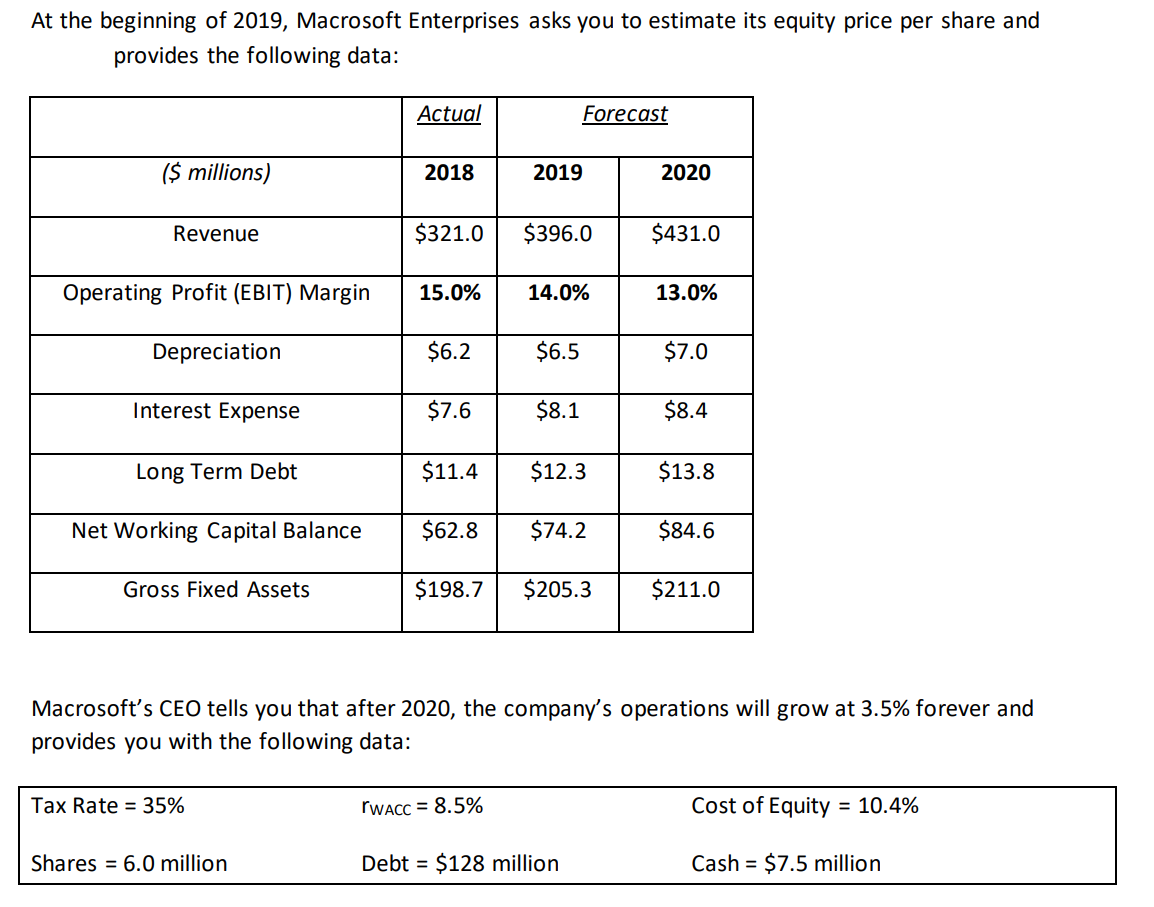

At the beginning of 2019, Macrosoft Enterprises asks you to estimate its equity price per share and provides the following data: Macrosoft's CEO tells you that after 2020, the company's operations will grow at 3.5% forever and provides you with the following data: At the beginning of 2019, Macrosoft Enterprises asks you to estimate its equity price per share and provides the following data: Macrosoft's CEO tells you that after 2020, the company's operations will grow at 3.5% forever and provides you with the following dataStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started