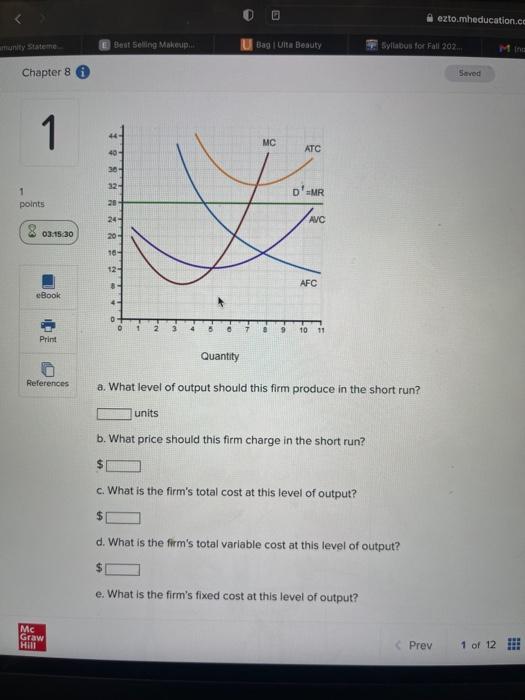

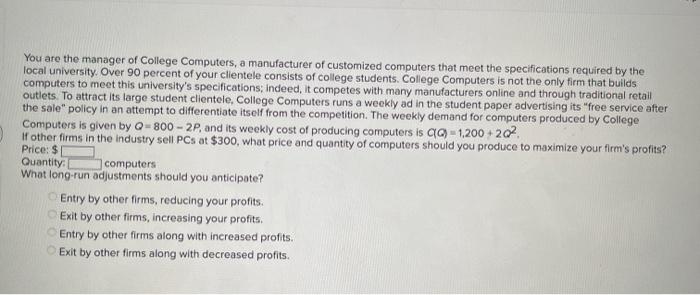

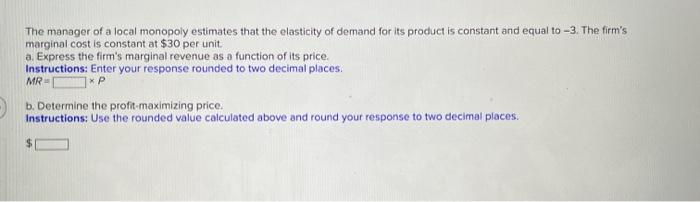

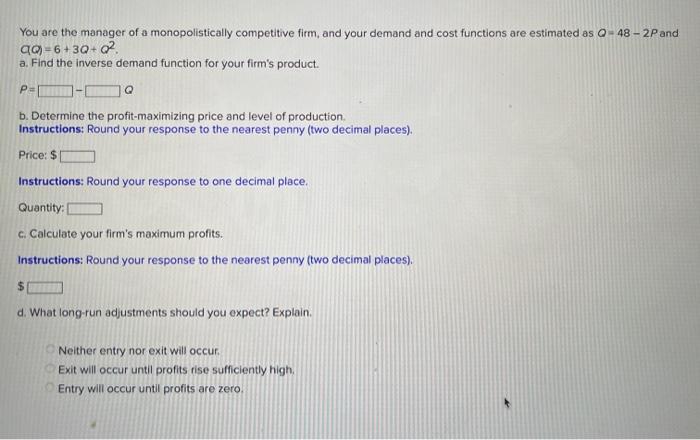

a. What level of output should this firm produce in the short run? units b. What price should this firm charge in the short run? c. What is the firm's total cost at this level of output? d. What is the firm's total varlable cost at this level of output? e. What is the firm's fixed cost at this level of output? You are the manager of a monopolistically competitive firm, and your demand and cost functions are estimated as Q=482P and qQ)=6+3Q+Q2 a. Find the inverse demand function for your firm's product. b. Determine the profit-maximizing price and level of production. Instructions: Round your response to the nearest penny (two decimal places). Price: $ Instructions: Round your response to one decimal place. Quantity: c. Calculate your firm's maximum profits. Instructions: Round your response to the nearest penny (two decimal places). d. What long-run adjustments should you expect? Explain. Neither entry nor exit will occur. Exit will occur until profits rise sufficiently high. Entry will occur untli profits are zero. Quantity a. What level of output should this firm produce in the short run? units b. What price should this firm charge in the short run? c. What is the firm's total cost at this level of output? d. What is the firm's total variable cost at this level of output? e. What is the firm's fixed cost at this level of output? f. What is the firm's profit if it produces this level of output? Instructions: If the firm is taking a loss, enter this as negative (-) profits. g. What is the firm's profit if it shuts down? Instructions: If the firm is taking a loss, enter this as negative () profits. h. In the short run, should this firm continue to operate or shut down? The manager of a local monopoly estimates that the elasticity of demand for its product is constant and equal to -3 . The firm's marginal cost is constant at $30 per unit. a. Express the firm's marginal revenue as a function of its price. Instructions: Enter your response rounded to two decimal places. MR=P b. Determine the profit-maximizing price. Instructions: Use the rounded value calculated above and round your response to two decimal places. You are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the local university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds computers to meet this university's specifications; Indeed, it competes with many manufacturers online and through traditional retail outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after the sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College Computers is given by Q=8002P, and its weekly cost of producing computers is QQ=1,200+2Q2 If other firms in the industry sell PCs at $300, what price and quantity of computers should you produce to maximize your firm's profits? Price: \$ Quantity: computers What long-run adjustments should you anticipate? Entry by other firms, reducing your profits. Exit by other firms, increasing your profits. Entry by other firms along with inereased profits. Exit by other firms along with decreased profits