Answered step by step

Verified Expert Solution

Question

1 Approved Answer

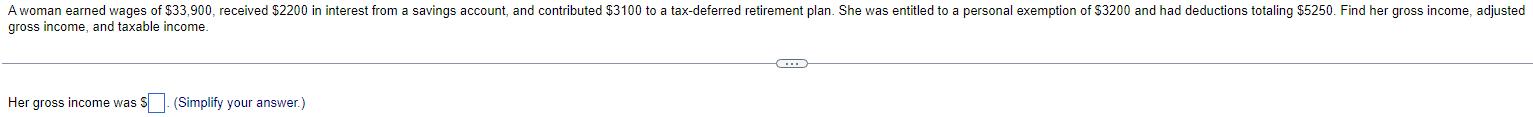

A woman earned wages of $33,900, received $2200 in interest from a savings account, and contributed $3100 to a tax-deferred retirement plan. She was

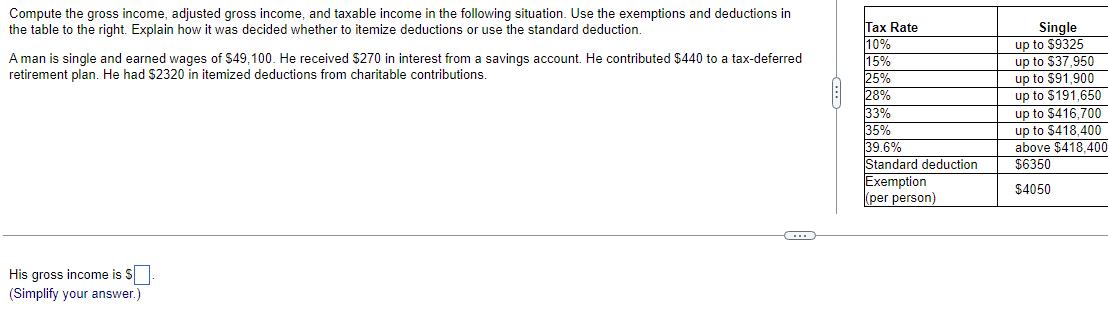

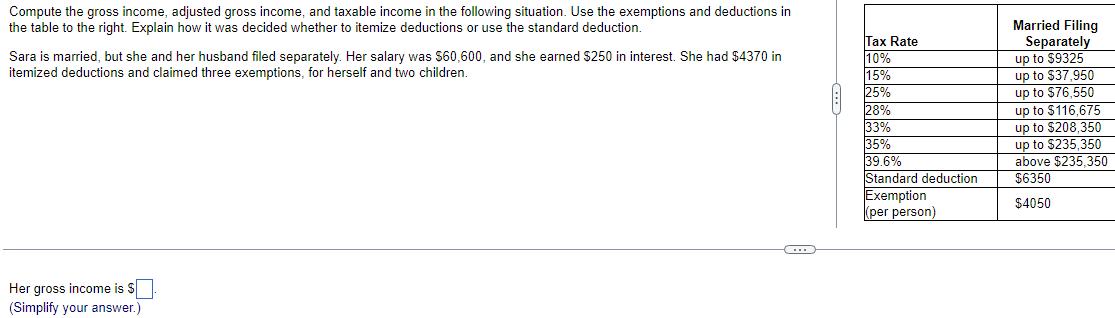

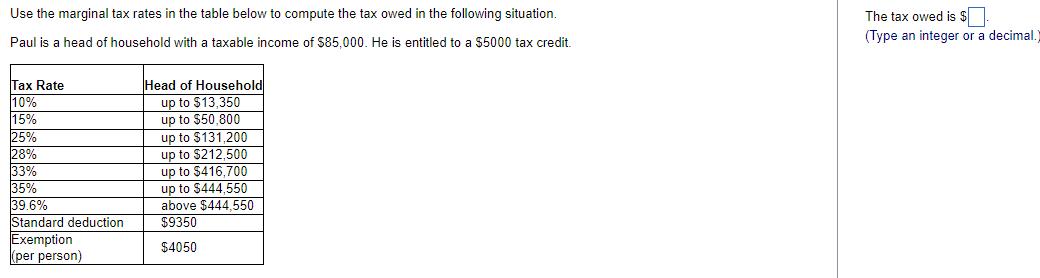

A woman earned wages of $33,900, received $2200 in interest from a savings account, and contributed $3100 to a tax-deferred retirement plan. She was entitled to a personal exemption of $3200 and had deductions totaling $5250. Find her gross income, adjusted gross income, and taxable income. Her gross income was S (Simplify your answer.) D Compute the gross income, adjusted gross income, and taxable income in the following situation. Use the exemptions and deductions in the table to the right. Explain how it was decided whether to itemize deductions or use the standard deduction. A man is single and earned wages of $49,100. He received $270 in interest from a savings account. He contributed $440 to a tax-deferred retirement plan. He had $2320 in itemized deductions from charitable contributions. His gross income is $ (Simplify your answer.) C .... Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Single up to $9325 up to $37,950 up to $91,900 up to $191,650 up to $416,700 up to $418,400 above $418,400 $6350 $4050 Compute the gross income, adjusted gross income, and taxable income in the following situation. Use the exemptions and deductions in the table to the right. Explain how it was decided whether to itemize deductions or use the standard deduction. Sara is married, but she and her husband filed separately. Her salary was $60,600, and she earned $250 in interest. She had $4370 in itemized deductions and claimed three exemptions, for herself and two children. Her gross income is $ (Simplify your answer.) C Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction. Exemption (per person) Married Filing Separately up to $9325 up to $37.950 up to $76,550 up to $116.675 up to $208,350 up to $235,350 above $235,350 $6350 $4050 Use the marginal tax rates in the table below to compute the tax owed in the following situation. Paul is a head of household with a taxable income of $85,000. He is entitled to a $5000 tax credit. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Head of Household up to $13,350 up to $50.800 up to $131,200 up to $212,500 up to $416,700 up to $444.550 above $444,550 $9350 $4050 The tax owed is $ (Type an integer or a decimal.)

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 To find the womans gross income we sum up all her earnings Wages earned 33900 Interest earned from a savings account 2200 Total earnings 33900 2200 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started