Question

A. Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that

A. Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao's current after-tax income of P94,500?

B. Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao's costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity?

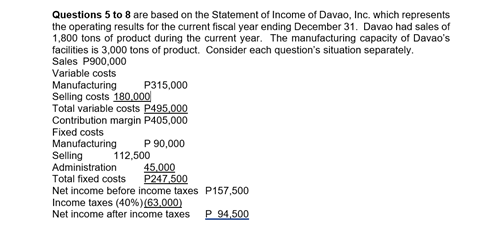

Questions 5 to 8 are based on the Statement of Income of Davao, Inc. which represents the operating results for the current fiscal year ending December 31. Davao had sales of 1,800 tons of product during the current year. The manufacturing capacity of Davao's facilities is 3,000 tons of product. Consider each question's situation separately. Sales P900,000 Variable costs Manufacturing P315,000 Selling costs 180,000 Total variable costs P495,000 Contribution margin P405,000 Fixed costs Manufacturing P 90,000 Selling 112,500 Administration 45,000 Total fixed costs P247,500 Net income before income taxes P157,500 Income taxes (40%) (63,000) Net income after income taxes P 94,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this well need to calculate the additional revenue needed from the new territory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664227fb0c338_985251.pdf

180 KBs PDF File

664227fb0c338_985251.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started