Answered step by step

Verified Expert Solution

Question

1 Approved Answer

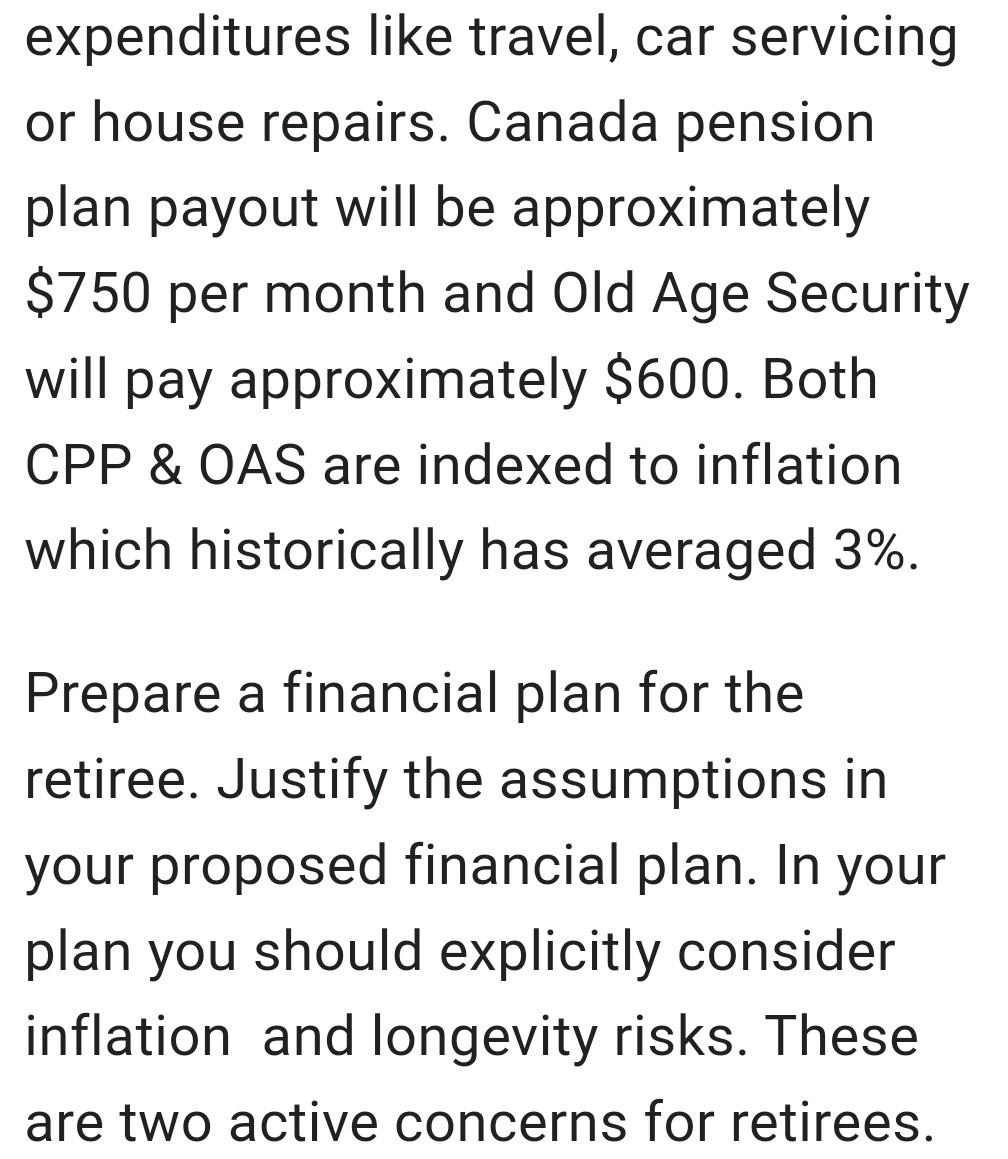

A worker is about to retire. The worker owns a home which is fully paid. The accumulated savings at retirement are $250,000 which can be

A worker is about to retire. The worker owns a home which is fully paid. The accumulated savings at retirement are $250,000 which can be expected to yield a minimum of 6% return. Emergency funds are approximately $30000 which are parked in a highyielding account at 3.25%. Post-retirement the monthly expenses are $2500 per month with $500 for incidentals and seasonal expenditures like travel, car servicing expenditures like travel, car servicing or house repairs. Canada pension plan payout will be approximately $750 per month and Old Age Security will pay approximately $600. Both CPP \& OAS are indexed to inflation which historically has averaged 3%. Prepare a financial plan for the retiree. Justify the assumptions in your proposed financial plan. In your plan you should explicitly consider inflation and longevity risks. These are two active concerns for retirees. plan payout will be approximately $750 per month and Old Age Security will pay approximately $600. Both CPP \& OAS are indexed to inflation which historically has averaged 3%. Prepare a financial plan for the retiree. Justify the assumptions in your proposed financial plan. In your plan you should explicitly consider inflation and longevity risks. These are two active concerns for retirees. In particular, a concern for retirees is the added costs of healthcare if they live in their 80 s \& 90 s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started