Question

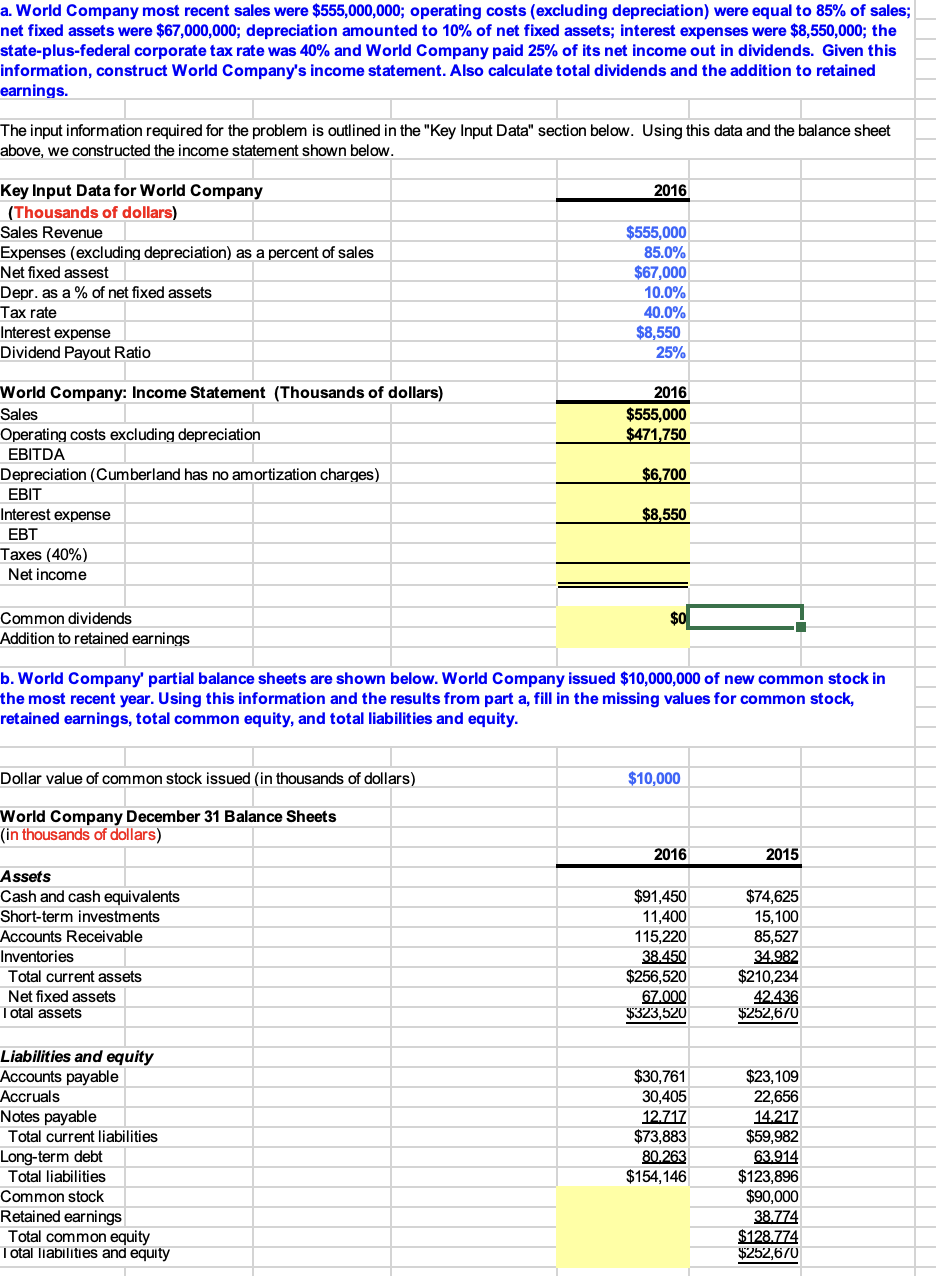

a. World Company most recent sales were $555,000,000 ; operating costs (excluding depreciation) were equal to 85% of sales; net fixed assets were $67,000,000 ;

a. World Company most recent sales were

$555,000,000; operating costs (excluding depreciation) were equal to

85%of sales;\ net fixed assets were

$67,000,000; depreciation amounted to

10%of net fixed assets; interest expenses were

$8,550,000; the\ state-plus-federal corporate tax rate was

40%and World Company paid

25%of its net income out in dividends. Given this\ information, construct World Company's income statement. Also calculate total dividends and the addition to retained\ earnings.\ The input information required for the problem is outlined in the "Key Input Data" section below. Using this data and the balance sheet\ above, we constructed the income statement shown below.\ Key Input Data for World Company\ (Thousands of dollars)\ Sales Revenue\ Expenses (excluding depreciation) as a percent of sales\ Net fixed assest\ Depr. as a % of net fixed assets\ Tax rate\ Interest expense\ Dividend Payout Ratio\ World Company: Income Statement (Thousands of dollars)\ Sales\ Operating costs excluding depreciation\ EBITDA\ Depreciation (Cumberland has no amortization charges)\ EBIT\ Interest expense\ EBT\ Taxes (40%)\ Net income\ Common dividends\ Addition to retained earnings\ b. World Company' partial balance sheets are shown below. World Company issued

$10,000,000of new common stock in\ the most recent year. Using this information and the results from part a, fill in the missing values for common stock,\ retained earnings, total common equity, and total liabilities and equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started