Answered step by step

Verified Expert Solution

Question

1 Approved Answer

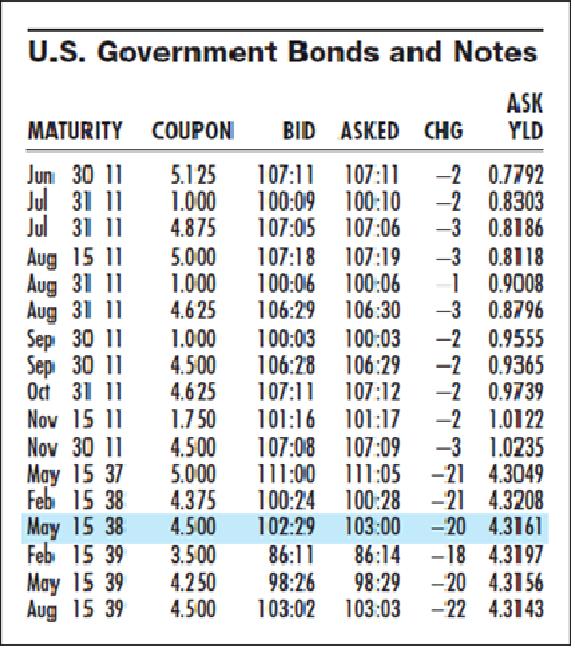

a) What were the bid price , asked price , and yield to maturity of the 4.50% August 2039 Treasury bond displayed in Figure below

a) What were the bid price, asked price, and yield to maturity of the 4.50% August 2039 Treasury bond displayed in Figure below ?

b) What was its asked price the previous day?

c) If 30 days have passed since the last coupon payment, what is the sale, or invoice, price of the bond?

U.S. Government Bonds and Notes ASK YLD MATURITY COUPON BID ASKED CHG -2 0.7792 -2 0.8303 -3 0.8186 Jun 30 11 Jul 31 11 Jul 31 11 Aug 15 11 Aug 31 11 Aug 31 11 Sep 30 11 Sep 30 11 Oct 31 11 Nov 15 11 Nov 30 11 May 15 37 Feb 15 38 May 15 38 Feb 15 39 May 15 39 Aug 15 39 5.125 1.000 4.875 107:11 107:11 100:09 100:10 107:05 107:06 5.000 1.000 4.6 25 107:18 107:19 100:06 100:06 106:29 106:30 -3 0.8118 0.9008 -3 0.8796 1.000 4.500 4.6 25 1.7 50 4.500 5.000 4.375 4.500 3.500 100:03 106:28 106:29 107:11 107:12 101:16 101:17 107:08 107:09 111:00 111:05 -21 4.3049 100:24 100:28 -21 4.3208 102:29 103:00 -2 0.9555 -2 0.9365 -2 0.9739 -2 1.0122 -3 1.0235 100:03 -20 4.3161 86:11 86:14 -18 4.3197 4.2 50 98:26 98:29 -20 4.3156 4.500 103:02 103:03 -22 4.3143

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Bid price 10302 of face value 103 232 of face value Bid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started