Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A wheat producer has 70000 bushels of wheat to sell in 4 months. They wish to lock-in their selling price at $7.12 per bushel.

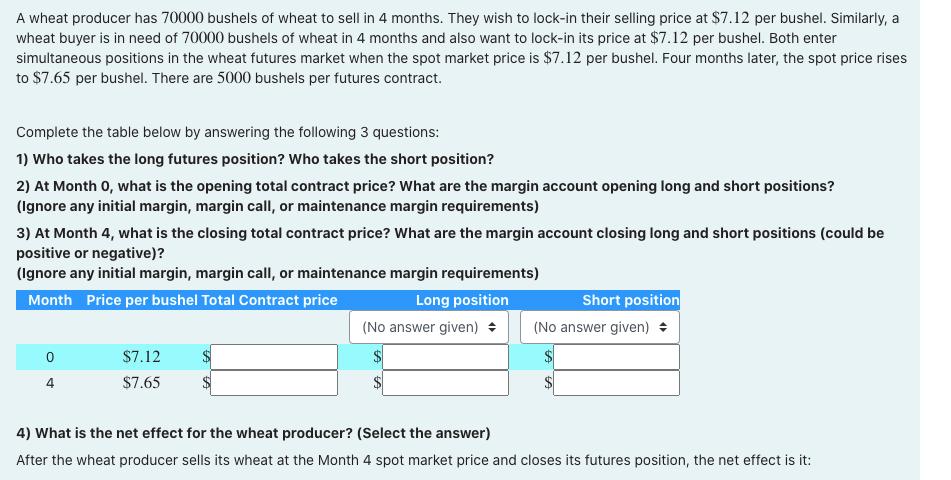

A wheat producer has 70000 bushels of wheat to sell in 4 months. They wish to lock-in their selling price at $7.12 per bushel. Similarly, a wheat buyer is in need of 70000 bushels of wheat in 4 months and also want to lock-in its price at $7.12 per bushel. Both enter simultaneous positions in the wheat futures market when the spot market price is $7.12 per bushel. Four months later, the spot price rises to $7.65 per bushel. There are 5000 bushels per futures contract. Complete the table below by answering the following 3 questions: 1) Who takes the long futures position? Who takes the short position? 2) At Month 0, what is the opening total contract price? What are the margin account opening long and short positions? (Ignore any initial margin, margin call, or maintenance margin requirements) 3) At Month 4, what is the closing total contract price? What are the margin account closing long and short positions (could be positive or negative)? (Ignore any initial margin, margin call, or maintenance margin requirements) Month Price per bushel Total Contract price Long position Short position (No answer given) (No answer given) 0 $7.12 $7.65 $ 4) What is the net effect for the wheat producer? (Select the answer) After the wheat producer sells its wheat at the Month 4 spot market price and closes its futures position, the net effect is it:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Completing the table and explaining the net effect for the wheat producer 1 Long vs Short Positions Long position The wheat producer will take the lon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started