Question

a) What is the value of BWM and each division? What is the debt-to-value ratio in each division? (6 marks) b) Assume BWM cost of

a) What is the value of BWM and each division? What is the debt-to-value ratio in each division? (6 marks)

b) Assume BWM cost of debt in the two divisions is in line with the industry average. What is the cost of levered equity for each division and for the company as a whole? Motivate assumptions used in your calculations. (12 marks)

c) What is the cost of debt for the company as a whole? Explain what the obtained value represents. What other ways of estimations of cost of debt can be used in practice? (4 marks)

d) Calculate the company-wide WACC and WACC for each division.Explain the consequences of using the company-wide cost of capital to benchmark projects in the automotive division, use examples in your discussion. (6 marks)

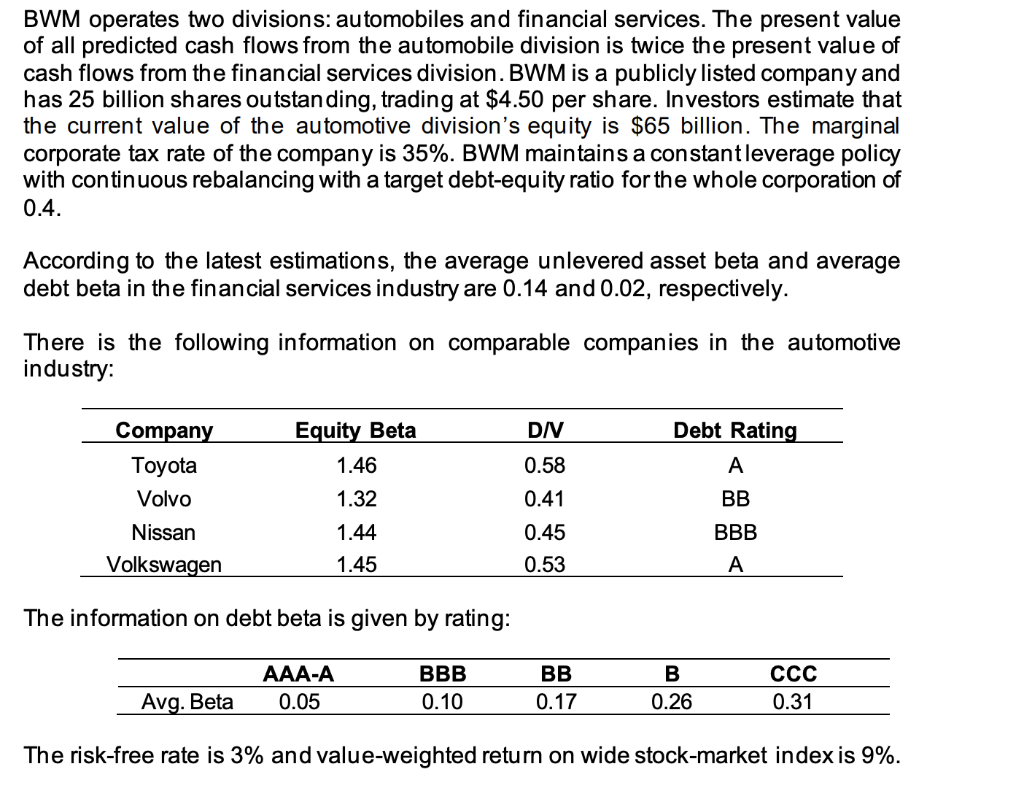

BWM operates two divisions: automobiles and financial services. The present value of all predicted cash flows from the automobile division is twice the present value of cash flows from the financial services division. BWM is a publicly listed company and has 25 billion shares outstanding, trading at $4.50 per share. Investors estimate that the current value of the automotive division's equity is $65 billion. The marginal corporate tax rate of the company is 35%. BWM maintains a constantleverage policy with continuous rebalancing with a target debt-equity ratio for the whole corporation of 0.4. According to the latest estimations, the average unlevered asset beta and average debt beta in the financial services industry are 0.14 and 0.02, respectively. There is the following information on comparable companies in the automotive industry: D/V Debt Rating 0.58 Company Toyota Volvo Nissan Volkswagen Equity Beta 1.46 1.32 1.44 1.45 BB 0.41 0.45 0.53 BBB A The information on debt beta is given by rating: AAA-A 0.05 BBB 0.10 BB 0.17 B 0.26 CCC 0.31 Avg. Beta The risk-free rate is 3% and value-weighted return on wide stock-market index is 9%. BWM operates two divisions: automobiles and financial services. The present value of all predicted cash flows from the automobile division is twice the present value of cash flows from the financial services division. BWM is a publicly listed company and has 25 billion shares outstanding, trading at $4.50 per share. Investors estimate that the current value of the automotive division's equity is $65 billion. The marginal corporate tax rate of the company is 35%. BWM maintains a constantleverage policy with continuous rebalancing with a target debt-equity ratio for the whole corporation of 0.4. According to the latest estimations, the average unlevered asset beta and average debt beta in the financial services industry are 0.14 and 0.02, respectively. There is the following information on comparable companies in the automotive industry: D/V Debt Rating 0.58 Company Toyota Volvo Nissan Volkswagen Equity Beta 1.46 1.32 1.44 1.45 BB 0.41 0.45 0.53 BBB A The information on debt beta is given by rating: AAA-A 0.05 BBB 0.10 BB 0.17 B 0.26 CCC 0.31 Avg. Beta The risk-free rate is 3% and value-weighted return on wide stock-market index is 9%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started