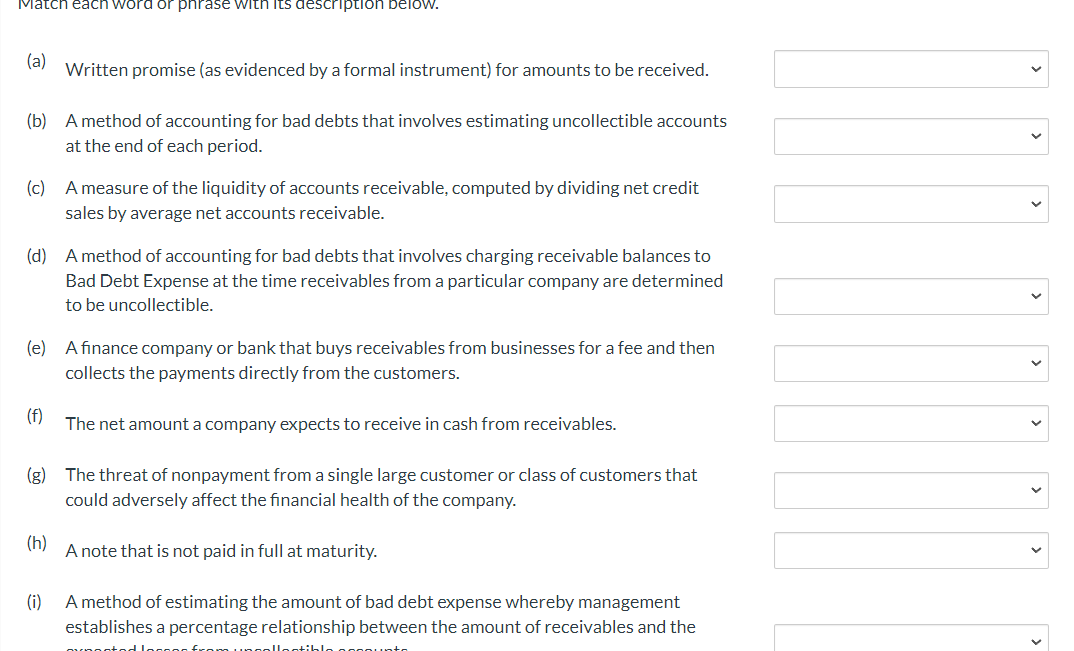

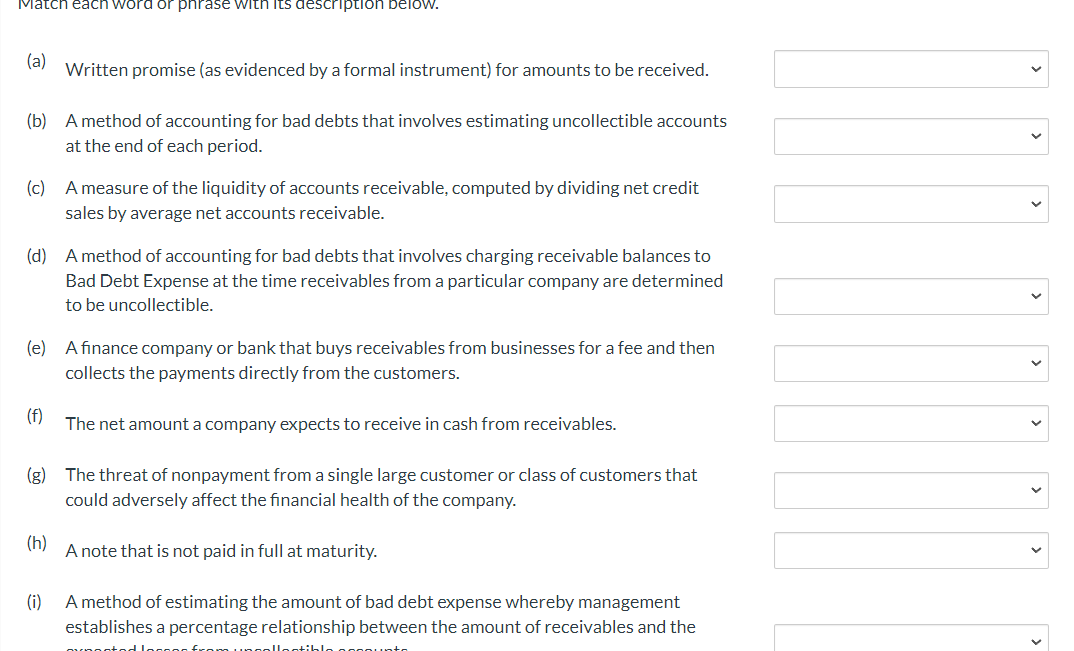

(a) Written promise (as evidenced by a formal instrument) for amounts to be received. (b) A method of accounting for bad debts that involves estimating uncollectible accounts at the end of each period. (c) A measure of the liquidity of accounts receivable, computed by dividing net credit sales by average net accounts receivable. (d) A method of accounting for bad debts that involves charging receivable balances to Bad Debt Expense at the time receivables from a particular company are determined to be uncollectible. (e) A finance company or bank that buys receivables from businesses for a fee and then collects the payments directly from the customers. (f) The net amount a company expects to receive in cash from receivables. (g) The threat of nonpayment from a single large customer or class of customers that could adversely affect the financial health of the company. (h) A note that is not paid in full at maturity. (i) A method of estimating the amount of bad debt expense whereby management establishes a percentage relationship between the amount of receivables and the (a) Written promise (as evidenced by a formal instrument) for amounts to be received. (b) A method of accounting for bad debts that involves estimating uncollectible accounts at the end of each period. (c) A measure of the liquidity of accounts receivable, computed by dividing net credit sales by average net accounts receivable. (d) A method of accounting for bad debts that involves charging receivable balances to Bad Debt Expense at the time receivables from a particular company are determined to be uncollectible. (e) A finance company or bank that buys receivables from businesses for a fee and then collects the payments directly from the customers. (f) The net amount a company expects to receive in cash from receivables. (g) The threat of nonpayment from a single large customer or class of customers that could adversely affect the financial health of the company. (h) A note that is not paid in full at maturity. (i) A method of estimating the amount of bad debt expense whereby management establishes a percentage relationship between the amount of receivables and the