Question

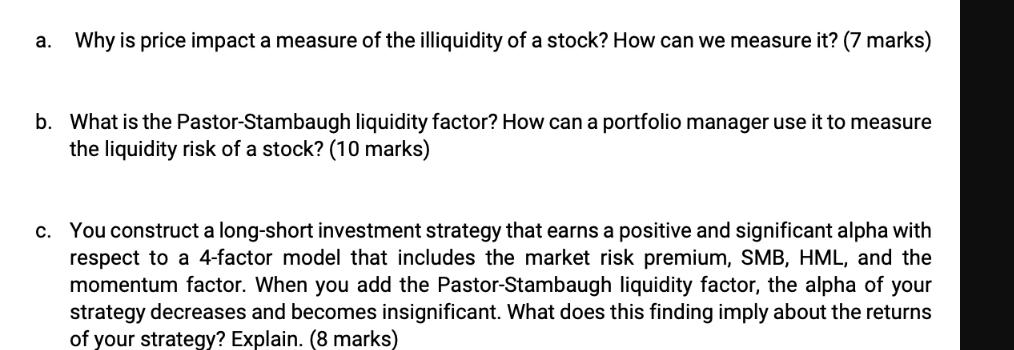

a. Why is price impact a measure of the illiquidity of a stock? How can we measure it? (7 marks) b. What is the

a. Why is price impact a measure of the illiquidity of a stock? How can we measure it? (7 marks) b. What is the Pastor-Stambaugh liquidity factor? How can a portfolio manager use it to measure the liquidity risk of a stock? (10 marks) c. You construct a long-short investment strategy that earns a positive and significant alpha with respect to a 4-factor model that includes the market risk premium, SMB, HML, and the momentum factor. When you add the Pastor-Stambaugh liquidity factor, the alpha your strategy decreases and becomes insignificant. What does this finding imply about the returns of your strategy? Explain. (8 marks)

Step by Step Solution

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Price impact is a measure of the illiquidity of a stock because it reflects how much a stocks pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Customer Service Career Success Through Customer Loyalty

Authors: Paul R. Timm

6th edition

133056252, 978-0132553001, 132553007, 978-0133056259

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App