Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) What was the reported increase/decrease in cash for both years. b) Calculate the net operating cash flows for both years. begin{tabular}{|c|c|c|} hline & begin{tabular}{c}

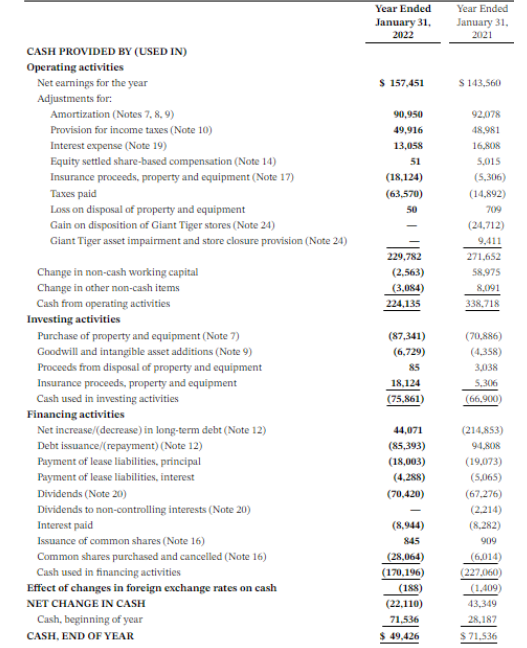

a) What was the reported increase/decrease in cash for both years.

b) Calculate the net operating cash flows for both years.

\begin{tabular}{|c|c|c|} \hline & \begin{tabular}{c} Year Ended \\ January 31, \\ 2022 \\ \end{tabular} & \begin{tabular}{c} Year Ended \\ January 31. \\ 2021 \\ \end{tabular} \\ \hline \multicolumn{3}{|l|}{ CASH PROVIDED BY (USED IN) } \\ \hline \multicolumn{3}{|l|}{ Operating activities } \\ \hline Net earnings for the year & \$ 157,451 & $143,560 \\ \hline \multicolumn{3}{|l|}{ Adjustments for: } \\ \hline Amortization (Notes 7, 8, 9) & 90,950 & 92.078 \\ \hline Provision for income taxes (Note 10) & 49,916 & 48,981 \\ \hline Interest expense (Note 19) & 13,058 & 16,808 \\ \hline Equity settled share-based compensation (Note 14) & 51 & 5,015 \\ \hline Insurance proceeds, property and equipment (Note 17) & (18,124) & (5,306) \\ \hline Taxes paid & (63,570) & (14,892) \\ \hline Loss on disposal of property and equipment & 50 & 709 \\ \hline Gain on disposition of Giant Tiger stores (Note 24) & & (24,712) \\ \hline \multirow[t]{2}{*}{ Giant Tiger asset impairment and store closure provision (Note 24) } & & 9,411 \\ \hline & 229,782 & 271,652 \\ \hline Change in non-cash working capital & (2,563) & 58,975 \\ \hline Change in other non-cash items & (3,084) & 8,091 \\ \hline Cash from operating activities & 224,135 & 338,718 \\ \hline \multicolumn{3}{|l|}{ Investing activities } \\ \hline Purchase of property and equipment (Note 7) & (87,341) & (70,886) \\ \hline Goodwill and intangible asset additions (Note 9) & (6,729) & (4,358) \\ \hline Proceeds from disposal of property and equipment & 85 & 3,038 \\ \hline Insurance proceeds, property and equipment & 18,124 & 5,306 \\ \hline Cash used in investing activities & (75,861) & (66,900) \\ \hline \multicolumn{3}{|l|}{ Financing activities } \\ \hline Net increase/(decrease) in long-term debt (Note 12) & 44,071 & (214,853) \\ \hline Debt issuance/(repayment) (Note 12) & (85,393) & 94,808 \\ \hline Payment of lease liabilities, principal & (18,003) & (19,073) \\ \hline Payment of lease liabilities, interest & (4,288) & (5,065) \\ \hline Dividends (Note 20) & (70,420) & (67,276) \\ \hline Dividends to non-controlling interests (Note 20) & & (2,214) \\ \hline Interest paid & (8,944) & (8,282) \\ \hline Issuance of common shares (Note 16) & 845 & 909 \\ \hline Common shares purchased and cancelled (Note 16) & (28,064) & (6,014) \\ \hline Cash used in financing activities & (170,196) & (227,060) \\ \hline Effect of changes in foreign exchange rates on cash & (188) & (1,409) \\ \hline NET CHANGE IN CASH & (22,110) & 43,349 \\ \hline Cash, beginning of year & 71,536 & 28,187 \\ \hline CASH, END OF YEAR & $49,426 & $71.536 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started