Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. XYZ Corporation depreciated one of its pieces of heavy machinery using the straight-line method for financial accounting depreciation and accelerated depreciation for tax

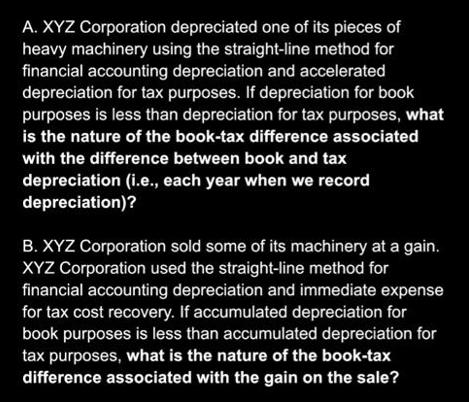

A. XYZ Corporation depreciated one of its pieces of heavy machinery using the straight-line method for financial accounting depreciation and accelerated depreciation for tax purposes. If depreciation for book purposes is less than depreciation for tax purposes, what is the nature of the book-tax difference associated with the difference between book and tax depreciation (i.e., each year when we record depreciation)? B. XYZ Corporation sold some of its machinery at a gain. XYZ Corporation used the straight-line method for financial accounting depreciation and immediate expense for tax cost recovery. If accumulated depreciation for book purposes is less than accumulated depreciation for tax purposes, what is the nature of the book-tax difference associated with the gain on the sale? For A and B answer Temporary or permanent? Favorable or unfavorable? For each

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

A In this scenario if depreciation for book purposes is less than depreciation for tax purposes the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started