Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) What number should be in the place of A, where A is the adjusted gross income of the individual? B) What number should be

A) What number should be in the place of “A”, where A is the adjusted gross income of the individual?

B) What number should be in the place of “B”, where B is the taxable income of the individual?

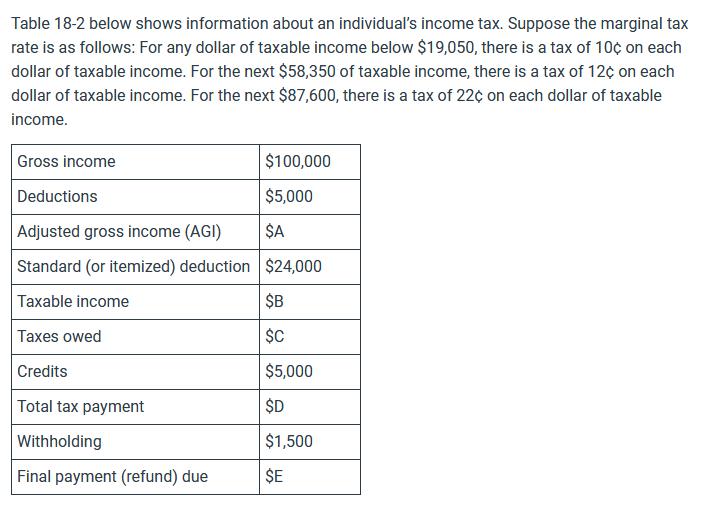

Table 18-2 below shows information about an individual's income tax. Suppose the marginal tax rate is as follows: For any dollar of taxable income below $19,050, there is a tax of 10 on each dollar of taxable income. For the next $58,350 of taxable income, there is a tax of 12 on each dollar of taxable income. For the next $87,600, there is a tax of 22 on each dollar of taxable income. Gross income Deductions Adjusted gross income (AGI) Standard (or itemized) deduction Taxable income Taxes owed Credits Total tax payment Withholding Final payment (refund) due $100,000 $5,000 $A $24,000 $B $C $5,000 $D $1,500 $E

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started