Question

A. When one receives a dividend from another corporation, it will be recognized as income under the following methods of accounting for investments? B. In

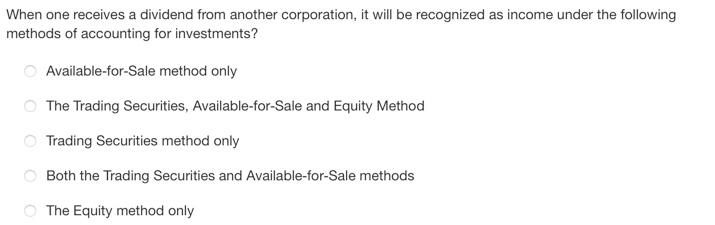

A. When one receives a dividend from another corporation, it will be recognized as income under the following methods of accounting for investments?

B. In adjusting Available for Sale securities to market at the end of the year, if there is an unrealized gain because of this adjustment, this gain will appear in which of the following statements.

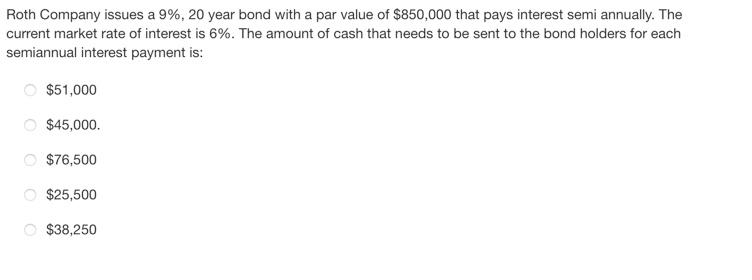

C. Roth Company issues a 9%, 20 year bond with a par value of $850,000 that pays interest semi annually. The current market rate of interest is 6%. The amount of cash that needs to be sent to the bond holders for each semiannual interest payment is:

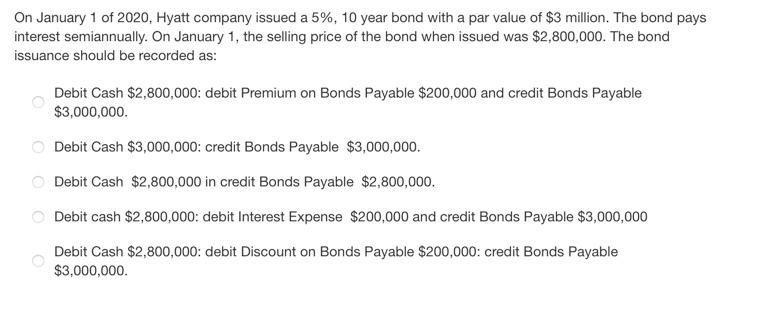

D. On January 1 of 2020, Hyatt company issued a 5%, 10 year bond with a par value of $3 million. The bond pays interest semiannually. On January 1, the selling price of the bond when issued was $2,800,000. The bond issuance should be recorded as:

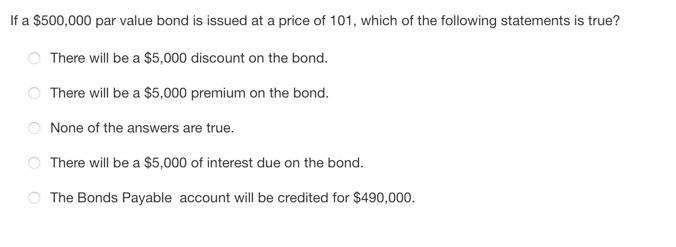

E. If a $500,000 par value bond is issued at a price of 101, which of the following statements is true?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started